🎆 Masterclass: $EMX Breakdown

Masterclass by James Foord: Mini-deep dive on a Canadian company leveraging royalties across precious and vase metals

My dear fellow Hermits 👋

Welcome back to 🧙♂️ The Hermit 🧙♂️

This content is intended for informational purposes only and should not be taken as investment advice. The author does not represent any third-party interest, and he may be a shareholder in the companies described in this series. Please do your own research or consult with a professional advisor before making any financial decision. You will find a full disclaimer at the end of the post.

In case you haven’t noticed, gold is on the rise. The yellow metal is breaking all-time highs day after day, and this trend will likely continue.

In this post, we will discuss:

Why gold is trading at all time highs

Why gold is a great asset to hold in any situation

How to gain exposure to gold through a royalty company

Why I think EMX Royalty EMX 0.00%↑ could appreciate 60% from here

But first, a little bit about me, The Pragmatic Investor

An approach that assesses the truth of meaning of theories or beliefs in terms of the success of their practical application.

That is Pragmatism, and it guides my investment philosophy.Through many years of analyzing markets, I have found this is what works.

Macro, Fundamentals and Technicals.

This is the three-pronged approach that has helped me beat markets over the last five years.

For long-term investing, there’s nothing better than understanding business cycles, macroeconomic trends and geopolitics.

On the other hand, when it comes to short-term moves in markets, the best tool we have is technical analysis. And not just a specific form of technical analysis but a robust set of tools that can all work in conjunction to help us find great setups.

I actually recently designed my own algorithm, you can see it here:

My Substack is designed to guide investors of all levels in their journey.

Understand markets with the weekly newsletter.

Build a diversified global portfolio that will stand the test of time.

Get actionable trade ideas to take your investment returns to the next level.

Every week I give a macro update, a technical analysis update on the main indexes and stocks and I cover a stock in-depth, looking at its fundamentals.

Now, it’s time to apply this three-pronged approach towards analyzing EMX Royalty.

The Case For Gold

With the Federal Reserve recently beginning to cut rates, everyone is now talking about a soft vs. hard landing and the possibility that inflation may resurge.

Whatever happens, I believe that gold exposure is a must for a well-diversified portfolio.

During a soft landing, gold typically rises modestly, as seen in 2001-2003 when it gained about 30%. Lower rates support gold, but slow growth limits the upside. It won’t be the best-performing asset, but it will do okay.

During a time of rapidly falling rates, a slowing economy and falling inflation, more of a hard landing scenario, gold thrives as a safe-haven asset, performing well during crises like 2008, when prices soared.

And, of course, gold benefits from inflation hedging, as seen in 2003-2006 when prices doubled. Gold was also a great hedge during the inflation of the 1970s

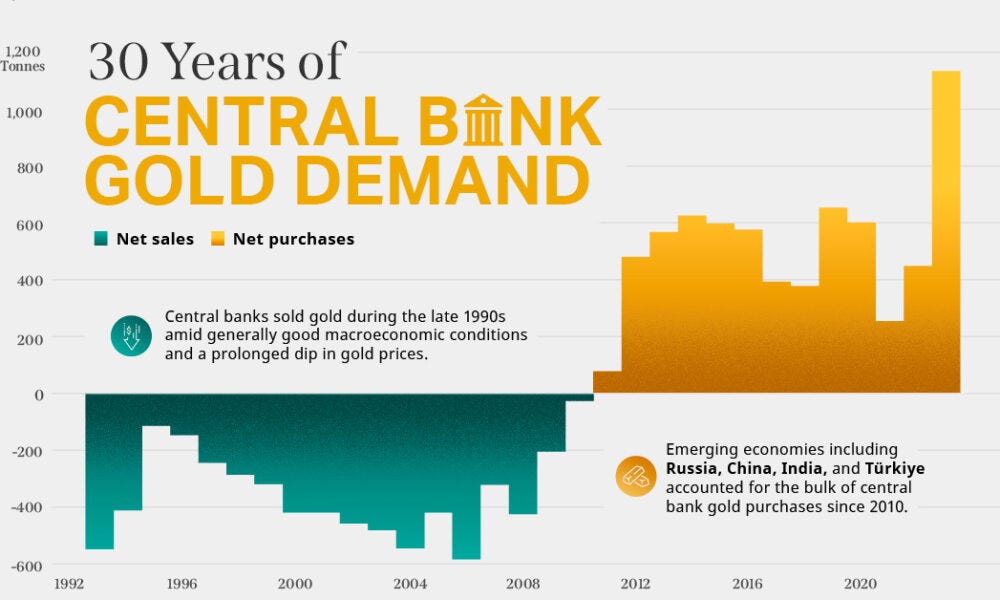

The largest players in the Financial system, Central Banks, have been ramping up their gold purchases in the last few years.

Central Banks buy gold to hedge against geopolitical and currency risks, and as this increases, so will the gold price.

This is a very encouraging sign for gold investors.

EMX: Gold Royalties At A Bargain Price

EMX Royalty is a Canadian company focused on generating revenue through a diversified portfolio of royalties across precious metals (gold, silver) and base metals (copper, nickel, zinc). It builds value through royalty generation, acquisitions, and strategic investments in mineral exploration.

Despite strong operating results and a wide asset base, EMX's stock has underperformed the broader market. With 12.6% of shares owned by management, directors, and employees, interests are aligned with shareholders, presenting a potential value opportunity given its underappreciated portfolio.

EMX Last Quarter

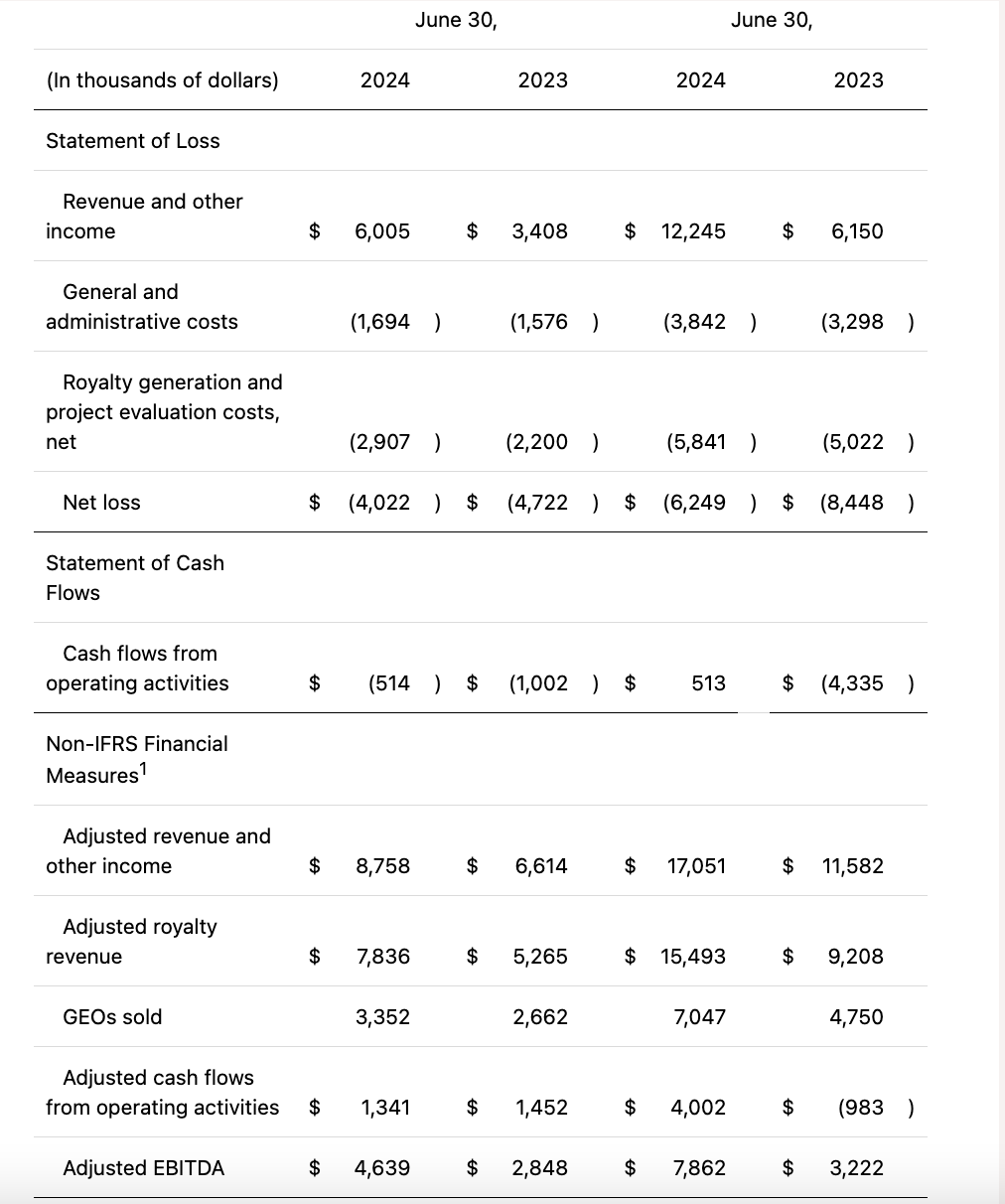

EMX Royalty's Q2 2024 revenue reached $6.01M, up 76.2% year-over-year. The company recognized $8.76M in adjusted revenue and $7.84M in adjusted royalty revenue, showing 32% and 49% increases, respectively, compared to Q2 2023.

EMX maintains its 2024 guidance of 11,000-14,000 GEOs sold and expects adjusted royalty revenue between $22M and $27.5M, on track to reach the upper end of these figures.

Growth And Profitability

One of the largest appeals for EMX is the fact that it has aggressively expanded its operations and revenues.

As we can see, revenues have exploded higher as EMX has expanded its portfolio. And while the company has generally struggled to stay profitable, we have also seen operating margins begin to flip positive.

Alphaspread gives the company a profitability score of 53, but to me, the growth in free cash flow and operating income are encouraging signs.

Balance Sheet

EMX Royalty has $21.4 million in cash and $33.7 million in debt, resulting in a net debt of $12.3 million. With growing royalty payments from Timok, debt pressure should ease. EMX also launched a share buyback program in April 2024, potentially signalling expectations of higher free cash flow. With a current market cap of $205.5 million and an enterprise value of $217.8 million, the company’s capital structure, composed of 94.3% equity and 5.6% debt, appears conservative and manageable.

Valuation

Valuing junior royalty/streaming companies can be very tricky, so I will try to do a peer comparison analysis. I'll be using Franco-Nevada (FNV), Osisko Gold Royalties (OR), and Wheaton Precious Metals (WPM). Franco-Nevada has a P/S ratio of 20x, Osisko Gold Royalties at 16.5x, and Wheaton Precious Metals at 24x.

EMX Royalty does indeed trade at a massive discount to revenues compared to its larger peers, trading at 6x FWD sales according to Seeking Alpha.

If we assume that revenues increase to $40 million annually as the uptrend in royalty revenues continue, and apply a below-peer multiple of 10x sales, we get a fair value of $400 million in market cap. Divide by shares outstanding of 112 million gets me $3, rounded down.

This means EMX has an upside potential of close to 60% at today’s price, and perhaps higher if gold and precious metal prices continue to rise.

EMX Technical Analysis

Now, let’s look at the technical chart for EMX.

Starting with the weekly chart, we an see that the 20 EMA may soon cross the 50 EMA. More importantly, though, the MACD could be ready to give us a bullish crossover, which would be a bullish signal.

But perhaps the most bullish of all the signals here is the seasonality graph we can see on the right.

Based on data from the last 13 years, the next three months are likely to be quite positive for EMX’s stock price.

Zooming into the 4h chart, my patented algorithm flashed a buy signal on EMX at around these levels, though the stock dipped lower and then recovered.

Overall, this algorithm’s strategy has managed to slightly outperform a buy and hold approach.

At the moment, we are consolidating around the $1.8 area, but once this is broken, the stock could jump up quickly as it doesn’t face as much resistance.

Risks

Possible risks with EMX exist due to the fact that it is still struggling to post positive earnings.

This poses a threat in terms of the need for future financing. Investors may need to be cautious about EMX Royalty's potential future capital needs. Despite holding $21.4 million in cash, the company could face future working capital deficits.

If this cash depletes, EMX might have to resort to issuing new shares or increasing debt to manage its operations. Monitoring the cash position will be essential to assess the risk of dilution or additional debt burden, which could impact the stock's value and investor confidence moving forward.

Takeaway

EMX Royalty presents a compelling investment opportunity. The company is positioned to benefit from rising gold prices and increased royalty revenues.

Despite its current undervaluation compared to peers like Franco-Nevada, EMX is expanding its portfolio, showing growth in both free cash flow and operating margins.

With a share buyback program in place and a conservative capital structure, EMX is set for potential long-term appreciation, making it a promising option for investors seeking gold exposure. However, potential risks include future financing needs and cash depletion.

🙏 Feel free to ❤️ and comment so that more people can discover and enjoy this Substack 😇

First thing I notice is capital inefficiency for a royalty company. They have 46 employees which is huge for a tiny royalty company with basically no operations.

Compare WPM which has 100x the market cap as this company and has 5 LESS employees.

Do you know the reason for their operational complexity? Or is this just poor management?

I didn't dig too much after seeing that but it kind of sounds like they're also in the exploration business so not a strict royalty/streaming co.