Hello fellow substack reader, I wanted to thank you for giving this article a read. I believe the following short note summarizes the events that transcended in the first half of the year for Cardlytics. Many investors have dismissed the company without giving it a real look. I hope this brief nudges you in the right direction and inspires further research on what I to believe to be a once-in-a-lifetime opportunity.

On June 30th the company traded at around the $215 M market cap mark, including $60M in cash after all expected cash outflows (figure 2).

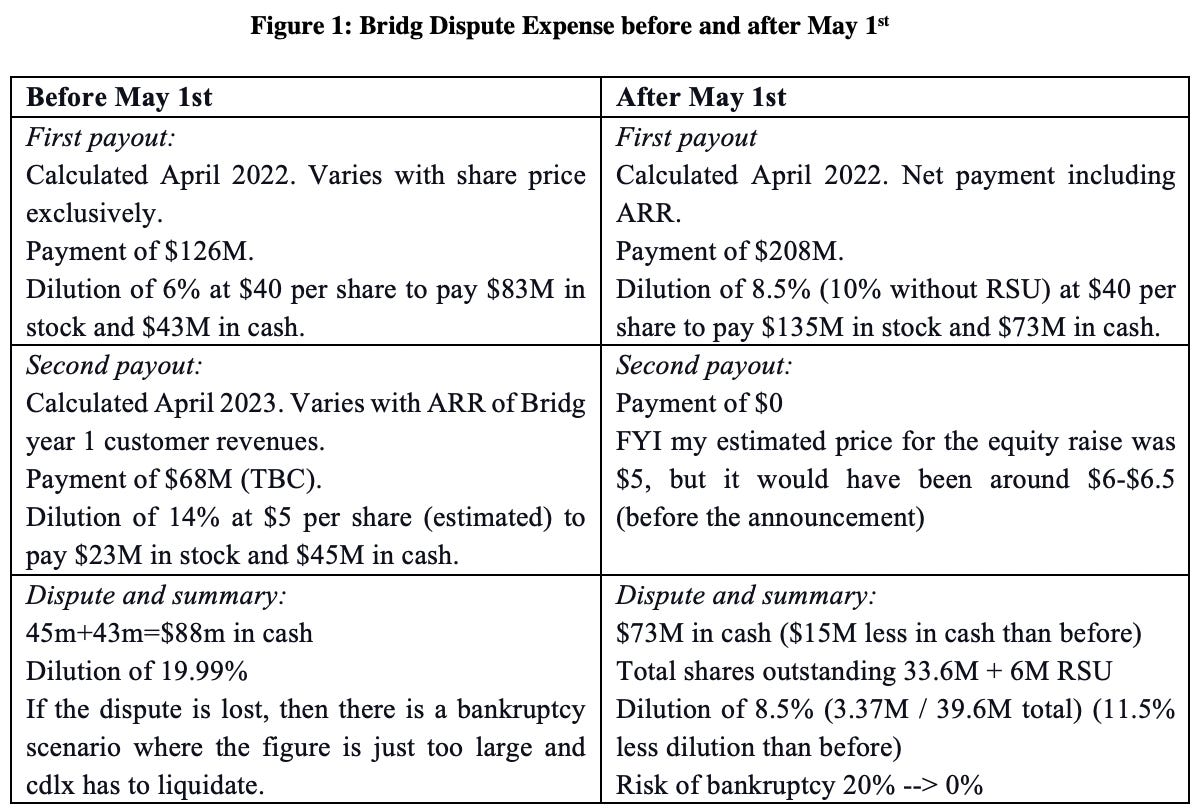

Let’s start with the most significant resolution in the last 6 months, the Bridg Dispute. On May 1st the company shared the result of the dispute through an expense filing. They awarded stock options to the Chief Legal Officer (Nick Lynton) a few days before the announcement, leading shareholders to believe a positive outcome was underway. Technically, the company lost the dispute, leading to a larger payment using the average price established on the first anniversary ($40.50).

In summary, the dispute led to lower dilution and a lower payment which solidifies Cardlytics’s cash position and ensures a longer runway before additional capital must flow into the company. The following graph portrays the estimated cash at the end of Q1 2024 for Cardlytics.

The company’s next challenge will be refinancing its $230M in convertibles due on September 15th, 2025. Capital raise options include equity, refinancing the loan with a higher interest payment, and factoring. If Cardlytics creates a positive FCF figure before the end of 2023, the company may get beneficial terms for a capital raise.

