📈 The Children's Place $PLCE - Fashion for the Future Generation

The rise, fall and rebirth of one of the leading brands in affordable trendy apparel for kids

Welcome back dear fellow 🧙♂️ Hermits 👋

🧸 The Children's Place Coverage 👇

Explore All Our Writings on Their Cost-Cutting Measures and Strategic Shifts

If you haven’t yet, subscribe to get access to this post, and every new post

Investment Thesis is a series of posts dedicated to providing a foundational understanding of listed microcaps. Additional corollary posts will expand the knowledge base for each investment case. The series aims to achieve a timeless understanding of how a business operates, rather than focusing on specific items related to current events (a separate series covers those). Every month, content on an investment case will be posted in either article or podcast form, or both.

This content is intended for informational purposes only and should not be taken as investment advice. The author does not represent any third-party interest, and he may be a shareholder in the companies described in this series.

Please do your own research or consult with a professional advisor before making any financial decision. You will find a full disclaimer at the end of the post.

Context

The Business

Why now?

Investment Case

☣️ Risks

🧙♂️ Conclusion

Preliminary Note

This report focuses on the trends, drivers, and challenges PLCE faces in the U.S. market, which made up 83.6% of its net sales in the last public report. If you include Canada, that number jumps to around 96.7%. So, the focus will be primarily on the U.S., with some context from North America.

👨👩👧👦 Origin story

The origin of The Children’s Place ($PLCE) dates back to 1969, when David Pulver and Clinton Clark founded it. Initially, the company focused on selling children's apparel, toys, and accessories at affordable prices through small retail stores. During its early years, The Children’s Place developed a reputation for offering high-quality, stylish children's clothing, which helped it carve out a niche in the retail market.

In the mid-1980s, the company shifted its focus solely to children's apparel, and this strategic change set the stage for its eventual growth. In 1988, the company was acquired by Federated Department Stores (now Macy’s, Inc.), but in 1989, it was sold to an investor group led by Joseph Sitt. This change in leadership brought new energy to The Children's Place, allowing it to expand and refine its business model.

Throughout the 1990s, the company experienced significant growth, focusing on becoming a specialty retailer dedicated to providing fashionable, value-priced clothing for newborns through pre-teens. By expanding its number of stores and leveraging its growing brand identity, The Children's Place became a leading destination for parents looking for trendy, affordable children's clothing.

In 1997, The Children's Place went public, listing its stock on the NASDAQ under the ticker symbol. This public offering allowed the company to fuel further growth, expand its store footprint across the United States, and increase its brand awareness. In the 2000s and 2010s, The Children’s Place embraced the growing e-commerce trend and invested heavily in its online platform, helping the company stay competitive in the shifting retail landscape.

Today, The Children’s Place is one of North America's largest pure-play children’s apparel retailers. It is known for its strong brand, value-based pricing, and significant e-commerce presence. The company's success stems from its ability to adapt to consumer needs and maintain a strong focus on delivering affordable, high-quality children’s fashion.

🏭 The Industry - Children & Infant Clothing

The infant and children retail industry is notoriously challenging to navigate, yet it has experienced significant consolidation in recent years. In 2023, the top 50 retailers, both public (listed) and private, accounted for 89.3% of total U.S. sales. More strikingly, the top three product lines made up 79% of total sales: 48.4% from girls' clothing and accessories, 18.4% from boys' clothing and accessories, and 12.4% from infant and toddler clothing and accessories.

The industry’s total revenue stood at $8.3 billion in 2023, with a projected annual growth rate of 3.6% through 2028. One of the most compelling segments is e-commerce, expected to grow by 13.6% over the next five years, increasing its share from 15.5% to 22.7% of total sales by 2028. This shift toward online sales is a recurring theme throughout the report. However, these projections are optimistic, especially considering that, from 2015 to 2023, the industry grew by just 1.1% annually, with a significant 32.3% decline in 2020 due to the pandemic, followed by a sharp recovery.

The sector can largely be considered a price taker, as most suppliers are commodity manufacturers, leaving companies with limited pricing power. This is especially true for brick-and-mortar retailers, where operations are highly labor-intensive. It's worth noting that only 68% of companies in this sector are currently profitable, reflecting the challenges of managing costs in a competitive landscape.

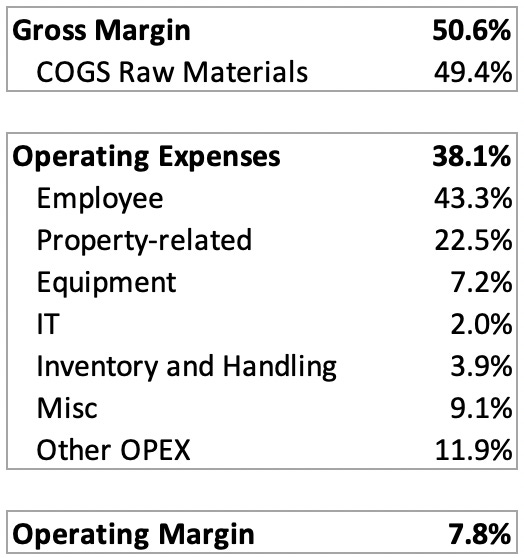

Here’s a breakdown of operating costs as a % of revenue for the average company in the sector in 2023:

These numbers show just how much labor and property costs weigh on companies, making it tough for many to stay profitable in such an expensive industry.

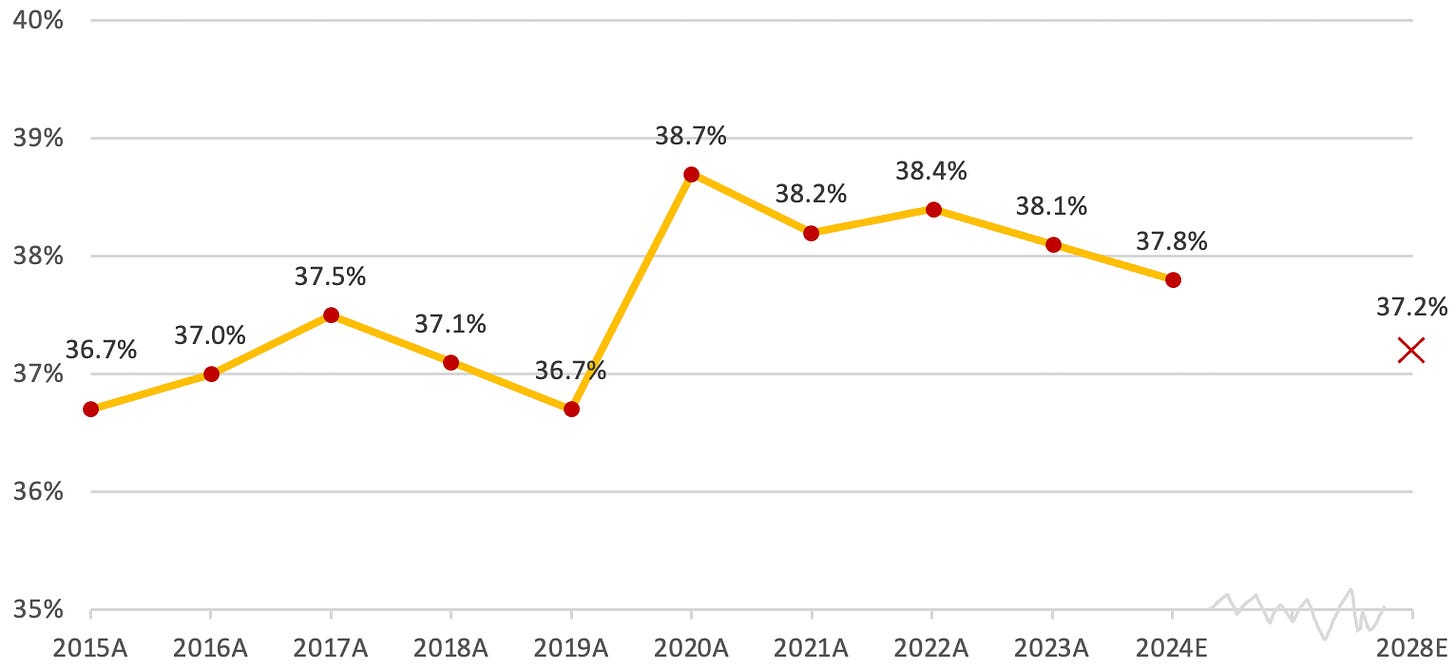

This is the historical series of operating costs over the last decade:

Aside from the COVID period, operating expenses (OPEX) in this sector have stayed pretty steady, thanks to the constant demand for these products. Companies have passed on rising raw material costs to consumers without much resistance. That said, as more shopping shifts to e-commerce, we should see overall OPEX start to decrease since online sales are generally more cost-efficient than running physical stores.

The sector directly employs around 70,000 people, meaning each employee is responsible for about $120k in sales. The average payroll (not salary) per employee (excluding management) sits at $16,237, growing at a 4.2% annual rate over the past three years. Hourly rates range from $7.69 to $16.83. These numbers suggest the workforce is largely made up of lower-skilled or part-time workers across the U.S., which is pretty common for retail jobs like this.

It’s worth noting that 85.9% of employees are sales personnel, with an average age of 38.3. Demographically, the workforce is primarily composed of white female part-time workers. This highlights the nature of the labor in the industry, where companies rely heavily on cost-efficient staffing to maintain operations.

On that note, the two top-performing states are New Jersey, with the highest per capita spend at $52/year, and Delaware, leading with the highest spend per location at $2.1 million/year.

Investing in demographics, in my experience, is a rookie mistake. But hey, here’s the fertility rate for the U.S., and I’ve got to admit, those pesky New Jerseyans are catching up! 😂 (No offense intended, just having a little fun!)

Retailers sink a lot of capital into inventory, so managing it well is key to driving growth. Keeping inventory costs under control and pricing it right is crucial for maintaining healthy profit margins. Here’s the inventory turnover (COGS/Inventory):