📈 Limes Schloss Clinics $LIK - Deluxe Mental Healthcare

A Deep Dive into an Overlooked Exclusive Mental Health Clinic Operator

Welcome back dear fellow 🧙♂️ Hermits 👋

🏥 Limes Schloss Clinics Coverage 👇

Explore All Our Writings on Mental Health Clinics Scaling Across DACH Region

If you haven’t yet, subscribe to get access to this post, and every new post

Investment Thesis is a series of posts that provide a foundational understanding of listed wunderkind companies. The series aims to achieve a timeless understanding of the company's inner workings. Every month, content on an investment case will be posted as an article, podcast, or both.

This content is intended for informational purposes only and should not be taken as investment advice. The author does not represent any third-party interest, and he may be a shareholder in the companies described in this series.

Please do your own research or consult with a professional advisor before making any financial decision. You will find a full disclaimer at the end of the post.

Context

The Business

Investment Case (🧙♂️ Premium)

⚖️ Valuation

Additional Content (🧙♂️ Premium)

🔍 Business Overview

Limes Schloss Kliniken (Xetra: LIK) is a private mental health clinic operator offering a comprehensive range of personalized well-being services.

Its approach focuses on nutrition, sleep, sports, and both conventional and alternative medicine to treat conditions such as burnout, depression, anxiety, PTSD, OCD, chronic pain, emotional disorders, and long-term COVID symptoms.

The company operates three clinics, and is set to open two more will open in Q1 2025.

Limes follows a hotel-style business model, where profitability depends on maintaining an occupancy rate above 49%. While the company faces high fixed costs, its strong pricing power and scalable operations provide a competitive advantage.

As of December 2024, Limes operates 398 beds across five core clinics (including the ones under reform).

In November 2021, the company acquired a majority stake in Paracelsus, a Swiss-German mental health clinic specializing in treating ultra-high-net-worth individuals (UHNW).

As of June 2024, Limes, headquartered in Cologne, employed over 210 staff members across its locations.

🏁 Origin Story

The foundation of Limes Schloss Clinics is deeply rooted in personal experience and a visionary approach to healthcare. The name Limes pays homage to the ancient Roman border defense system that once marked the empire's boundaries, symbolizing protection, structure, and a defined space for well-being.

This concept of a secure and specialized healing environment became the guiding principle for the company’s creation.

A Founder’s Journey: From Engineering to Elite Healthcare

The story of Limes Schloss Clinics begins in 1993, when its founder, Dr. Gert Frank, sought to solve a deeply personal challenge.

A family member was struggling with health issues, and despite extensive research, no existing clinic provided the ideal combination of top-tier medical care, personalized treatment, and an environment that fostered true recovery.

With 30 years of experience in finance, pharmaceuticals, and medical investments - especially during his investment banking stage at Warburg - he understood the industry’s gaps.

His exposure to international markets, including Arizona Meadows and elite Hollywood rehabilitation centers, revealed how high-profile individuals - actors, executives, and public figures - had access to customized treatments involving healthcare specialists, and tailored medication plans.

Yet, such an offering did not exist in a similarly exclusive and immersive European setting.

Determined to fill this void, he explored elite treatment options in the UK countryside, where specialists operated from historic castles and estates. He noticed that while luxury hotels struggled to sustain operations in castles and heritage properties, clinics could legally repurpose these spaces for medical use.

The idea was born: a premium, private medical retreat situated in historical castles and prime landscapes, where surroundings played a crucial role in recovery.

In 2016, the first Limes Schloss Clinic was established on an expansive 12-hectare estate (10,000 square meters of clinical space). The vision was clear:

Trademarks of Excellence: Combining historical castles, carefully preserved landscapes, and state-of-the-art treatment.

Healing Through Space: Leveraging land, architecture, and peaceful surroundings to enhance mental and physical rehabilitation.

Exclusive, Individualized Care: Offering a discreet, high-end medical experience tailored to each patient’s needs.

Financing such a project required significant investments. Dr. Frank provided shareholder loans at low interest rates to support initial operations. His sale of Geratherm, a medical diagnostics company, helped secure the financial foundation needed for the clinic’s launch and expansion.

Additionally, the company IPOed quietly in 2019 in Germany to raise additional financing with the promise of executing Dr. Frank’s vision.

🌐 Industry Overview and Competitors

The mental health rehabilitation sector in Europe, particularly in the DACH region (Germany, Austria, and Switzerland), is undergoing significant transformation. Historically dominated by highly regulated hospitals and publicly funded institutions, the sector has witnessed the emergence of private, luxury-focused alternatives in recent decades.

However, this shift is not without challenges. Tight regulatory oversight, insurance complexities, and a competitive landscape in which most players are from the public sector make entry and expansion difficult.

Germany, in particular, is an evolving market where political shifts influence healthcare policies. While mental health clinics and rehab facilities remain critical components of the healthcare system, they are often operated under strict regulations that limit private sector competition.