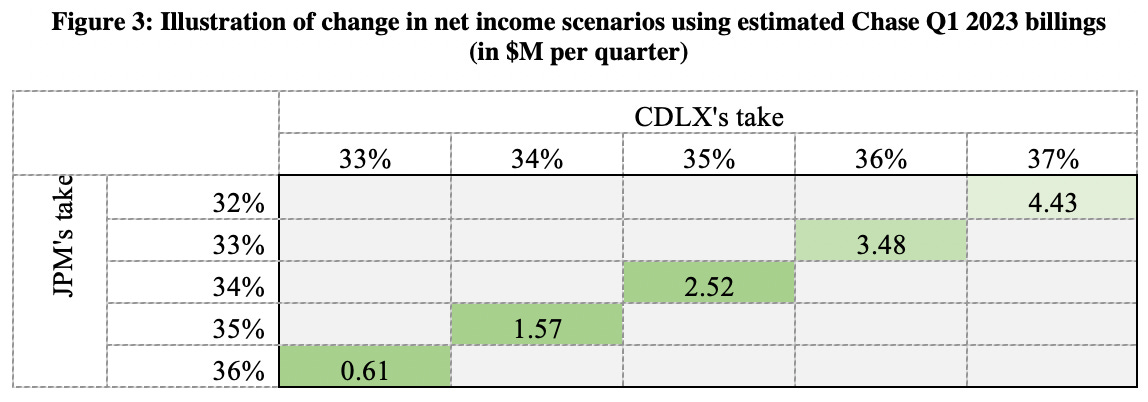

The likelihood of positive EBITDA and cash flow figures before the end of 2023 has clearly increased. This refers to the two big announcements made at the end of June, one nominating Cliff Sosin to the empty board seat and the other referring to the contract amendment with JPM. On the first note, Cliff Sosin is the largest individual shareholder (16%) of the company. He is a highly intelligent and capable individual that has proven his ability to maneuver tactically in the markets and, at times, as an activist shareholder. The most recent example of the latter is the company “at Home” (NYSE:HOME). I strongly recommend you check it out. On the second note, cdlx amended its share contribution with JPMorgan Chase starting June 1st and lasting until the master agreement expires in November 2025. This translates to a quantitative and a qualitative item. On the quantitative front, this means that for every 1% added in cdlx’s favor, the company will add at least $0.96M per quarter directly to the bottom line. On the qualitative front, this conveys tangible negotiation strength from cdlx which seems to be adding value by implementing non-bank data. In both cases, it equates to a stronger positioning with other existing and potential clients.

The latest quarter’s distribution was 32.73% for consumers, 34.91% for bank partners, and 32.36% for Cardlytics. Using Q1 2023 billings data ($95M) serves as a very conservative estimate for this new revenue allocation as this has been consistently cdlx’s worst quarter. I believe a 1-2% change in favor of cdlx is the most probable scenario.

Moving on to operations, the new user experience is being deployed by Chase as we speak. The bank deployed the new UI at the beginning of the year and is expected to reach 100% of its users by early August. With the new UI, cdlx expects to see a boost in offer interaction, and to that effect, it has launched some new offers, including product-level and time-of-day offers that allow better targeting and redemption rates. Karim Temsamani, Cardlytic’s CEO, also pointed out in the earnings call that the company was looking at stretch offers (spend $20 get $5 back) and new ways of monetizing the ads including interaction, visualization, and hyperlink forwarding.

On that note, Karim also announced the hiring of a new COO in the Q4 call. Amit Gupta joined the ranks in late January as Chief Operating Officer and head of Bridg. He worked alongside Karim at Stripe and Google, and is, on paper, a great candidate for the role. On the flip side, Andrew Christiansen was removed as CFO, which is also great news since it will lead to a lower frequency of accounting mistakes. It is unclear who will take over, but Karim seems to have a list of candidates and is waiting for share price increases to pull the trigger on talent that requires high compensation.

On a not-so-bright front, Cardlytics lost a large client who I believe to be Starbucks, and a smaller bank partner in the UK who I believe to be Santander. The loss of the bank partner is not relevant, as the service in the UK is of much lower quality because of a lack of data usage. In other words, Cardlytics cannot deploy its business model as is, leading to no competitive edge. The UK division is also a very small part of total revenues. However, the loss of a large restaurant client (as defined by the cdlx team) is concerning. This event caused the negative YoY growth for Q1 2023 and is concerning given the long duration of the relationship and the lack of formal explanation on the matter. Excluding this client, the growth from new and existing advertiser revenue was 23%.

As a final thought, one of Karim’s focal points is getting new bank partners. I wanted to illustrate the spending and MAUs of the banking institutions that could become cdlx clients. AmEx, Capital One, Citi, Discover, etc.