🎆 Masterclass: This Sector is About to Explode

Masterclass by MktContext: How Rate Cuts, Earnings, and Economic Growth Combine to Create a Powerful Mix.

My dear fellow Hermits 👋

Welcome back to 🧙♂️ The Hermit 🧙♂️

This is a guest post in collaboration with

, a seasoned macro expert. He brings a wealth of knowledge and fresh insights to the table, making this a must-read for anyone trying to wrap their head around the macro levers driving our economy, especially if you're still scratching your head about how rate cuts impact small companies!Welcome to the free midweek edition of MktContext. I am a professional money manager. We’ll help you improve your investment returns by timing the stock market. Subscribe to receive free weekly insights in your inbox:

For those new to MktContext, we use macro economic data and stock market signals to make investment decisions. This helps us beat the market compared to a buy-and-hold ETF strategy.

We were recently able to time the top and bottom of the August selloff. Check out our past archive to see market timing in action!

Current state of the economy

Lately the market has become concerned about recession. Recent economic data have shown some signs of decelerating and investors mistake this for the start of a slide. In reality, we are coming down from a period of elevated post-Covid activity and shortages.

We make the case that we are NOT headed for a recession, and in fact there could be a reacceleration in economic growth later this year. By now you’ve probably heard that the unemployment rate is rising, but as we wrote in the past, rising unemployment is not being driven by layoffs. That’s the key difference from past recessions.

Consumers remain on strong footing. According to banks, people still have a lot of cash and investments in their accounts — around twice as much as they had in 2019. Consumer spending data is quite positive as they splurge on vacations and experiences. People are spending money because they remain gainfully employed and wages are rising.

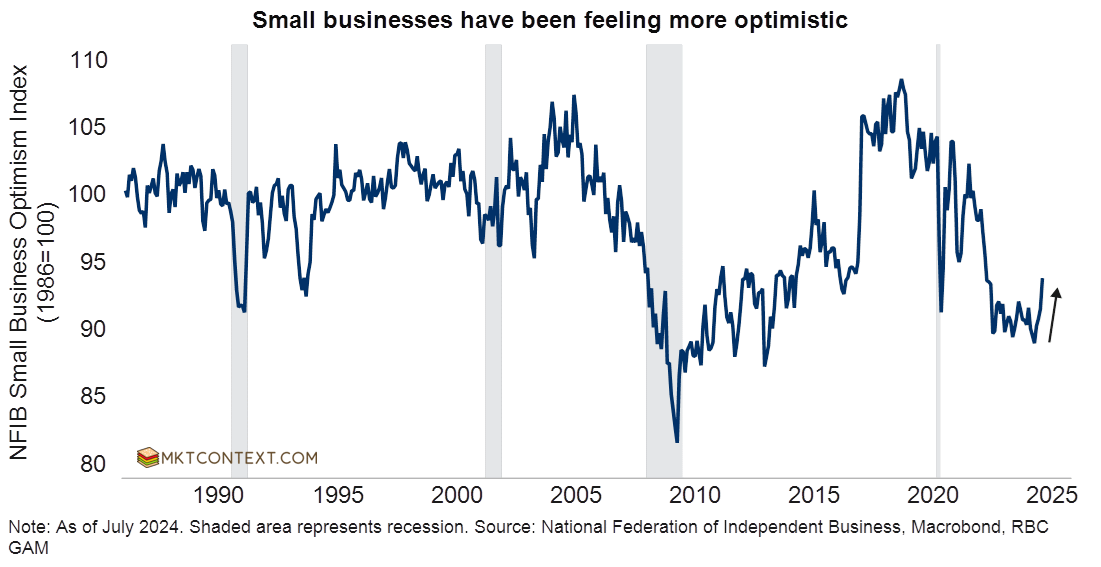

Businesses are also doing surprisingly well. Profit margins are expanding and few companies are defaulting on loans. Small businesses are, frankly, the most optimistic they’ve been all year:

Which leads us to the crux of this post: The sector you want to buy in such environments is Small Caps (IWM).

Rate cuts and earnings a potent mix

With the Fed cutting interest rates, small companies perform well because they pay less interest on their high debts. Polls of business owners show that they are holding off hiring and spending decisions until they get clarity on interest rates.

The Fed rate cuts announced on Wednesday and for the rest of the year will unleash a growth surge across small companies. The IWM is heavily driven by cyclicals and banks, both beneficiaries of falling interest rates.

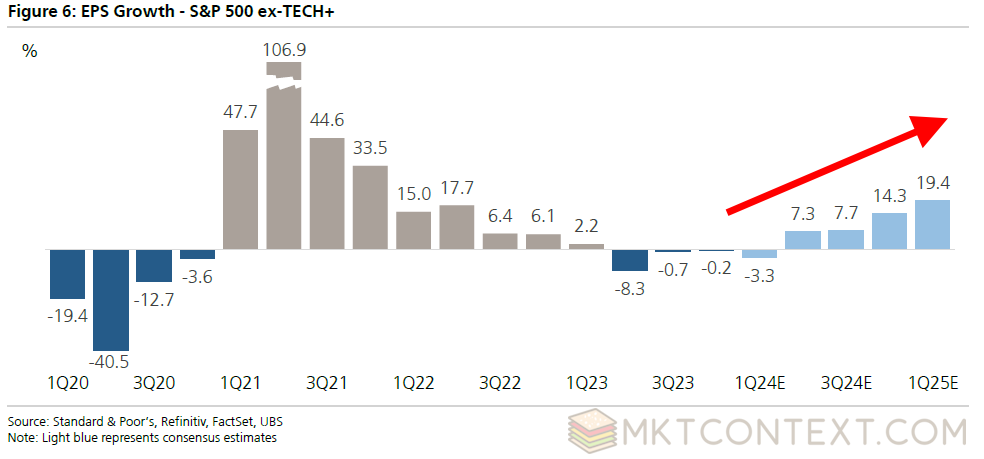

After a two-year slowdown, earnings for smaller companies in the S&P500 are set to grow (chart below). Analysts are revising estimates higher and all industries are participating. This contrasts with the Mag 7 whose earnings are peaking. The ensuing rotation could reverse a decade of underperformance in IWM.

Drivers of outperformance

For a bull market in small caps, you usually need 3 ingredients:

Manufacturing activity

Above average GDP growth

Valuations

US Manufacturing has been in a slump for two years post the post-Covid buying spree. Practically everyone is negative on manufacturing, which usually signals an opportunity to be contrarian. No one is mentioning the regional green shoots that are showing up, for example in New York (H/T Daily Chartbook):

GDP is estimated to be growing at 3% (net of inflation) which is very healthy. In fact, it has started to accelerate over the past month. Small cap outperformance is correlated with economic expansion, which we are getting closer to in 2024.

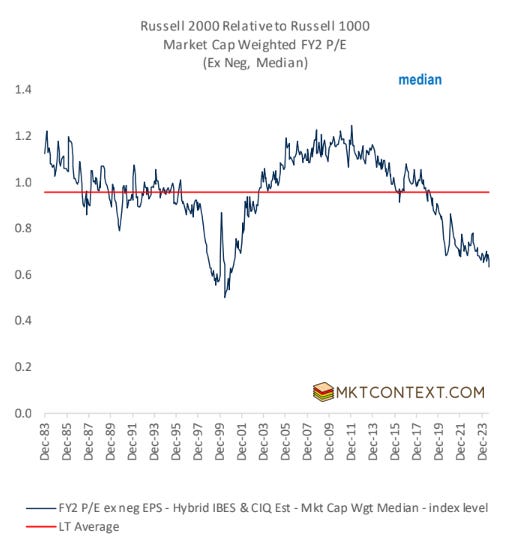

Lastly, the median valuation of small cap companies are at generational lows:

Technical analysis

Cup/handle patterns encapsulate a long consolidation followed by a new uptrend. After a two-year consolidation (the cup), IWM broke out of resistance at $210. It then retested that level and held. This is a signal for a bullish move in the months ahead.

Longer term, we could see IWM reverse a decade-plus of underperformance relative to the SPX:

Aside from chart reading, technical analysis includes analyzing the components of the index and the positioning of other traders. This akin to analyzing the other players at a poker table.

In mid-July IWM had a “breadth thrust”. Breadth analyzes the general momentum of the stock market to reveal when buyers start to dominate the market. The thrust occurs when the vast majority of stocks move in tandem, and is a sign of shifting sentiment. It carries a strong edge for returns over the following 12 months.

In addition, the advance/decline line (tracks the number of advancing stocks relative to the number of declining stocks) is at all-time highs. Breadth is returning to the market, meaning there’s a concerted rally across the board. The equal-weight SPX is reaching new highs as we speak.

One area of caution: Positioning of large speculators in the market (green line in chart below) is near 3-year highs, showing the market is already long Russell 2000 (IWM). A selloff could potentially trigger a positioning unwind.

How to play this rally?

With the debate still raging about whether recession is coming, plus election year seasonality not in our favor (regular readers will know), there will likely be opportunities to buy dips in IWM. We would suggest buying at the 9-day and 21-day moving average (daily bars).

In terms of portfolio allocation, we would put 10-15% of your normal US equity allocation into IWM. Why the small position? We want to wait for a positioning wash and more confirmation that the economy is reaccelerating.

That’s it for today’s post! If you like our content, please click the button below to subscribe. Our free weekly letters will teach you how to use economic data and technical analysis to make money in the market. We’ve been timing the market (and beating it) since 2014.

Disclaimer: This publication is for educational purposes only. The authors are not investment advisors and nothing here is investment advice. Always do your own due diligence.

🙏 Feel free to ❤️ and comment so that more people can discover and enjoy this Substack 😇

Awaiting to see more!

What do you think about gold and commodities in this environment?