Unlike in other industries, doctors in this sector are not traditionally business owners, making it harder for private entities to scale operations independently. Those who venture into the private sector have historically failed, as medical acumen does not translate well into business success.

The typical process of establishing a clinic is capital-intensive, requiring substantial upfront investment. Owners must secure a property through purchase or long-term rental - undertake extensive remodeling to meet medical and regulatory standards, hire qualified staff, navigate complex approval processes, and then sustain operations at a loss for months or even years before reaching profitability.

Among private sector players, luxury mental health rehab hotels, such as Lanserhof, are setting a new standard by blending high-end hospitality with medical treatment.

These facilities cater to affluent patients seeking a discreet, hotel-like environment for recovery rather than a traditional clinical setting. While they offer a compelling alternative, they remain a niche segment.

Moreover, their resort-style model inherently limits accessibility, as most guests visit for short-term stays averaging just 2 to 10 nights. Thus, they are more akin to wellness retreats than long-term rehabilitation centers.

Several companies operate in adjacent spaces within the German healthcare market. M1 Kliniken AG (Xetra: M12) and MediClin AG (Munich: MED) are notable publicly traded healthcare providers, though their focus is broader than mental health rehab.

Other healthy private players also exist in the space like Lütgenhof.

On a global scale, companies like HCA Healthcare (NYSE:HCA) in the U.S. and Dr. Sulaiman Al-Habib Medical Services in Saudi Arabia exemplify how private healthcare can be successfully commercialized, but similar large-scale private models are still rare in Europe.

The sector's strategic direction remains uncertain. Some private operators, including those with a luxury focus, have indicated plans to expand into new markets, such as the UK and Scandinavia.

Both the UK and Denmark present equally, if not more, competitive landscapes. However, their client bases tend to be significantly more informed and discerning, potentially creating a higher demand for premium, specialized services. However, leadership statements on these plans have been inconsistent.

The competitive landscape is still developing. Private and institutional investors rarely enter the space, as most private mental health clinics in Germany are not profitable and, more importantly, lack the scale to attract the “big bucks.”

Most of these businesses are family businesses with a single clinic.

🧩 Understanding of the Business Model (Core)

Regulatory and Licensing Barriers to Entry

The process of establishing a mental health rehab clinic in the DACH region is highly regulated and capital-intensive. Before applying for a license, clinic owners must secure a property through purchase or rental - undertake extensive remodeling to meet medical and regulatory standards, hire at least 15 to 30 staff members, and ensure operational readiness. There are three types of licenses:

Regular Clinic License – Covers standard mental health rehabilitation services only via insurance

Acute Clinic License – Allows clinics to accept patients who pay out-of-pocket

Psychiatric Training License: This license enables clinics to educate new psychiatrists and is typically granted only after establishing at least two licensed clinics

Limes' first two clinics hold training licenses, while the rest operate under acute clinic licenses.

A key barrier to entry is financing. Banks are generally unwilling to provide loans until a clinic is fully operational, making external investment or parent-company backing essential. The entire process, from design to execution, takes about one year, with profitability typically achieved within two to four years (if ever).

Luxury Mental Health Facilities and Market Dynamics

While luxury mental health sites appeal to affluent individuals, their business model differs fundamentally from traditional rehab centers. They function more like resorts, with short average stays of about 1 week, limiting their ability to generate long-term patient retention. However, clinics following a more structured rehab approach, such as Limes, maintain high occupancy rates.

Profitability requires at least 50% occupancy. However, some clinics can be operationally (EBIT) positive with about 40% occupancy. Currently, the average fully operational Limes clinic reports an 80% occupancy, which should translate to EBIT margins of over 20%.

Most patients are newcomers, but 20% return for additional therapy, which is noteworthy. From a treatment perspective, this could indicate either the need for continued care or limitations in long-term effectiveness. However, from an investment standpoint, it translates into recurring revenue, reinforcing the business model’s stability and customer retention.

A key advantage for private mental health clinics in Germany is that they are VAT-exempt, making their pricing structure more competitive relative to other non-healthcare services.

Additionally, public officials (Beamte), including government employees such as police officers and teachers, can access these clinics. The costs are split 50/50 between private and public insurance. In other words they pay 50% of the rate, the rest is paid by the government.

Marketing and Patient Acquisition

Despite claims in investor meetings that patient acquisition is driven by referrals from medical doctors, in practice, a minority of clients come through direct referrals from past patients or independent networks. According to Dr. Frank, 80% of customers learn about the company and its services online.

Marketing remains a critical challenge, with questions about how best to balance confidentiality with brand visibility. Clinics also host industry events, such as drug abuse symposiums in Cologne, to increase awareness

Limes invests heavily in digital marketing, spending €3 million annually on Google ads alone. The strategy generates 10-20 inquiries per day, with the following conversion funnel:

50% of potential clients consider the clinic too expensive.

