📈 Century Casinos $CNTY - Stacking the Deck for Shareholders

A deep dive into the catalysts driving this overlooked gaming company forward after an intense CAPEX cycle

Welcome back dear fellow 🧙♂️ Hermits 👋

🎰 Century Casinos Coverage 👇

Explore All Our Writings on Global Gaming and Resorts Insights

If you haven’t yet, subscribe to get access to this post, and every new post

Investment Thesis is a series of posts that provide a foundational understanding of listed wunderkind companies. The series aims to achieve a timeless understanding of the company's inner workings. Every month, content on an investment case will be posted as an article, podcast, or both.

This content is intended for informational purposes only and should not be taken as investment advice. The author does not represent any third-party interest, and he may be a shareholder in the companies described in this series.

Please do your own research or consult with a professional advisor before making any financial decision. You will find a full disclaimer at the end of the post.

Context

The Business

Investment Case

🏁 Origin Story

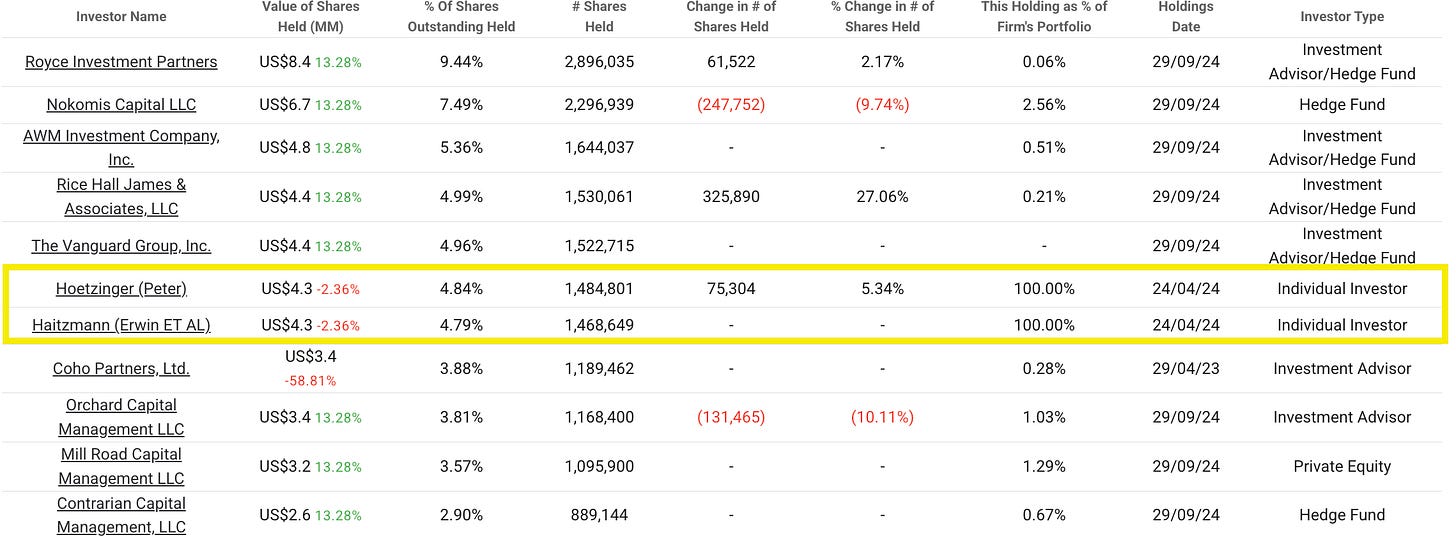

Century Casinos ($CNTY) was founded in 1992 by Austrian entrepreneurs Erwin Haitzmann and Peter Hoetzinger, who remain co-CEOs. The duo shared a bold vision of assembling a global portfolio of casinos, listing the company on NASDAQ just two years later in 1994. Since its inception, the founders have taken moderate but calculated risks on various ventures, some of which have yielded success while others have faced challenges.

Over the years, Century Casinos has operated in diverse markets, including cruise ships, Cambodia, Argentina, China, the UK, Bermuda, Canada, and the US. One of their most successful ventures has been in Poland, where they have run highly profitable casinos with minimal CAPEX requirements.

Until 2019, Century Casinos primarily focused on spreading moderate investments across multiple regions. But in recent years, the company has shifted its strategy to double down on its most promising market: everyday casinos in the United States.

Following smaller investments in Canada, Century made a bold move by acquiring three major and two minor US casinos. They have since heavily invested in these and other existing locations, transforming them into full-fledged entertainment destinations.

They now offer a complete weekend experience tailored to meet their customers' evolving demands by adding hotel rooms, amenities, and facilities for hosting shows.

With its intensive CAPEX cycle coming to an end, the company is poised to deliver significant rewards to investors, setting the stage for impressive returns.

🌐 Industry and Sector Overview

The casino industry in North America is a major player in the entertainment world. It combines gaming, hospitality, and tourism into one big package. The industry comprises everything from traditional brick-and-mortar casinos to racinos (think horse racing meets slot machines), Native American gaming operations, and the booming online gambling scene.

The U.S. dominates the market, raking in over $60 billion annually, with hotspots like Las Vegas, Atlantic City, and the Gulf Coast leading the charge. Canada and Mexico aren’t slouches either - Canada has a mix of government-run and private casinos, while Mexico’s focus is more on resorts aimed at tourists.

Classic casinos are still at the heart of the industry, offering the slots, blackjack, and roulette people love. However, they’re stepping up their game with more entertainment options, such as concerts, fancy restaurants, and luxury hotels.

Native American gaming has also carved out a huge slice of the pie, bringing in over $30 billion annually with massive operations like Foxwoods and Mohegan Sun.

Meanwhile, online gambling is shaking things up big time. Ever since the U.S. allowed states to legalize sports betting in 2018, mobile apps and virtual casinos have exploded in popularity. Racinos and big resort casinos are also on the rise, combining gaming with other attractions to pull in crowds.

The industry is definitely changing with the times. Online gaming is becoming a huge deal, casinos are offering more non-gaming perks to attract all kinds of customers, and regional markets in places like Pennsylvania and Ohio are seeing big growth thanks to relaxed laws.

At the same time, big mergers, like Eldorado Resorts buying Caesars Entertainment for $17 billion or MGM selling the Bellgaio to Blackstone for $4 billion, are reshaping who runs the show.

The casino industry is the poster child for legal monopolies. Each casino operates under a web of strict regulations and oversight at multiple levels. First, it needs licenses to operate, which are tightly controlled and limited state-by-state. Then, local regulators impose hefty taxes on profits, gross earnings, or revenues - sometimes as high as 85% of the business's cash flow.

It’s a high-stakes game (pun intended), and the house doesn’t always win regarding government intervention. In the regulation section, we will discuss this in detail in a state-by-state case.

Casinos must deal with shifting regulations, competition from online gambling, and the fact that people cut back on entertainment spending during tough economic times. Labor shortages are also a headache, especially for big resort casinos. But there’s a lot to look forward to. More states are opening the doors to legalized gambling, technology like virtual reality and blockchain is creating new gaming possibilities, and younger generations are looking for more interactive and skill-based games.

Big names like MGM Resorts, Caesars Entertainment, and Wynn Resorts still dominate the scene with their massive integrated resorts, but smaller players like Boyd Gaming and Century Casinos are holding their own in regional markets.

For local and regional casinos, business growth really boils down to two key factors: inflation and market share. These two elements set the pace for revenue growth and offer a clear picture of the casino managers' skills and the effectiveness of the holding company's broader strategy.

Funnily enough, while we were writing the thesis,

posted his thoughts on a competitor: Full House Resorts ($FLL). Although the investment case for FLL is significantly less compelling than for CNTY - given that FLL has yet to undergo a major CAPEX cycle - his thesis provides valuable context on the fundamentals of the everyday casino business model. Among other things, he discusses the successful case study of Monarch Casinos. Thanks, Andrew!🎯 Major Milestones

1992 - The company started operations

1993 - Opened their 1st casino on a cruise vessel

1994 - The founders listed the company on the NASDAQ

1995 - Acquired Womacks Casino and Hotel in Cripple Creek, Colorado, marking its entry into the U.S. gaming market

2000 - Purchased casinos in South Africa (later sold in 2009 for 9x adj. EBITDA)

2006 - Opened Century Casino & Hotel in Central City, Colorado, and another in Edmonton, Alberta, Canada (entering Canada)

2007 - Acquired a 33% stake in Casinos Poland

2009 - Sold its casinos in Prague and South Africa

2010 - Acquired Century Casino Calgary

2015 - Opened Century Downs Racetrack and Casino (Calgary, Canada)

2016 - Opened ship-based casino in China + Acquired Century Casino St. Albert, Canada

2017 - License awarded for Century Mile Racetrack and Casino (Edmonton, Canada)

2018 - Opened a casino in Bath, England, marking its entry into the UK market

2019 - Acquired three properties from Eldorado Resorts: Century Casino Cape Girardeau, Missouri + Acquisition Century Casino Mountaineer, Virginia + Acquisition Century Casino Caruthersville barge, Missouri

2022 - Acquired 50% ownership in the property company of The Nugget Casino Resort in Sparks, Nevada, marking its entry into the Nevada gaming market

2023 - Full acquisition of The Nugget Casino Resort in Nevada + Acquisition of Rocky Gap Casino, Resort & Golf operations in Maryland

2024 - Completed the hotel for Cape Girardeau, Missouri + moved Century Casino Caruthersville, Missouri, to a permanent land-based location, and completed the hotel facility

👥 Founders & Management

The company’s story starts with two Austrian founders who have been steering the ship since day one. On December 31, 1991, they bootstrapped the operation with $1.7 million in startup capital, focusing on a bold idea: casinos on cruise ships. While the strategy has always been flexible and opportunistic, this unique niche set the foundation for what the company would become.

Fast-forward to today, and Erwin Haitzmann (71) and Peter Hoetzinger (62) are still at the helm, each playing a key role. Erwin handles day-to-day operations and decides how funds are used, while Peter handles the financial side and investor relations, focusing more on capital sourcing.

Together, they’re not just the driving force behind the business - they also have skin in the game, owning a collective 9.6% of the company’s shares. Their hands-on leadership and vision have been crucial to the company’s success.

Here’s a concise overview of the other key members of the management team:

Margaret Stapleton: Chief Financial Officer and Corporate Secretary. Ms. Stapleton oversees the company's financial operations, including accounting, reporting, and investor relations.

Timothy Wright: Chief Accounting Officer and Corporate Controller. Mr. Wright is responsible for the company's accounting functions and ensuring compliance with financial regulations.

Andreas Terler: Executive Vice President of Operations – United States. Mr. Terler manages the company's U.S. operations, ensuring efficient performance across all domestic properties.

Nikolaus Strohriegel: Executive Vice President of Operations – Canada and Europe. Mr. Strohriegel oversees operations in Canada and Europe, focusing on maintaining high standards and profitability.

Nicholas Muscari: Chief Information Officer. Mr. Muscari leads the company's information technology initiatives, ensuring robust and secure IT infrastructure.

William Beaumont: Vice President of Human Resources. Mr. Beaumont oversees human resources, including talent acquisition, employee relations, and organizational development.

Geoff Smith: Senior Vice President of Operations – Canada. Mr. Smith manages Canadian operations, focusing on operational excellence and customer satisfaction.

Eric Rose: Senior Vice President and General Manager of Nugget Casino Resort. Mr. Rose oversees the Nugget Casino Resort, ensuring its successful integration and operation within the company's portfolio.

Century Casinos operates two main corporate offices to support its global operations. The U.S. headquarters, in Colorado Springs, Colorado, is 11,000 square feet and houses key departments such as executive leadership, finance, legal, marketing, and operations, focusing on North American properties. The European headquarters, in Vienna, Austria, is 2,500 square feet and supports operations in Europe, including properties in Poland and the UK. It also facilitates engagement with European regulatory bodies and partners.

🧩 Understanding of the Business Model

The recent bet (2019), has significantly changed the company’s business model. Everyday gaming and sports betting casinos operate differently from destination locations like Las Vegas, focusing on consistent local traffic rather than seasonal tourism. Here's a breakdown of the key differences of the business model:

Anti-Recession Characteristics:

Everyday gaming casinos are more resilient during economic downturns than destination resorts like Las Vegas. Their local focus and accessibility mean they cater to regular players who visit for smaller, affordable entertainment rather than relying on tourists.

“Exclusivity” in a 60-to-90-Minute Range:

These casinos aim to dominate within a 60-90 minute driving radius, creating a sense of exclusivity for local patrons. They often position themselves as the primary option for gaming and entertainment in their geographic area, minimizing competition and fostering repeat visits.

Cyclical Performance (Q1 Impact):

The business is cyclical. Q1 typically is the weakest quarter due to lower discretionary spending after the holidays and colder weather affecting customer visits. Activity picks up in subsequent quarters as consumer habits stabilize.

This model emphasizes regular, local customer engagement, consistent revenue streams, and affordability, distinguishing it from Las Vegas-style resorts' luxury and tourism-heavy approach.

Everyday casinos also benefit significantly from a strategy known as “border control.” This concept involves strategically locating casinos in states where gambling is legal, close to the borders of states where it is not. These "border casinos" effectively extend their customer radius by attracting patrons from neighboring areas with limited or no gambling options.

This approach capitalizes on untapped demand, as residents from non-gambling states often cross state lines for gaming and entertainment. The result is a steady influx of customers, making these casinos highly profitable and creating intense competition for prime border locations.

A notable example is Oklahoma, where numerous casinos are positioned near the Texas border. Since gambling is illegal in Texas, these casinos cater to a large market of Texas residents seeking gaming experiences, turning them into significant revenue generators. The high profitability of these locations often leads to rapid development and significant investment in amenities to outshine competitors and secure customer loyalty.

This strategy underscores the importance of geographic positioning in the everyday casino business model, leveraging regional legal disparities to maximize reach and profitability.

CNTY and its competitors have addressed competition by enhancing the amenities and offerings at each casino. This is especially evident in the focus on accommodations, with hotel rooms emerging as the strongest driver of customer retention.

In an interview we conducted in May 2024, co-CEO Peter Hoetzinger highlighted this strategy, noting (paraphrased): "The more we invest in creating a comprehensive guest experience, the more loyalty and repeat visits we see."

This approach underscores the critical role of integrated hospitality in maintaining a competitive edge and careful CAPEX management.

Casinos with hotels show a clear positive trend, particularly in the higher-tier revenue segment. Guests staying at these hotels tend to spend approximately 30% more compared to non-hotel patrons which highlights the value of integrated accommodations in driving increased customer spending and overall profitability.

- Peter Hoetzinger (Co-CEO)

The latest advancement in CNTY's customer retention strategy is the Winner's Edge app, introduced in 2019 as the cornerstone of its loyalty program. This app represents a significant step in engaging customers and driving repeat visits.

Winner's Edge offers a user-friendly platform where members can track rewards, access exclusive promotions, and receive personalized offers tailored to their gaming and spending habits. The app integrates seamlessly with CNTY’s casino operations, allowing guests to earn points across various activities, including gaming, dining, and hotel stays.

This loyalty program not only incentivizes customer spending but also fosters a sense of exclusivity and brand attachment. By leveraging data collected through the app, CNTY can enhance the customer experience with targeted marketing campaigns, VIP perks, and real-time updates on events and offers.

Data Analytics

This brings us to the core of the casino business model: casinos are no longer just betting parlors - they have evolved into 360º customer satisfaction centers.

What does this mean? A casino's profitability depends less on the volume of bets placed and more on its ability to cultivate lasting customer relationships. Retention is the lifeblood of this model, measured by two critical factors:

Duration of visits – How long customers stay during each visit.

Frequency of visits – How often customers return, whether weekly, monthly, or annually.

These two indicators align almost perfectly with a casino's profitability. The longer and more frequently customers engage, the greater their overall spending across gaming, dining, lodging, and entertainment. Recognizing this, CNTY has made a strategic bet on customer analytics to fine-tune its approach to retention and satisfaction. Here is the customer breakdown: