🧗 A Perpetual Funnel of Investing Ideas

OIJ (#12) Manifesting an endless pipeline of ideas seems to be key in the world of financial. But how does this impact you?

My dear fellow Hermits 👋

Welcome back to 🧙♂️ The Hermit 🧙♂️

ICYMI:

💼 The Hermit Portfolio: August Update

🧗 Our Investing Journey: Mozart’s biggest failure

📝 Company Updates: Limes Schloss Clinics H1 2024

If you haven’t yet, subscribe to get access to this post, and every new post

⚠️ Beware: Controversial Ideas Ahead! ⚠️

I have no doubt that this article will ruffle some feathers among my peers. Frankly, I’m not concerned about that.

This topic touches on one of my core beliefs, and I'm willing to stand by it, even if it challenges the status quo or makes others uncomfortable.

Integrity > Money

Professional Stock Idea Generators

So why are so many people pushing out large quantities of “top 5 stock you should buy this month” posts? To me, the answer lies in one of two incentives:

Commission: Professional salespeople, such as brokers and investment bankers, must continually sell to earn commissions. Sell-side professionals and intermediaries are often driven to produce a high volume of content, frequently lacking substantive value, in their pursuit of income.

This focus on quantity over quality is a significant shortcoming, making their advice a poor companion for serious decision-making. Without careful attention to detail, their guidance can be not only unhelpful but potentially harmful.

Engagement: Influencers and commentators also seek to capitalize on the excitement, flooding the space with a constant stream of content. While they may not directly profit from your investment decisions, they do benefit from capturing your attention. Their primary goal is to keep you engaged.

Though generally harmless, the real risk arises when people follow their advice to the letter. These figures can occasionally offer valuable insights, particularly in areas where they have expertise. However, it's often wiser to observe their actions rather than blindly follow their words.

If investing were easy, everyone would be wealthy - yet that's far from reality. So, why isn’t that the case?

To be frank, most investing ideas suck.

I don't mean to suggest that advice can't make money - often through sheer luck. What I’m trying to point out is that incentives are lined up to keep you in the loop.

The real goal of this industry isn't necessarily to help you secure your retirement; it's to keep you engaged.

No one else is fighting for you. The only person who can truly fight for you is yourself. So, let's dive right into the training your skills and intuition. Let’s get the party started.

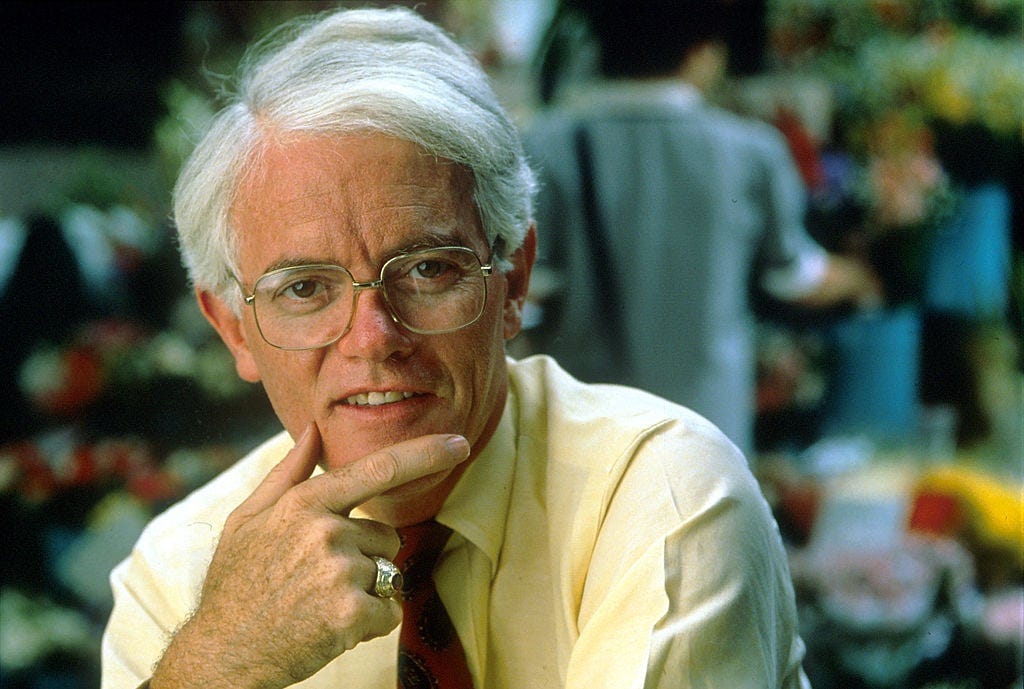

Finding and Training Your Edge ft. Peter Lynch

Here’s my humble attempt at bouncing Peter Lynch’s lessons around, along with some insights on how you can apply his teachings to your own investing strategy.

When it comes to investment research, it’s all about playing to your strengths and knowing your limits - something Peter Lynch mastered. He famously coined the concept of the “circle of competence,” which is essentially sticking to what you know best. Instead of chasing the latest trends or complex investments you don’t fully understand, focus on industries or companies where you have real knowledge or experience. That’s where you’ll have a real edge.

The next time you come across someone's top 5 list, take a moment to consider: does this person genuinely understand microprocessors, drones, retail, and oil, or are they just speaking without real knowledge?

A more blunt way of saying this would be “Are they talking out of their ass?” 😊

Lynch also emphasized the importance of understanding and timing. He didn’t just dive into stocks blindly; he did his homework. He studied the companies, understood their business models, and kept an eye on the market to find the right entry points.

You can do the same by paying attention to the products and services you use every day.

Who manufactures your shampoo? What makes this shirt so comfortable? How are the tires on your car made? Why are there so many spas in your city?

Back to Lynch. Part of his approach was considering not just what you know, but who you know. Lynch often leveraged his expert network, tapping into the insights of people who had deep expertise in various fields. These connections can provide valuable perspectives that might not be immediately obvious.

What businesses are your parents, friends, and acquaintances involved in? Can I grab a beer with them and pick their brains about what really works in their industries?

And finally, there’s time. Lynch was patient; he didn’t expect overnight success. He knew that good research takes time, and so does letting your investments grow. He was in it for the long haul, understanding that time in the market often beats trying to time the market.

You shouldn't rush to invest your money. Take a step back and tune out the noise of people hyping so-called "whisper stocks." There's an endless stream of those, but truly good ideas are rare - they'll only come to you a handful of times in your lifetime.

Let me illustrate your advantage with a complex yet fascinating video by one of my favorite YouTubers: "The Cost of Concordia" by The Internet Historian.

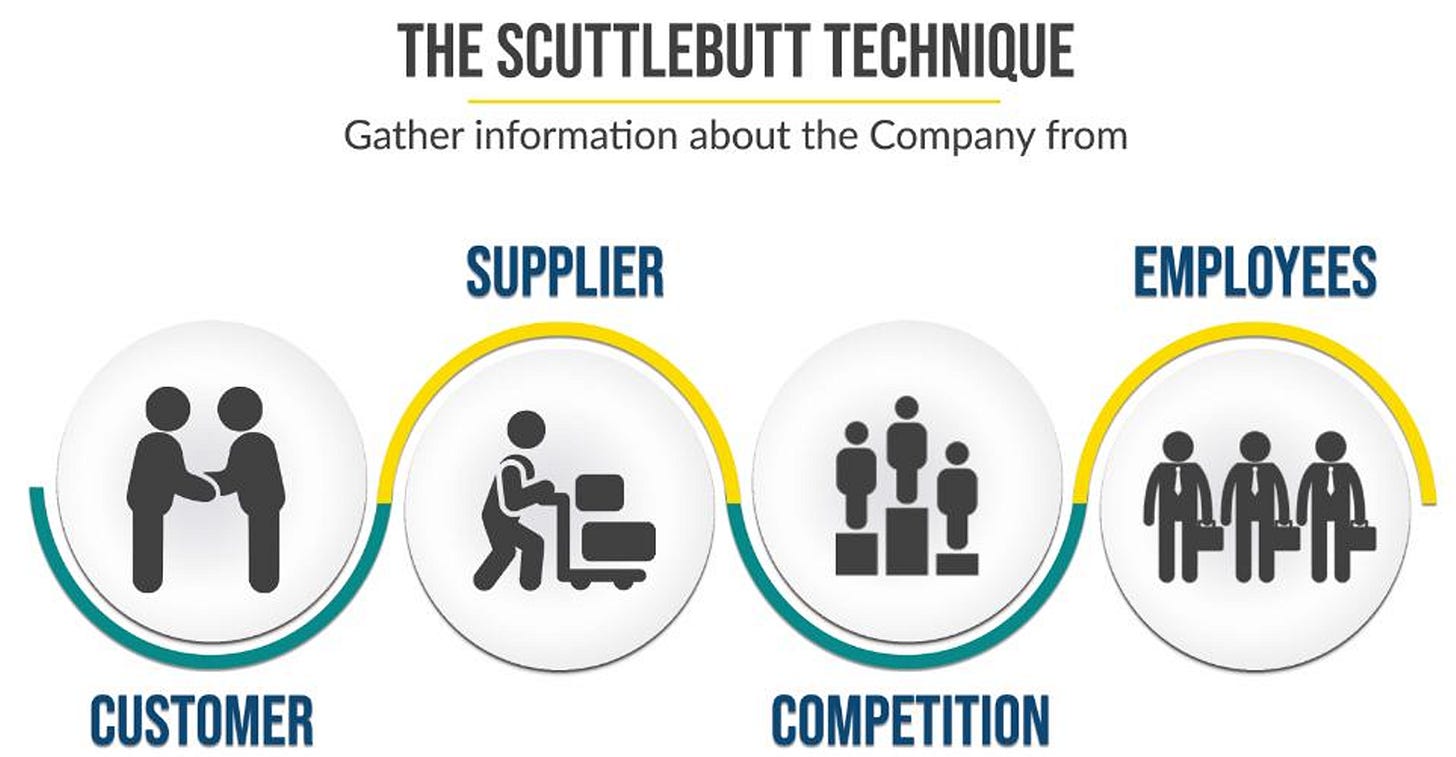

For context, the video recounts the Costa Concordia disaster with a good dose of humor, but more importantly, it dives into the behind-the-scenes gossip and lesser-known details aka scuttlebutt. This guy can take up to a year to release his videos.

The video is a prime example of how dedication and a keen eye can lead to remarkable results. Created by an ordinary individual with sheer determination, it goes far beyond simply recounting the disaster.

The creator meticulously examines the technical details, human errors, and decision-making processes that contributed to the tragedy, all while humanizing those involved with humor.

The video turns complex information into something both accessible and engaging. If you ask me, this thoughtful approach elevates "The Cost of Concordia" to a true work of art.

Here’s the video. If this is your first time watching it, I genuinely envy you.

The Flip Side: The Challenges I Encounter

Before starting this publication we had a steady stream of ideas going back to 2017/18. We’ve tracked most of these ideas for anywhere from 1 to 5 years, and the difference between a year and five is worlds apart.

We might come across 1, 2… maybe 3 solid new ideas a year. It’s our experience that you can spend a lot of time researching, only to find that most ideas don’t make the cut.

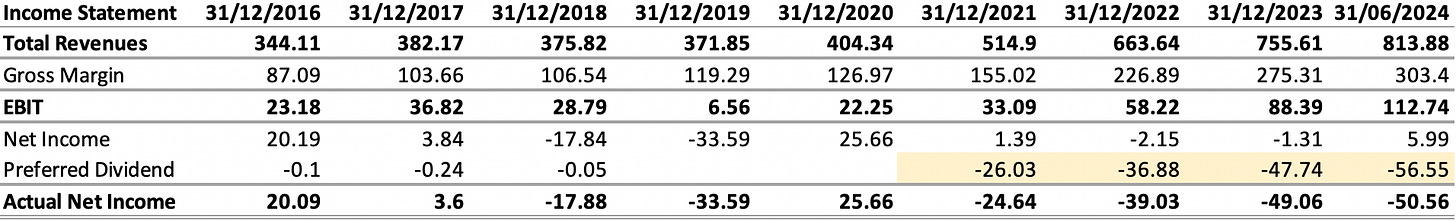

Take Priority Technology Holdings as a recent example PRTH 0.00%↑ . It has a great business model, with competent management, and promising future prospects. However, it’s rendered uninvestable due to the issuance of preferred shares. This instrument paid out 15% in 2022, then 17% in 2023, and has a cap of 22%. For common equity investors, this is a complete trap - they’re unlikely to ever see a return. For the technical guys out there, it’s essentially perpetual debt at 12% plus 3-month LIBOR. Here’s the issuance document:

The initial dividend rate will be equal to the Three-Month LIBOR Rate (subject to a 1.00% floor) plus 12.00% per annum, reset quarterly as provided in the Certificate of Designations.

The Dividend Rate shall increase automatically by (i) 2.00% per annum effective as of the first day of each Dividend Period in respect of which the Company for any reason does not pay cash Dividends at or greater than the Three-Month LIBOR Rate for such Dividend Period plus 5.00% per annum through the final day of such Dividend Period, (ii) 3.00% per annum effective immediately upon the occurrence of and during the continuance of a Preferred Default and (iii) 5.00% per annum effective immediately upon the 120th calendar day following the approval by the Sale Demand Special Committee of a Sale Transaction if all required stockholder approval shall not have been obtained on or prior to such 120th calendar day, plus an additional 5.00% per annum on the 30th calendar day after such 120th calendar day and on the first day of each subsequent 30 calendar day period, which incremental increase(s) shall continue until such time as the Required Stockholder Approval shall have been obtained.

You can read the entire document here. These are the actual numbers from 2016 through June 2024.

To me, this is the textbook definition of scamming your shareholders. Sure, it’s perfectly legal, but that doesn’t make it any less immoral.

I spent about 30 hours researching this before I finally got around to reading the full issuance document. Now, some of you might be thinking, "Why didn’t you check that first?" In my defense, when you’re in the thick of research, it’s not always clear where to start. My process is more about ticking boxes.

The reality is that even the best ideas and the strongest companies can end up being terrible investments. That’s why understanding the capital structure is a crucial aspect of investing. It’s one of many necessary, but not sufficient, factors that every investor should strive to master.

We’ve seen a lot of similar scenarios and probably only scratched the surface of all the possible scams, quirky derivatives, and financial trickery out there. So, yeah, there’s still plenty of room to fall victim to scammers.

If they can fool a professional, imagine what they can do to someone who’s vaguely acquainted with the brand.

Conclusion

If I had to sum up what you’re about to read I’d say the following:

Not all advice is created equal.

Stay critical and prioritize quality over quantity to protect your financial well-being.

🙏 Feel free to ❤️ and comment so that more people can discover and enjoy this Substack 😇