20% are deemed not a good fit based on their needs.

30% proceed to in-person admission, securing a stable cash flow.

Operational Structure and Scalability

Long-term leases on buildings allow clinics to adapt spaces to their needs, though high capital expenditure (CAPEX) remains a challenge. A key operational hurdle is staffing - clinics require one staff member per bed (approx.), making recruitment a critical factor in scaling the business.

However, compared to public sector clinics, hiring appears somewhat easier due to higher salaries (+15%) and share option incentives that align employees’ interests with long-term success. Staff equity vests over four years, and key personnel, such as the director of the first clinic, just receive board positions as retention incentives.

As a side note, board members receive no compensation beyond expense coverage of approximately €3,000–€4,000 per year. They do have stock incentives but these are entirely performance-based. Compensation is only triggered if the share price reaches €600, aligning their interests closely with shareholders.

From an investor's perspective, growth depends on expanding services or increasing the patient base. However, the niche market raises scalability concerns, as the company targets only 5-6% of the population, and this segment is shrinking in countries like Germany.

While the business model appears robust, understanding fixed costs and initial capital investment per clinic remains critical for assessing long-term profitability. We will provide details later on.

Customer Journey

Approximately 50% of patients pay out-of-pocket, often double the price of public alternatives. Clinics charge premium rates, with the average patient stay costing over €45,000. The average patient stays two months, though some remain for up to nine months, particularly for trauma-related conditions.

The customer journey from initial inquiry to admission varies significantly based on payment method:

Cash-paying patients can be admitted within 24 hours after an initial phone screening to ensure they are a good fit for the existing patient environment

Insurance-covered patients face two scenarios:

Acute cases (requiring urgent treatment) can typically be admitted within a day, pending approval from a referring doctor

Non-acute cases often experience delays of 4 to 6 weeks, as insurance companies require extensive documentation and second opinions

From a business stability perspective, mental health clinics enjoy perfect information per quarter, as the admissions pipeline is predictable. On average, 20% of patients are classified as acute, requiring immediate care, while some clinics report up to 50% of their patients paying in cash, enabling more immediate intake.

Insurance reimbursement can be complex, requiring patients to visit a doctor, obtain a second opinion, and submit extensive documentation. This process typically takes two months, which delays revenues but, once again, makes occupancy rates very predictable.

Future Expansion and Market Potential

Dr. Frank is currently focusing on replicating Limes’ successful model for young adults, seeing this demographic as a growth opportunity within the German-speaking (DACH) region.

Customer acquisition has shifted significantly over time, with the average patient age decreasing from 45 in 2019 to about 35 in 2023. While early growth relied on networks of medical doctors and educational institutions, today, clients find clinics through online searches. Patients actively compare facilities and seek tailored solutions, reinforcing the importance of digital presence and brand credibility.

To accommodate demand, clinics have streamlined onboarding processes. Upon arrival, patients undergo a medical check-up on day two, followed by a personalized treatment plan developed in collaboration with doctors and therapists. While some patients stay as little as one week due to external commitments, others remain for up to nine months, depending on the severity of their condition.

In addition to regular clinics and the shifter focus on young adults, Limes is the majority owner of Paracelsus Recovery. Based in Zurich, Paracelsus operates as a premier luxury rehab brand. It offers ultra-exclusive treatment, where a team of 15-25 professionals either visits clients at their homes or arranges for them to travel to the clinic. These high-end services cater to an elite clientele, positioning themselves as a luxury wellness experience rather than a traditional clinic.

🏥 Clinic Overview

Location is Critical

The most important factor in founding a successful clinic is location. A poor choice - one based solely on cost savings - can undermine the entire operation.

The right environment plays a crucial role in supporting the healing process, so it is essential to select a setting with fresh air, open space, hills, water, and sunlight. Historical context and a serene atmosphere further enhance the clinic’s therapeutic value.

For this reason, clinics in eastern or northern regions are not viable. The ideal locations are in southwestern Germany, near wealthy areas like Baden-Württemberg and Liechtenstein, where demand and purchasing power are higher.

Decentralized Operations with Centralized Support

Each clinic operates independently, with its own management. However, financing and marketing are handled centrally by headquarters. Oversight remains tight - clinic heads spend about two weeks annually in Mecklenburg, where performance reviews are conducted.

If issues arise, management intervenes with immediate calls and reassesses operations 2-3 times per year to ensure alignment with the overall strategy.

Properties and Employees

Most clinics operate on long-term leases, typically 20 years with a 5-year extension option. These leases feature indexed rent adjustments to manage costs. All properties are leased except for Abstee, which was purchased at an exceptionally low price and has an expected payback period of 3-4 years.

