Aurora Spine Corp. $ASG – Breakthrough in Spinal Surgery

Conviction Bet on the Next Wave of Minimally Invasive Surgery

Investment Archive: Aurora Spine Corp. ($ASG) The complete chronology of our research and primary data

Investment Thesis is our core series where we break down standout public companies so you understand exactly how they make money, where the risks lie, and why the opportunity exists long before the market agrees.

Most medtech micro-cap stocks are science projects. This here is a scalable recurring revenue business.

In this deep dive, we break down a company that is fundamentally changing the physics of back surgery, shifting from a commoditized hardware war to a high-margin, data-driven ecosystem.

The business is executing a textbook Blue Ocean strategy: bypassing the crowded shark tank of traditional surgery to dominate the untapped, high-volume world of Interventional Pain.

This report is built on primary research, including exclusive details on a (likely) transformational debt deal and direct insights from our conversations with management.

This content is intended for informational purposes only and should not be taken as investment advice. The author does not represent any third-party interest, and he may be a shareholder in the companies described in this series.

Please do your own research or consult with a professional advisor before making any financial decision. You will find a full disclaimer at the end of the post.

Context

The Business

Investment Case

🔍 Business Overview

To understand the opportunity here, you first have to unlearn what you think you know about spine surgery.

Most people imagine a gruesome, six-hour procedure involving hammers, screws, and a week in the ICU. While that still happens, the industry is shifting rapidly toward minimally invasive, light procedures.

Aurora Spine is effectively building the surfboard (to ride the wave).

At its most basic level, Aurora designs and sells spinal implants. But calling them a hardware company misses the point. They are arguably the only player in the space treating spine surgery as a data problem rather than a carpentry problem.

They are pivoting away from the crowded, commoditized world of traditional surgeons and diving headfirst into a Blue Ocean market (you will hear this analogy repeatedly throughout the write-up) that the industry giants are completely ignoring: interventional pain management.

There is a fundamental flaw in the current spine market. Companies like Medtronic and Stryker operate like massive hardware stores. They sell titanium and PEEK (hard plastic) cages that are incredibly stiff. This works fine if you are a 25-year-old athlete with rock-hard… bones.

But the average spine patient isn’t 25. They are 75, often female, and likely suffering from osteoporosis or low bone density.

When a surgeon jams a rock-hard titanium cage into a grandma’s soft, brittle spine, the laws of physics take over. The bone can’t handle the pressure, and the implant essentially acts like a heavy rock sitting on a sponge. It sinks.

This is called subsidence, and it’s a massive cause of surgical failure. The pain comes back, the patient needs a revision, and the healthcare system burns cash.

Aurora’s secret sauce is its prop DEXA Technology Platform.

Instead of guessing or using a ‘one-size-fits-all’ approach, Aurora integrates the patient’s bone density scan (DEXA scan) directly into the surgical planning.

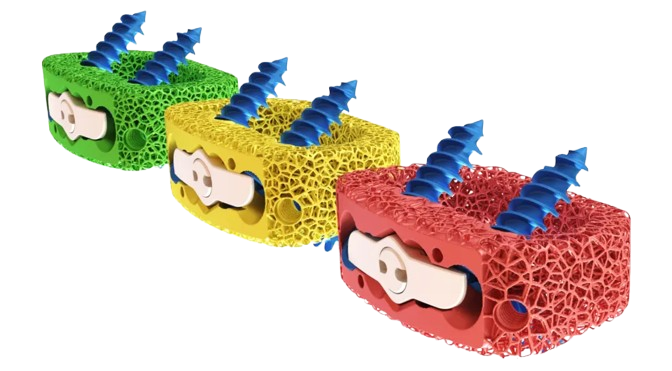

Think of it as a tailored suit versus a generic uniform. If the data shows the patient has soft bone, Aurora provides a porous, softer implant that matches that specific density. If the bone is hard, they provide a stiffer one. Plus, they are currently the only company automating this matching process.

It sounds simple, but in an industry obsessed with selling more titanium, this patient-centric approach is a massive differentiator that insurance payers and hospitals are starting to pay attention to. One that great doctors love.

This is where the investment thesis gets exciting.

The traditional spine market is a Red Ocean, it is shark-infested waters where massive companies fight over the same orthopedic surgeons, usually by bundling knee and hip implants to force competitors out.

Aurora realized they couldn’t win a price war there. So, they moved away from it.

And… they identified a rising class of doctors called Interventional Pain Physicians.

Historically, these doctors only did steroid injections to mask pain. But recently, they’ve started doing light surgeries to actually fix the problem. The ‘Big Spine’ giants ignore these doctors because they don’t want to cannibalize their massive spinal fusion businesses.

Aurora stepped into this gap. They built specific tools (e.g. SiLO system) designed exclusively for these pain doctors. This allows a pain physician to fix a Sacroiliac (SI) Joint issue in under an hour, through a tiny incision, in an outpatient center. You’ll get to see how they actually work later on.

It’s safer for the patient, cheaper for the insurance company, and incredibly profitable for the doctor.

And finally… the economics. They’ve created a classic razor/razorblade revenue stream. They place the instruments (the razor) with the doctor, and every time that doctor sees a patient, they buy a new, high-margin sterile implant kit (the razorblade). It’s a recurring revenue model disguised as a medical device company.

We’ve had the unique opportunity to speak with a wide range of industry experts, from the surgeons actively using Aurora’s devices in the operating room to the sales reps mastering their distribution on the ground.

And, of course, we have also maintained an open line of communication with the management team. These conversations have been incredible for helping us truly understand both the bottlenecks holding the company back and the catalysts that could drive it forward. This write-up features direct insights from:

Trent Northcutt, Chief Executive Officer

Chad Clouse, Chief Financial Officer

Matthew Goldstone, Chief Commercial Officer

Stay put, we’re going to dive deep into how Aurora isn’t fighting the Medtronics of the world, but instead it’s flipping the board to empower a new class of doctors with technology that actually accounts for the patient’s biology.

They are betting that the future of spine surgery isn’t more metal; it’s a better, personalized fit.

If you want to get a true feel for Trent’s leadership style and the company’s vision, this 15-minute presentation is a fantastic primer: