🧙♂️ 2025: 5 Game-Changing Predictions Rooted in Macroeconomic Trends

Insightful Economic Forecasts for the Year Ahead 🔮📈

My dear fellow Hermits 👋

Welcome back to 🧙♂️ The Hermit 🧙♂️

ICYMI:

🧗 Our Investing Journey: Lessons from 3 Elite Managers

💼 The Hermit Portfolio: November Update

📈 Investment Thesis: Lazydays (write-up)

If you haven’t yet, subscribe to get access to this post, and every new post

🚨 Big things are coming in 2025! 🚨

We’re beyond excited to share some big news: The Hermit is leveling up! 🚀 After a full year of relentless hard work (and red tape), countless hours of research, and unwavering dedication, we’re officially launching a regulated hedge fund! 💼📈

This isn’t just a milestone - it’s the culmination of everything we’ve built together. And the best part? The fund launch will take The Hermit to the next level, delivering even deeper, more professional insights straight to you.

Let’s make 2025 our best year yet! 💪✨

The portfolio is getting a full reset with the fund launch, so you’ll get a front-row seat to how it’s built from scratch - no secrets, just strategy. 🛠️✨

🔮 Prediction Time

We’re pretty sure every manager goes through that phase where they’re convinced they can master the mystical art of macroeconomics. You know, the big, daunting stuff: unemployment, inflation, interest rates (monetary policy), government spending (fiscal policy), aggregate demand, and supply - basically the Avengers of economic factors.

Some rare souls are skilled enough to cherry-pick a few of these, dabble in commodities and currencies, and - brace yourself - actually make money. And not just pocket change; we’re talking serious money, because they’re leveraged to the hilt (or as we like to say, “leveraged to the tits”).

For the rest of us mere mortals - yours truly included - this is a Herculean task. Macroeconomics just soars over our metaphorical heads like a 747. We’re left to grapple with the much humbler realm of microeconomics: businesses, where we can actually make a difference without causing global meltdowns.

With that in mind, it’s always a blast (and slightly terrifying) to go full throttle, risk looking like a complete fool, and share our predictions on how things might unfold. Hopefully, by the end of the article, you’ll want to share your predictions as well 😊.

So, let’s dive into that.

#1 💸 Argentina's inflation in 2025 will average close to 0%, as the balance between money supply growth and demand for the currency reach equilibrium

It’s our strong conviction that most - if not all - the inflation created in the past century, ever since fiat money was unshackled from the gold standard, has been the handiwork of money printing. To put it simply, inflation happens when the supply of a currency grows faster than its demand. There are plenty of reasons for doing this - some good, most neutral, and quite a few downright bad.

When the numbers go wild, it’s essentially the modern-day equivalent of what the North American revolutionaries would call "taxation without representation." Inflation hits the most vulnerable the hardest - primarily those without hard assets, like young people and the poor.

And in a healthy economy, you want the exact opposite: opportunities for everyone to thrive, not get crushed under the weight of monetary policy gone rogue.

Enter the central bank of Argentina, a paragon of governance (pause for dramatic effect). They’ve pledged to stop money printing altogether - just as soon as their balance sheet looks a bit less like a disaster movie. In the meantime, they’ve settled on printing a modest 2% per month while paying down their debts.

Baby steps? Maybe. More like sturdy baby steps if you ask us.

In this case, we’ll refer to Graph 3.1.2, which tracks the monthly increase in monetary base as a percentage.

The goal is simple: get that number to zero ASAP.

If it drops below 2%, like it has done since August, it’s a sign demand is growing faster than supply - a rare win in this saga. So yeah, it seems to be headed in the right direction.

Using our framework, the real inflation rate in November would be the reported inflation of 2.4% minus the 2.0% increase in the monetary base.

This implies that the non-induced, or "real", inflation rate for the country currently stands at 0.4%.

We believe this figure will eventually drop to 0%, particularly if the peso ceases to be the country's base currency. However, it's important to note that this logic applies equally to the USD. If the supply of dollars outpaces demand, currency debasement is inevitable. And we would need to subtract that from the inflation rate to get the non-induced inflation figure.

#2 📉 The Cost of Capital (Debt) will decrease to 2.5% in the US

Quick and simple: either the Fed rate will drop to 2.5%, or - more likely - the 10-year Treasury yield will hit the 2.5% mark.

This boils down to the USD flexing its muscles against other currencies and the global thirst for cheap money to make some otherwise eyebrow-raising investments seem reasonable.

These range from the ever-growing public debt in countries like France or the U.S. (because who needs a balanced budget, right?) to ambitious mega-projects in crypto, infrastructure, and even national security - because nothing says "fiscal prudence" like spending big on everything from digital coins to defense toys.

#3 ⚡ Energy prices will stabilize and start to decrease by the end of 2025, especially in the US

With the rise of “AI” - or as we like to call it, fancy linear regression dressed up as complex machine learning - we've seen a steady uptick in electricity demand. Throw in the green transition, which has left us with an inadequate supply, and you've got a perfect storm. Prices are climbing, driven by policy and trends, but this shift is definitely pouring fuel on the fire.

This is hitting Europe especially hard, where the average cost per kilowatt-hour (kWh) is about $0.40 - roughly double what folks in the U.S. pay and a staggering five times what’s paid in China. Ouch.

It’s a particularly bitter pill for industrial producers, who already operate on razor-thin margins. Case in point: Volkswagen in Germany, whose struggles are at least partly fueled by this energy debacle.

It all comes down to energy sources. In the EU, about 39% of energy comes from renewables, compared to 21% in the U.S. And China? Well, let’s just say I don’t trust their stats.

The U.S. relies on cheap oil, gas, and nuclear power, while China burns through coal like it’s an Olympic sport. Unsurprisingly, China also racks up over 35% of global greenhouse gas emissions. Nice touch.

Here’s the prediction: a tidal wave of new supply is coming online in the short to medium term, thanks to a “drill, baby, drill” attitude that feels straight out of the Trump playbook. This will likely push oil and gas prices downward.

On top of that, mini-nuclear reactors are now a thing, and a whole bunch of them are coming online. These reactors are insanely cost-efficient, with nuclear energy reportedly pricing out at 0.04€ per kWh (or at least consistently below $0.08 per kWh globally). And unlike renewables, nuclear power gives you a steady, reliable energy flow 24/7.

There is a minor caveat to this argument regarding price increases due to recent developments on long-term contracts in the uranium market. However, it's important to note that fuel costs account for only 15-20% of the total production cost, equivalent to one-fifth to one-sixth of the overall expenses.

So yeah, buckle up - energy prices are going down on this shtick

#4 📊 Small-cap stocks will outperform their larger counterparts. A balanced allocation (33% each) across three major U.S. indices - the NASDAQ 100, S&P 500, and Russell 2000 - will yield a return exceeding 10%, with the majority of this growth driven by the Russell.

Convergence to the mean is just a fancy way of saying that things have a natural habit of snapping back to their average. We’ve touched on the concept of ergodicity before, where short-term averages give us a decent approximation of the long-term picture.

Large caps have had their moment in the spotlight over the past few extraordinary years, while the smaller guys have been stuck in the dressing room. Most large caps seem to have already baked those rate decreases into their valuations, which now look... well, a little overcooked.

The smaller caps, however, are still waiting to get their share of the action. This means we’re likely to see their averages make a solid comeback; and this is especially true if we focus on individual names.

Oh, and high-grade bonds? They’re shaping up for a pretty decent year if rates moved tot he expected levels. As for their high-yield cousins, let’s just say they might not be feeling as festive as there’s been a lot of hedging done in recent years.

#5 💵 Argentina will not dollarize the economy but rather open up the means of exchange to any currency, in other words, Milei will eliminate the mandatory use of Pesos (including its use for tax purposes)

In November, I wrote this last prediction that - funnily enough - partially unfolded just last week. Milei passed a law eliminating the mandatory use of Pesos for all transactions except taxes. True to his liberal philosophy, instead of enforcing a specific currency, he simply allowed people the freedom to choose what they prefer.

The twist in this prediction is that these changes may eventually extend to tax payments, leading to the widespread use of the USD - not because it's mandated, but because it becomes the natural choice.

