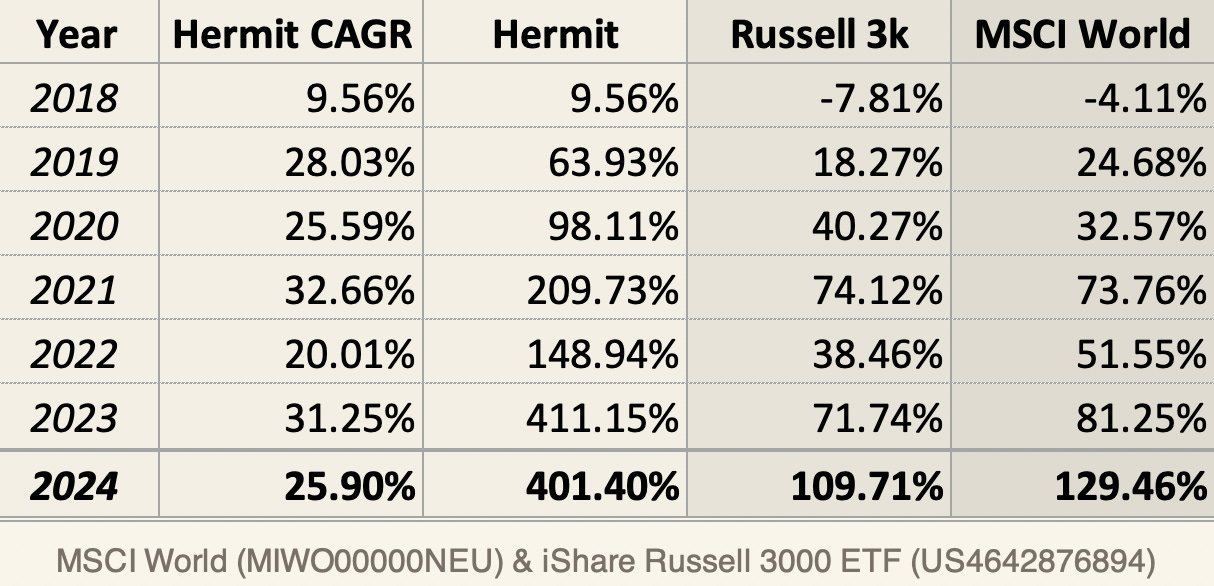

💼 12/24: From Excel Grinds to Big Dreams, a Decade of Investment Adventures

Q4 Review. Mistakes, Milestones, and a Dream to Redefine Microcaps

My dear fellow Hermits 👋

🎄 Merry Christmas! 🎄 And welcome back to 🧙♂️ The Hermit 🧙♂️

Want more context? Track the journey so far:

💼 The Hermit Portfolio: November (previous) Update

Index

Briefing

What does it take to turn 600 companies into a single, high-conviction position?

We’ll start by laying bare our multi-phase investment process, from the initial flood of ideas sourced through 13F filings and investor networks, to the intense, hands-on scuttlebutt research that involves speaking with trustees, competitors, and even ex-employees.

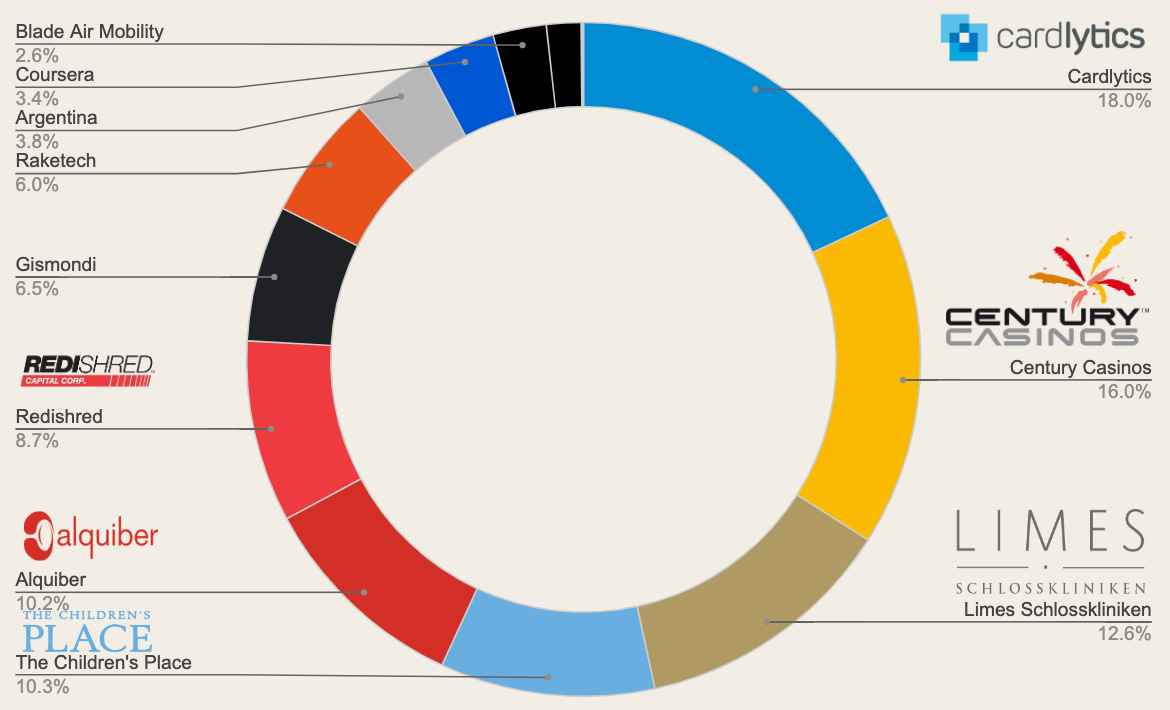

But this seventh installment is not just about the wins. We also reflect on the lessons learned the hard way, like the painful misstep with Cardlytics’ sizing and timing or the frustration of sitting on the sidelines for opportunities like Nebius Group. Alongside these insights, you’ll find updates on portfolio favorites, such as the evolving short-interest drama with The Children’s Place, and the bold expansion of Gismondi into Tokyo’s luxury market.

As always, we’ll include a deep dive into the portfolio - a no-holds-barred review of every position, complete with updates, shifts, and our unfiltered commentary on its progress. This edition, however, comes with a twist. Drawing inspiration from the ever-candid Michael Melby from Gate City Capital, we’re embracing transparency like never before.

Think of it as portfolio management meets show-and-tell, minus the macaroni art.

For those curious about the personal side of the journey, we’re also diving into the past and reviewing my decade as investors: from an 18-year-old’s reckless leverage to the disciplined investor of today. Whether it’s the drama of high-stakes deals, the grind of day-to-day portfolio management, or the lofty aspirations for the future, this is the story behind it all.

Please note that this portfolio faithfully reflects the author’s personal seven-figure investment portfolio.

This publication is confidential and intended solely for the use of the person or entity to whom it is given or sent. It may not be reproduced, distributed, or transmitted without the author's prior written consent. By accepting to receive the full post as a 🧙♂️ Hermit Premium member, the recipient agrees to be bound by the foregoing limitations.

None of the following should be construed as investment advice. Please consult a financial advisor before making any investment decision. You will find a full disclaimer at the end of this post.

We recently took the time to articulate our process, and we believe it could offer valuable insights to many of you. At the end of the day, what you’re getting is pure honey - gold distilled from countless hours of meticulous sifting and analysis. 🍯✨

Here’s the full breakdown:

The Process: From Discovery to Initiating a Position

The journey from discovering an idea to initiating a position takes at least four months. Ideas primarily originate from filtered company lists, 13F filings from other investors, or investor networks (such as VIC, Microcap Club, conferences, professional investors, etc.). These filters generate an average flow of 600 micro- and nano-cap companies per quarter - a historical average over the past 20 quarters - that we examine through a four-phase process:

Note: The numbers of companies mentioned are illustrative. In the historical series, there have been quarters in which we’ve found only 2 companies and others in which we’ve identified 25.

1. Preliminary Review

In the first phase, we review each company's financial statements, website, and main competitors. The goal is to determine whether we can understand its business model, reasonably project its activity over 2–5 years and evaluate whether it’s intriguing within its sector. This initial screening (mainly quantitative) helps identify attractive prospects.

We’ll evaluate the financial statements with a focus on three key aspects: high Return on Capital Employed (ROCE) as a measure of effective management, low debt levels to reduce the risk of financial distress, and prudent capital allocation relative to project risk - a nuanced but critical factor for long-term success.

We discard around 90% of the initial candidates at this stage, narrowing the list to approximately 60 companies.

2. Business Model Analysis

For companies that pass the preliminary review, we delve deeper into their data: press releases, interviews, reports, and other resources to gain a clearer understanding of their business. Here, we focus on identifying "red flags," such as excessive poorly structured debt, questionable management decisions, unusual interventions/actions, accountability, incentive alignment, or lack of transparency.

After this phase, we typically eliminate 60–70% of the remaining companies, reducing the list to about 20.

3. Scuttlebutt Research

Next comes scuttlebutt research, which often requires some expense and significant preparation time. We gather information from people connected to the company, such as customers, suppliers, competitors, and former employees. Each investigation is tailored to the specific company. For example, last week, we spoke with the trustee of an oil and gas trust with few employees. This individual has managed the trust for over 20 years. Although this trust has no traditional customers or suppliers, conversations with investors proved very valuable after learning about certain crucial details about oil well extraction (operations) and property rights.

We generally leave conversations with management or investors for last, as they tend to be knowledgeable but understandably biased. By the end of this phase, we usually cut the list in half, leaving around 10 viable companies.

4. Price Action and Valuation

For the final contenders, we perform a detailed valuation analysis. The remaining companies are divided into three watchlists based on their price-to-intrinsic-value ratio, essentially waiting for favorable entry points. When a company’s price falls within a favorable margin of safety (around 90%), it moves to the “actionable” list for potential inclusion in the portfolio.

Most companies we analyze never reach this stage, but they still serve a purpose. The more companies we evaluate, the more attuned we become to patterns associated with long-term value creation, which can inform future stock selection.