Finding and retaining skilled employees remains a major challenge. Clinics are strategically located within an hour of major cities to ensure access to a larger labor pool. The company actively recruits highly qualified professionals, offering long-term stock option plans to attract and retain top-tier talent. Additionally, there is an opportunity to leverage former tuberculosis clinics and royalty’s vacation estates, which were historically built in ideal healing environments and could be repurposed for mental health treatment.

Here’s an example of a clinic description that a customer would receive:

The Limes Schlossklinik Mecklenburg Switzerland, located in the Teterow district of Teschow, is a premier clinic set within a historic estate surrounded by 120 hectares of pristine landscapes, including an English park, two golf courses, and direct access to Lake Teterow.

The clinic offers 90 elegantly furnished suites, providing a serene and luxurious environment that fosters recovery, relaxation, and holistic well-being.

With extensive walking paths, outdoor activities, and first-class amenities, the clinic emphasizes the importance of surroundings in the healing process, creating an ideal retreat for individuals seeking restoration of body and mind.

Specializing in psychiatry, psychotherapy, and psychosomatic medicine, the Limes Schlossklinik provides a protected space for patients struggling with mental and emotional exhaustion, including conditions such as depression, burnout, trauma, anxiety, and chronic pain.

Its holistic therapy concept is led by an interdisciplinary team of experts, offering personalized high-frequency psychotherapy, medical diagnostics, relaxation techniques, sports therapy, and creative therapies.

Patients benefit from healing nature, specialized treatments, and comprehensive support for insurance and cost-related matters.

With its exclusive facilities, natural surroundings, and personalized approach, the Limes Schlossklinik is a sanctuary where individuals regain their strength and reconnect with themselves.

Now, let’s take a closer look at each clinic individually.

1. LIMES Schlossklinik Mecklenburgische Schweiz

This is the first clinic established under the Limes brand, located in Mecklenburg Switzerland, Germany (not to be confused with the country). The facility has a capacity of 110 beds across 90 patient rooms and has been operating since April 2016.

According to our estimates, it currently runs at 90% occupancy, with a daily rate of €650 per patient.

2. LIMES Schlossklinik Fürstenhof

This is the second clinic established by Limes, is located in Bad Brückenau, Germany. This private care facility specializes in treating psychological and psychosomatic disorders, as well as stress-related illnesses.

Housed in a Bavarian King's historic former summer residence, the clinic offers a serene environment conducive to healing. It began operations in June 2020 and has a capacity of 60 beds. The daily rate is €700 per patient.

Efforts to expand the clinic have encountered challenges due to a 1,000-year-old oak tree on the property, which is protected and currently in a fragile state. This has led to difficulties obtaining expansion permits, as the tree's preservation is a priority for local authorities, including the Green Party and town officials. Consequently, the clinic is exploring alternative locations for expansion.

3. LIMES Schlossklinik Bergisches Land

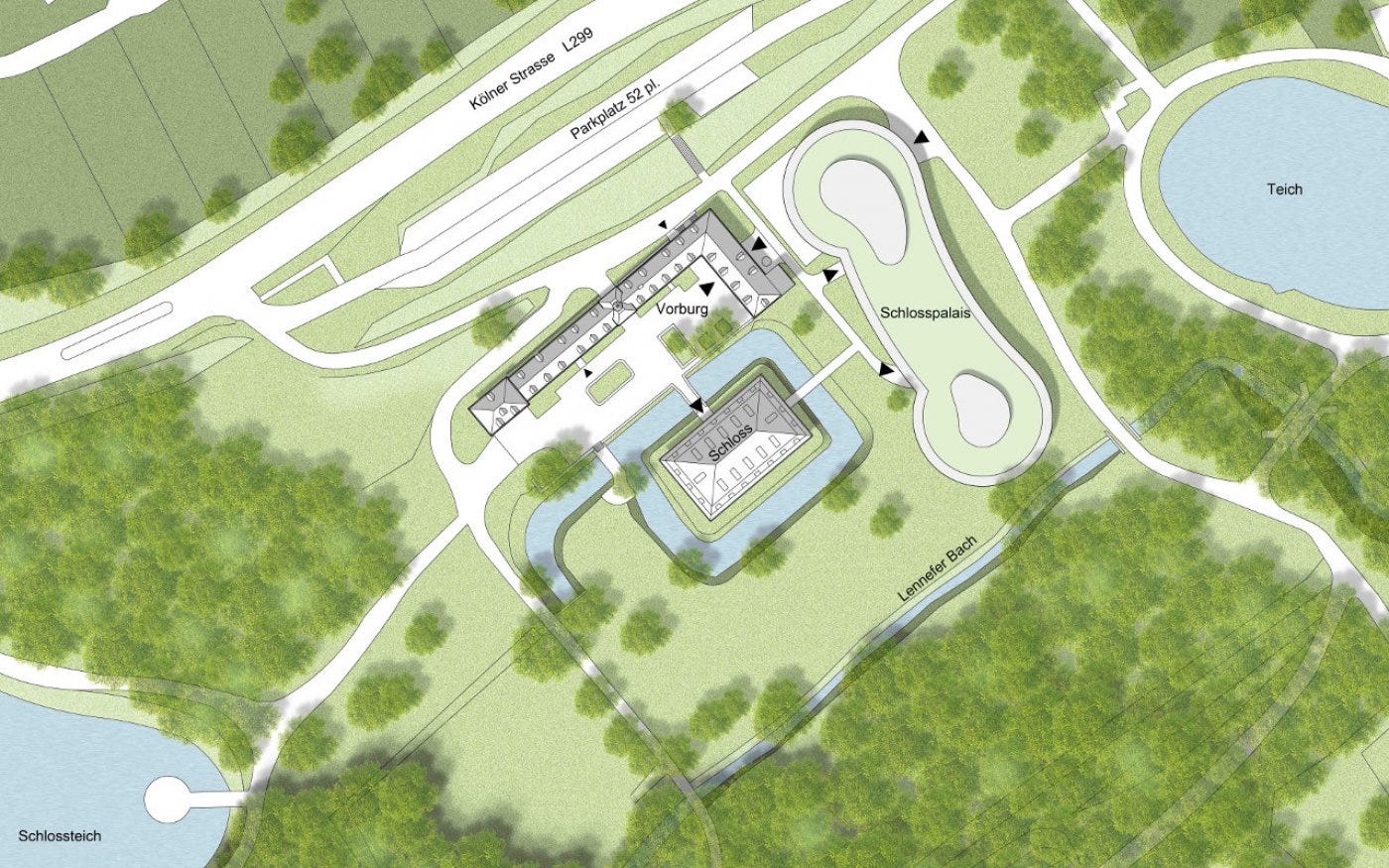

LIMES Schlossklinik Bergisches Land, also known as Heiligenhoven, is Limes’s third clinic. It is located near the company’s headquarters in Lindlar, Cologne, Germany. Originally planned to open in November 2022, the project faced multiple delays due to changes in ownership and ongoing disputes between the buyer and seller. As a result, development was halted and restarted several times, leading to two rounds of hiring and one round of layoffs.

This will be the largest clinic in Limes's portfolio, with a capacity of 128 beds (100 patient rooms). The facility is expected to specialize in high-end psychiatric and psychosomatic treatments.

However, 10-20% of the setup remains unfinished, requiring an additional €4-6 million investment (shared capex Limes-owner). The total setup cost was originally estimated at €42 million.

Property ownership changed hands in June 2022, and tensions between the buyer and seller prevented the project's progress. The new owners - a French investment fund - have since committed €50 million to complete the development.

Once completed, Limes plans to position it as its flagship facility. It will strategically focus on younger patients, catering to the growing demand for specialized mental health services in this demographic.

As of August 2023, preparations for operations began, with staff training commencing. However, the project faced further setbacks due to ongoing legal and financial disputes. All 30 previously hired staff members were laid off, except for one employee retained on the payroll, alongside minimal IT and standby costs. The long-term lease has not yet started, and without a license in place, no rental payments have been nor will be made until operations start.

The project was revived in July 2024, and it is planned to open in Q1 2025. Personnel hiring for the clinic is already underway, and key staff will start on January 1, 2025.

Bergisches Land is expected to charge over €750 per day, making it one of the company’s premium-priced facilities. Its strategic location near Luxembourg and the Netherlands is a key advantage, as patients from these regions typically pay higher rates than German insurers. If successfully launched, the clinic could become one of the most profitable and prestigious mental health rehab centers in Limes’s network.

4. LIMES Schlossklinik Abtsee

LIMES Schlossklinik Abtsee is a fully owned property by Limes, marking a strategic departure from their typical long-term lease model. Formerly known as Fachklinik Tiergarten, the clinic, which will open in Q1 2025, will have a capacity of 50 beds across 35 rooms and an estimated setup cost of €4–5 million.

The site has a rich history, originally serving as a refuge for children who lost their parents during World War II, before later becoming a plastic surgery clinic.

Limes acquired the property through a special purpose vehicle (SPV) at what appears to be an attractive price. Our estimation suggests a total purchase cost of around €4 million, of which €1.9 million has already been paid. The 25,000 m² lakeside property, located 20 minutes from Salzburg and easily accessible via S-Bahn, provides a serene healing environment that aligns with Limes’s treatment philosophy.

Rather than operating the facility as acquired, Limes opted for a full restructuring and renovation to modernize the clinic. The goal is to position Schlossklinik Abtsee as the most exclusive facility in their network, with a strong focus on younger patients.

Dr. Frank, a key figure in the project, emphasized that they have “picked up some history points” in revitalizing the location while maintaining its legacy.

Currently, 15 workers are on-site daily, installing infrastructure and preparing the clinic for operations. A dedicated suite is being designed to accommodate families, allowing parents and children to stay together if needed.

Unlike other Limes facilities, which rely on lease agreements, Abtsee is 100% owned by the company. This provides greater flexibility in facility design, operations, and long-term strategic decisions. Beyond its core healthcare function, the real estate itself represents a valuable asset, acquired at a highly favorable price. Thus, Abtsee is a healthcare investment and a real estate play. We will discuss this in depth later.

5. LIMES Clinicum Alpinum

Limes acquired Clinicum Alpinum, located in Gaflei, Liechtenstein, for €3.2 million, including cash and an earnout, which has already been paid in full. Unlike most acquisitions, Alpinum has been operating at break-even since its inception, making it a stable addition to Limes’s portfolio.

Clinicum Alpinum operates at a premium price point, charging €1,000 per day for its services. This places it in the upper tier of private mental health facilities, reinforcing Limes’s targeting of affluent clientele in highly specialized, well-located clinics.

6. Paracelsus Recovery

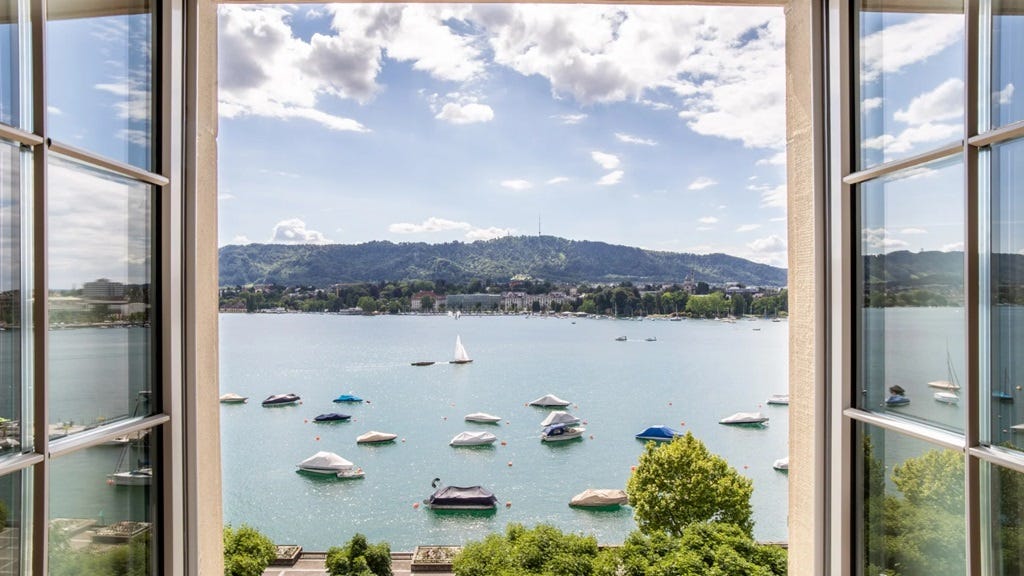

Paracelsus Recovery is a luxury rehabilitation clinic with locations in Zurich, Switzerland, and London, UK. It specializes in individualized treatment for ultra-high-net-worth (UHNW) clients. Limes Schlosskliniken holds a 56% ownership stake in Paracelsus Recovery, reflecting its strategic investment in the high-end mental health sector.

Jan Gerber, founder and CEO of Paracelsus, started his journey in luxury rehab through a personal experience. In 2010, his family helped a high-profile friend in need by turning their home into a private recovery space.

This led to the creation of The Kusnacht Practice, which quickly gained traction and was sold to private equity within a year. Still driven by his vision for elite, personalized care, Gerber founded Paracelsus in 2012, setting a new standard for high-end rehabilitation.

Paracelsus Recovery is renowned for its one-client-at-a-time approach, ensuring unparalleled privacy and personalized care. Each client benefits from the dedicated attention of a multidisciplinary team comprising over 15 doctors and therapists, maintaining a 15:1 staff-to-client ratio.

This intensive support model addresses a wide range of issues, including addiction, mental health disorders, and chronic conditions. Notably, the clinic offers the flexibility to deploy its comprehensive services to clients' preferred locations, providing on-site treatment with the full complement of staff and equipment.

The clinic's services are positioned at the premium end of the market. Pricing ranges from 25,000 CHF for a three-day health assessment to 120,000 CHF per week for an executive detox program at the Zurich facility.

Clients are accommodated in luxurious, private residences with amenities such as a personal chef, housekeeping staff, and dedicated limousine service, ensuring a comfortable and discreet environment conducive to recovery.

Most clients are (surprisingly) under 40, which has shaped a treatment approach tailored to a younger demographic. On average, patients stay for a month.

Many arrive via private jets, which severely impacted operations during COVID due to mandatory airport quarantines. This disruption created a financial strain, opening the door for Limes to step in with much-needed funding.

With the acquisition of 51%, in 2021, Paracelsus Recovery reported sales of EUR 8 million and an operating result (EBITDA) of EUR 2.5 million, contributing EUR 4.2 to Limes's consolidated earnings per share. The businesses are not reported separately, but we are confident they have performed well.

In 2023, they doubled their capacity, increasing from serving a single client at a time to accommodating up to two clients simultaneously. In June 2023, Limes acquired an additional 5% stake, increasing its ownership to 56% of the business.

For us, this is simply a bonus addition to an already exceptional clinic business.

Renting vs Owning

Please bear with me as we discuss this point. It’s incredibly important and deserves a thorough discussion.

This is one of two items that has led us down a rabbit hole of "what ifs."

Dr. Frank has repeatedly proven that his greatest strengths lie in his ability to select and reform properties, and his expertise in pricing and financing them.

With this in mind, Limes’s original strategy was to operate a capital-light, pure-play model - one in which properties would not appear on the balance sheet, but would instead be leveraged through long-term leases that increase at a fair, fixed rate aligned with inflation.

Given its potential for impressive returns, such as the +60% return on invested capital (ROIC) achieved with the first clinic alone and triple-digit ROIC on his second, we much prefer this approach.

Nonetheless, we must reiterate that Dr. Frank is a master of these operations. His latest approach involves opportunistically purchasing failing (but already equipped) clinics, with an expected payback period of three to four years.

While this presents an attractive deal in theory, it ultimately returns to the original business model, which requires a lean operational framework and instead now involves managing an incredibly illiquid asset.

Germany is well known for its abundance of "old money." This wealth often takes the form of impressive castles and expansive estates, which are generally extremely illiquid. Such assets demand massive capital investments or are subdivided into ever-smaller portions over successive generations.

Either way, selling is generally not an option. These assets are often used as collateral to finance extravagant, unsustainable lifestyles - a topic we won’t delve into here. What matters is that the demand for them remains very low.

For us, the capex light pure play should be the way to go.

We want the team to focus on operating super profitable, super high-quality clinics, and that is it.

Limes typically takes several years to select and prepare properties. Historically, this process has taken about four to five years from discovery to operation, with costs only incurred at the very end.

Under the pure-play model, Limes has historically assumed roughly 15% of the new capital expenditures required for renovations, ranging between €2 and €6 million. Additionally, Limes employs a highly refined and systematic approach to securing licenses, thereby minimizing the startup costs of new clinics.

Moreover, Limes has significantly shortened the revenue ramp-up period. While the first clinic took approximately 2.5 years to break even, new clinics now reach break-even in just three to four months, with some even starting off at break-even - similar to the Alpinum model. Note that perhaps this is in part because of the acquisition.

This streamlined approach not only makes the model less capital intensive but also effectively self-finances operations and boosts the internal rate of return on deployed capital.

One property that warrants further reflection is Meckelberg, which is currently secured under a long-term lease.

Dr. Frank has confirmed that the company holds an option to purchase this asset. This move could add over €100 million to the balance sheet and effectively transform the majority of the operation into a real estate venture.

While it is clear that Dr. Frank does not intend to exercise this option, its availability remains an important strategic consideration.

This naturally leads back to the broader question: Should the company focus on acquiring properties rather than solely leasing them?

We’d be very interested in hearing your perspective on this matter; leave your thoughts in the comments.

Challenges Faced by Traditional Clinic Founders

Most mental health clinic founders come from medical backgrounds, excelling in patient care but often lacking expertise in business operations, IT, marketing, and finance. Many struggle with fundamental administrative tasks, such as billing, leading to delays of 2-3 months in receivables.

Furthermore, they frequently encounter challenges in managing bank relationships and debt obligations, which create persistent cash flow issues. These financial constraints hinder their ability to scale operations effectively and, in some cases, may even lead to bankruptcy.

Dr. Frank, a key figure in Limes’s expansion, has emphasized that in this industry, finance and marketing take precedence over medical expertise when it comes to sustaining and growing a successful clinic. Professionalizing these core functions is crucial to ensuring long-term profitability and operational efficiency.

👥 Founder and Management

Limes Schlosskliniken AG is led by a team of distinguished professionals dedicated to providing exceptional psychiatric and psychotherapeutic care. The main management figures include:

Core Operations:

Dr. Gert Michael Frank (early 60s): Serving as the Chief Executive Officer and Chairman of the Management Board

Dr. Frank is the quintessential owner-operator, holding 76.9% of Limes Schlosskliniken’s outstanding shares. Before founding Limes, he was the CEO of Geratherm, a medical technology company

His journey to creating Limes was deeply personal - after the passing of his wife, he found inspiration in building a company that redefined high-end psychiatric and rehabilitation care

Balancing dual roles, Dr. Frank led both Geratherm and Limes simultaneously, ultimately selling his shares in the former to finance the latter

His deep expertise in finance, coupled with years of hands-on operational experience, has sharpened his ability to navigate the complexities of running a business in this sector

However, he has been known to be overly optimistic in some of his forecasts, a trait associated with ambitious entrepreneurship

Dr. Frank describes his experience as "fun," which is remarkable given the challenges of scaling a specialized healthcare company. He understands that success isn’t just about having a great idea - it requires resources, experience, and an unrelenting enthusiasm for the mission

Dr. Kjell R. Brolund-Spaether (mid 40s): As the Chief Medical Officer, he leads the medical team at LIMES Schlossklinik Mecklenburgische Schweiz

Dr. Brolund-Spaether, known as “Dr. Brolo”, recently joined the board and took on a key leadership role within Limes Schlosskliniken

Having played a crucial part in revitalizing Meckelberg, he now oversees all medical operations across the company

As the central figure in medical decision-making, he maintains daily contact with the heads of each hospital, ensuring consistency and high standards of care

His leadership not only strengthens the medical framework of the organization but also frees up significant time for Dr. Frank to focus on broader strategic initiatives

A specialist in psychiatry and psychotherapy, he emphasizes personalized and holistic treatment plans for patients

Dr. Rita Löw: Serving as the Chief Physician at LIMES Schlossklinik Fürstenhof, Dr. Löw focuses on providing a tranquil environment for patients to facilitate mental recovery, leveraging her extensive experience in psychiatry

Supervisory Board:

Board compensation is purely expense-based, with members working on a success-driven model - they only receive shares if the stock price reaches €600. From the very beginning, Dr. Frank has been unwavering in his vision of operating the business targeting whom and distributing the rewards. Here are the members of the board:

Dirk Isenberg: As the Chairman of the Supervisory Board, Dirk Isenberg oversees the company's governance and ensures that strategic objectives align with stakeholder interests

Bruno Gerard Schoch: A member of the Supervisory Board, Bruno Gerard Schoch contributes his expertise to guide the company's long-term vision and compliance

Halim Boustani: Also serving on the Supervisory Board, Halim Boustani plays a crucial role in advising on financial and operational matters

Medical Advisory Board:

At first, we were surprised by the presence of an advisory board, but it makes perfect sense, especially during the company's early stages. These members played a key role in shaping Limes’ identity, contributing to its initial discovery (by patients) and helping establish it as a premier brand for mental health clinics.

Prof. Dr. Thomas C. Südhof: Chairman of the Advisory Board, Prof. Dr. Südhof is a Nobel Laureate in Medicine and Physiology (2013). He brings invaluable scientific insight to the therapeutic approaches at Limes Schlosskliniken

Prof. Dr. med. Christian Otte: A member of the Advisory Board, Prof. Dr. Otte is a Professor of Clinical Psychiatry at Charité-Universitätsmedizin Berlin. His expertise enhances the clinic's medical-psychiatric competencies

Prof. Dr. med. Uwe Nixdorff: Also serving on the Advisory Board, Prof. Dr. Nixdorff is a leading cardiologist and sports physician in Germany. He supports the development of somatic medicine and the LIMES Sports Care program

💵 Income Statement and Balance Sheet

Operations

The model operates like a hotel: there are fixed costs to cover, and profitability skyrockets once the occupancy rate reaches a certain level.

In Limes’s case, the average clinic breaks even at roughly 39% capacity.

For the entire operation to turn a net profit, occupancy must exceed 49%. Thanks to the relatively low overhead costs, this threshold should converge toward 39% as the number of clinics increases.

As capacity usage climbs, EBIT is expected to rise correspondingly. Our estimates suggest that achieving 90% capacity could drive an EBIT margin just under 40%, which is (to put it lightly) remarkably impressive.

Even more noteworthy is the consistency of free cash flow, which should consistently equate to 90-95% of EBIT. Given this model is capital-light, there’s little depreciation or significant maintenance capex involved.

We will jump into the detailed reasoning and present the actual figures in the Valuation section.

Financing

The financing approach is straightforward. Dr. Frank financed the entire operation through shareholder loans at an interest rate of just 1-2%.

Currently, outstanding debt costs have fluctuated between 1% and 6%, underscoring the company’s conservative financing strategy, which is expected to continue.

Moreover, given the robust cash flow generated by the business, funding new clinic CAPEX should be relatively easy, that is, unless the company decides to invest in owning large-scale properties.

Pricing Power

One of this model's core competitive advantages is its pricing power. Customers remain largely indifferent to price increases, and healthcare insurance behaves similarly. Thus, the company can pass costs on to patients while expanding margins as Limes’ brand recognition grows.

Dr. Frank noted that price adjustments in 2023 were modest, but due to the inflationary period, a significant increase is expected in 2024. While this approach initially led the company to cover some extra costs out of pocket, the upcoming repricing should result in a substantial margin rebound.

📈 Looking Ahead: Operational Leverage and Prospectus

To consolidate our ideas, let’s briefly recap the company’s activities. Limes currently runs three distinct, simultaneous businesses: