My dear fellow Hermits 👋

Welcome back to 🧙♂️ The Hermit 🧙♂️

ICYMI:

💼 The Hermit Portfolio: June (previous) Update

If you haven’t yet, subscribe to get access to this post, and every new post

Index

📜 Thesis Explained (Argentina)

Briefing

This second post in the series will focus on strategy and edge. We will dive into the core strategic decisions, highlighting business fundamentals and bottom-up research principles used to assemble The Hermit Portfolio.

Please note that this portfolio faithfully reflects the author’s personal seven-figure investment portfolio.

This publication is confidential and intended solely for the use of the person or entity to whom it is given or sent. It may not be reproduced, distributed, or transmitted without the author's prior written consent. By accepting to receive the full post as a 🧙♂️ Hermit Premium member, the recipient agrees to be bound by the foregoing limitations.

None of the following should be construed as investment advice. Please consult a financial advisor before making any investment decision. You will find a full disclaimer at the end of this post.

Strategy Overview

The core strategy of The Hermit Portfolio is simple and effective:

💼 Ensemble of exceptional MICROCAPS

🚀 Antifragile companies

🌎 Worldwide company selection

👑 Ownership of 5 to 15 positions (w/ my own money)

⌛ Holding period of 7+ years

🔄 Minimal portfolio turnover

🕓 No market timing

📈 Uncapped upside

ℹ️ Asymmetric information

What I’m looking for in a company:

Misunderstood or temporarily depressed fundamentals

Fanatic managers w/ skin in the game

Definable and Tangible Total Addressable Markets (TAMs)

Expanding competitive advantage

High revenue growth potential

High profitability potential w/ abnormally depressed earnings (currently)

Obvious and simple reinvestment opportunities

Priced at a steep discount to the long-term FCF generation potential

NEW: Thesis Explained

In the previous note, I did not include my cash position and a unique position I tried to keep under the radar.

This position was one I started researching in July/August 2023, anticipating Javier Milei's victory in the preliminary election. As we now know, he not only won the preliminary round but also the first round in October and the runoff in November.

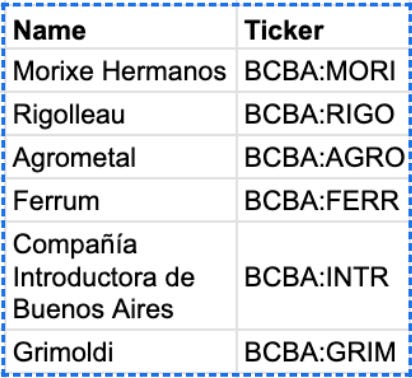

During that time, I built a position in these six companies as a singular bet on Argentina's progress in the coming decade.

I consider the purchase of these companies a single position. They are mainly betting on the low-cost profile in Argentina. Currently, Argentinian labor costs are among the top 1% cheapest in the world, particularly those in agriculture. This has two massive macro trends that will push companies in the sector forward swiftly:

Poverty within Argentina. Argentina has 55% of its population living under the poverty line. The first step to climbing out of poverty is housing and nutrition. In this specific case, inferior goods (goods where demand decreases as you become more wealthy) have a very high demand but supply has to catch up.

Export Superpower. The Argentinian peso is extremely weak which provides for very attractive exports. Additionally, the labor force is also cheap which can lead to companies outsourcing staff and production to the country.

In 2024, the average salary in Argentina is approximately 572,425 ARS per month, which is about $635. This figure marks a significant increase from previous years, despite the country's high inflation rates. In comparison, the average salary in the United States is around $60,000 annually or about $5,000 per month.

When it comes to farming, there's a stark contrast. The average monthly salary for a farmer in Argentina is around 14,300 ARS (approximately $16 per month), with a range from 6,700 ARS to 22,500 ARS per month. Crop farmers earn a higher average annual salary, around 11,821,692 ARS (approximately $13,100 per year).

In the United States, the typical annual salary for a farmer is about $41,600, with a range from $33,600 to $77,000, depending on factors such as location, type of farming, and experience.

On average, hiring a professional in the US is about 8x more expensive than in Argentina. However, a farmer in the US can earn 3x to 200x more than their Argentinian counterpart. This disparity is largely due to differences in productivity, driven by the use of capital (e.g. tractors, fertilizers, farming tools) in the US, compared to the more manual labor prevalent in Argentina.

Addressing this productivity gap requires significant capital investment, which has been hindered by Argentina's unstable legal framework, particularly concerning property rights. With the new administration under Javier Milei, we believe there is potential for more favorable conditions.

With this macroeconomic context in mind, the companies selected for investment have been chosen based on both qualitative and quantitative criteria, much like the other positions.

I will dive deeper into each company in future posts.

Note: Corrections and Clarifications

FYI, with the cash position and Argentina included, the returns are slightly less negative for June at approximately -4.94%.

I usually don’t include cash, because it can vary significantly depending on my current needs (e.g. purchasing a car, going on vacation, staying indoors during winter, etc.). I will withdraw and add to it as if it were a checking account. However, for this exercise, it’s only fair that you understand the extent of my dry powder.

To clarify, I’m fully invested, and this portfolio represents the vast majority of my net worth. We are in the same boat.