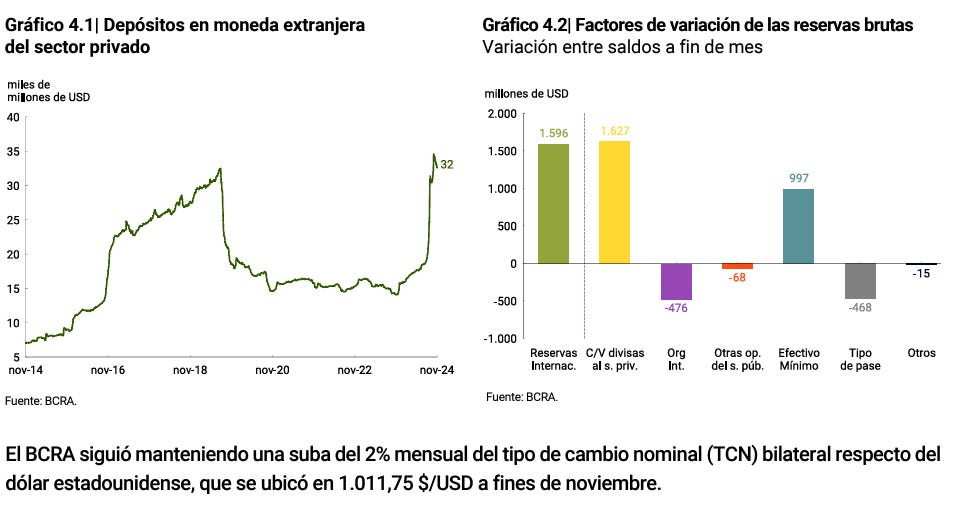

The key metric to watch is the trend in bank deposits and loans denominated in foreign currency (see graph 4.1 below).

The faster these two numbers rise, the quicker the private sector can transition to what appears to be the people's preferred choice: the USD. Here’s the latest data (November), along with a broader year-over-year perspective.

🎁 Bonus Content

For those of you who made it through this lengthy list of predictions 😉, I’d like to share a document from someone who actually understands macroeconomics and will soon become one of two people in my office aka someone I can hopefully learn from. Note that I don’t receive any compensation for this.

Jose Manuel Pérez-Jofre Santesmases is an investment advisor for FMAS alfa FIL, a fund he designed and launched in 2022.

With over 25 years of experience, he has held leadership roles in the industry, including Chief Investment Officer at Santander AM Spain, where he managed a team of 50 professionals and oversaw assets exceeding €60 billion. He also served as Chief Investment Officer at Mutuactivos AM and was a founding partner of Valórica Capital e Inversiones SGIIC, where he created and managed Valórica Alfa FIL, the predecessor to FMAS alfa FIL. Additionally, he was Chief Financial and Operations Officer at Cobas AM, where he also served as a senior manager for ESG initiatives, sustainability programs, and UNPRI compliance.

With expertise in finance and law, as well as specializations in sustainability, Jose Manuel is known for his systematic and quantitative investment approach, balancing profitability with ethical and sustainable commitments.

Throughout his career, he has consistently outperformed industry benchmarks and earned over 25 awards and accolades for his fund management performance.

His current fund is built around a four-part, multi-strategy systematic allocation

Relative Value Management in the interest rate yield curve.

Currency Management (top 10 global currencies).

Systematic futures management.

70/30 Spot Portfolio: fixed income duration and exposure to equities management.

Before we share the one-pager, please note that this is not shown to commercialize or solicit. These types of instruments are intended exclusively for qualified and professional investors, and the content is intended for informational purposes only and should not be taken as investment advice. The author does not represent any third-party interest or is incentivized in any way to share this information. Please do your own research or consult with a professional advisor before making any financial decision.

🙏 Feel free to ❤️ and comment so that more people can discover and enjoy this Substack 😇

You just got a new subscriber 😄 Small-cap finally went up after a couple of years of expectancy, I guess the trend will continue.

Fascinating macro take on 2025, especially the prediction about energy costs - I've heard that in the semiconductor space, some companies are already factoring lower energy costs into their AI chip production forecasts.