🧗 A Guide on Moats

OIJ (#15) Defending the Castle: Understanding Company Moats and Their Role in Long-Term Growth

My dear fellow Hermits 👋

Welcome back to 🧙♂️ The Hermit 🧙♂️

ICYMI:

🧗 Our Investing Journey: On Leadership

💼 The Hermit Portfolio: September Update

📈 Investment Thesis: Lazydays (mini write-up)

If you haven’t yet, subscribe to get access to this post, and every new post

The Moat Confusion

By now, you’re probably used to my mix of random trivia and (hopefully) great insights. In this latest chapter of 'Alejandro Yela’s introspective journey,' I’m diving into one of the most important, yet often overlooked, aspects of investing: execution.

Over the last few months, we’ve gotten a lot of questions about how we spot interesting opportunities. One of the most common themes is around competitive advantages, or moats, and how they play into long-term growth.

We believe people have this upside down.

Most people are hunting for companies with obvious, established moats. But here’s the thing - by the time a moat is that clear, it’s already baked into the price.

In the end, that’s not what sets a company apart. It’s the execution that really makes the difference.

This post will explore the top 6 core types of moats, their key advantages, and a few myths about how moats work.

The Moats

Companies can have one or more of these traits, or sometimes just bits and pieces of them. I'll break them down for you, from easiest to hardest to achieve.

🚫 Regulatory Barriers

Regulation is the easiest competitive advantage to spot. Whether it’s a local monopoly in utilities or a biotech patent, both rely on third-party approval.

Companies with this kind of moat tend to get comfortable with their privileged status usually resulting in management becoming fat and complacent.

💸 High Switch Costs

Switching costs create friction when moving from your service to a competitor’s. This could be something like a supermarket loyalty program or an internet provider requiring you to return equipment before you can cancel. In the end, you’re usually paying extra for little benefit.

Overall, switching costs aren’t very effective. If you're happy, you won't want to switch, and if you're unhappy, they just add to your frustration and can even hurt the company’s reputation.

👑 Status Holders

Some brands are all about status. Think Ferrari: flashy, loud, fun - but not always the most reliable.

The thing is, what signals status today might not hold up tomorrow. To be super crude, owning slaves was once a marker of wealth, and we all know how that aged 😳

💡 Advice and Reputation

High-quality or reputation-dependent products are typically top-tier because they prioritize the customers’ best interests. It’s all about alignment.

The happier you are, the more the company benefits.

This can be anything from knowing a Coke will taste the same anywhere in the world, to Walmart’s quick customer service ensuring you get your money back immediately. You trust and purchase the product knowing a consistent outcome will always be the case.

🌐 Network Effects

Network effects increase the value of your product or service as more people use it. The more users, the more valuable it becomes.

While social networks are the classic example, this also applies to the Uber driver-rider dynamic and even tools like ChatGPT, where more usage helps improve the product itself.

💰 Cost Savers

Economies of scale shared are easily the most powerful moat on this list. The idea is that as a company’s operations become more efficient, the benefits are passed on to you, the customer, through better products, lower prices, or both.

These companies are actively competing on your behalf. Classic examples that demonstrate this in action are Costco and Amazon.

Moat Myths

🏰 The wider the moat, the better

Complacency breeds failure. A company may be ahead with a super wide moat, but if they're snoozing at the wheel, they're toast. It’s not just about having a narrow or wide lead - it’s about making sure that lead is constantly growing (or widening).

🔥 All moats are created equal

Both incentives and scale increase the barriers for competitors. Some moats can lead to different outcomes, especially when they align with customers' wants and needs. A business should aspire to develop a moat in the bottom three (💡, 🌐, 💰)

The Common Factor

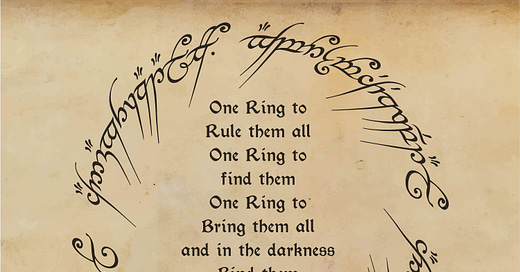

What do all these moats have in common? We like to call it the 'one moat to rule them all'. A moat is simply the result of great execution, which is why execution should be the core focus of what we look for.

An investor should not only identify where a company has an edge, but also assess whether management can effectively capitalize on it. Without capable leadership, even the most promising advantages can fail to materialize, and the business will struggle to compound its value over time consistently.

Leadership, and the culture it cultivates within a company, are the ultimate competitive advantages.

Additionally, moats alone aren’t enough - they depend heavily on the context in which they exist. Today, we live in a world driven by destructive and disruptive innovation, meaning companies need to reinvent themselves constantly. In a more static environment, a company understands its competitors well. But in a dynamic one, new competition can emerge from anywhere.

For example, Amazon could suddenly enter the finance sector and disrupt local banks overnight. The threat can come from anywhere, and in this environment of constant change, companies must continuously improve key aspects of their business including R&D product innovation, customer and supplier relationships, and market positioning to remain viable.

This post is heavily inspired by something we came across a few weeks ago. We stumbled upon Rob Vinall’s podcast, where he wrapped up a brilliant three-part series on the Value Investor Club.

The insights from that series really resonated with us, and we couldn’t help but reflect on how they align with some of the core ideas we’ve been exploring recently.

🙏 Feel free to ❤️ and comment so that more people can discover and enjoy this Substack 😇

A fantastic reminder of why Alejandro such a valued voice in our investing community. The breakdown of the six core types of moats is spot-on, especially that often-overlooked gem - the 'cost saver' moat. But where Alejandro and I really see eye-to-eye is on the paramount importance of execution. In the fast-paced world of Nasdaq-100 companies, it's not just about having a moat - it's about constantly reinforcing and adapting it.

Take MSFT. They've masterfully evolved from a company with high switching costs in PC software to one with powerful network effects in cloud computing. Or AMZN, continuously deepening its cost-saver moat through relentless innovation. For us investors, this means keeping an eye on how companies are investing in R&D and talent acquisition. These factors often signal a company's ability to maintain and strengthen their moats in our ever-changing tech landscape. So, try to spot the companies that are constantly building new moats.