🧗 What are Elite Money Managers Doing That You're Not (1/2)

OIJ (#21) Lessons from Hidden performers w/ 30%+ decade-long compounding habits

My dear fellow Hermits 👋

Welcome back to 🧙♂️ The Hermit 🧙♂️

ICYMI:

🧗 Our Investing Journey: Worst Financial Invention

💼 The Hermit Portfolio: November Update

📈 Investment Thesis: Corticeira (write-up)

If you haven’t yet, subscribe to get access to this post, and every new post

This two-part series will dive into how to save money by learning from the mistakes of others rather than making them yourself. We'll spotlight a handful of investment managers, examine their approaches, and analyze their missteps to understand how even top-tier professionals might have improved their strategies.

The goal? To extract valuable lessons from their journeys.

We'll be breaking this down by analyzing the writings, interviews, and ideas of three US-based managers in the first installment, followed by three Spain-based managers in the second. The series will include commentary from the managers themselves, offering unique insights straight from the source.

If you enjoy this content, don’t forget to like and share - your feedback helps us continue exploring lessons learned and could even pave the way for direct 1-on-1 interviews with these elite professionals. We’re talking about managers overseeing hundreds of millions, sometimes billions, and consistently delivering stellar performances. Let’s uncover the wisdom behind their success (and stumbles)!

Clifford Sosin, The Visionary

Clifford A. Sosin is the founder and portfolio manager of CAS Investment Partners, LLC, a value-focused investment management firm he established in October 2012.

Prior to founding CAS, Sosin served as a Director in the Fundamental Investment Group at UBS for five years, where he was a senior member of a team analyzing equities and fixed-income securities. His earlier experience includes roles as an analyst at Silver Point Capital, a hedge fund specializing in high-yield and distressed opportunities, and at Houlihan Lokey Howard & Zukin, an investment bank renowned for its financial restructuring advisory services. Sosin holds a B.S. in Engineering with High Honors and a B.A. in Economics from Swarthmore College.

Under Sosin's leadership, CAS Investment Partners has achieved notable success, with reports indicating a 96.5% return during the pandemic year of 2020.

The firm's investment strategy is characterized by a concentrated portfolio, with significant positions in companies such as Carvana, which, as of the third quarter of 2024, accounted for approximately 85% of the portfolio's value.

Sosin demonstrates a 360º vision, showcasing a clear commitment to deep fundamental analysis and scuttlebutt-style investing. His process demands high conviction, as evidenced by the level of concentration he’s willing to maintain. While the portfolio highlights only his equity positions, it’s well-documented that he holds significant fixed-income investments alongside it, further underscoring the breadth of his strategy.

Sosin's investment philosophy emphasizes understanding the underlying mechanisms of businesses and industries, allowing for informed discussions about future probabilities and potential outcomes. He views investing like hypothesis testing, where the goal is to disprove his most loved ideas. By rejecting these, he holds onto the most infallible companies with the highest upside potential.

This methodology has led CAS Investment Partners to avoid sectors where the firm lacks expertise, such as biotechnology, and instead focus on areas like insurance brokerage, subprime lending, and wealth management, where the firm's comprehension of "loyalty effect economics" provides a competitive advantage. This approach is challenging to quantify, unlike the methods many other managers rely on, as Sosin's competitive edge stems from qualitative insights that he gathers from close contact with the company’s stakeholders.

Lessons Learned

We draw immense inspiration from Cliff Sosin, whose insights over the years have taught us invaluable lessons. If we were to distill them into three key takeaways, they would be:

Build and rebuild conviction, ignoring the noise of others.

Concentration is only as risky as the gaps in your knowledge.

Don’t shy away from activism when the situation calls for it.

Firstly, building conviction demands time, effort, and resources. When these elements align, they can lead to those rare moments of clarity - what Sosin, the inventor, might call moments of "Eureka." In the process of forming conviction, it’s crucial to disregard external opinions and reach conclusions independently. Once you’ve done so, however, validating your thesis by examining opposing perspectives can be immensely beneficial.

The journey doesn’t end there. Retesting your thesis regularly and asking, "Does this still hold true?" is essential. And remember, changing your view when the facts change isn’t a sign of weakness - it’s a mark of wisdom.

Secondly, it’s crucial to establish clear limits for position sizing at both ends. If an idea doesn’t meet your minimum threshold for allocation, it’s likely not worth your time or capital. The same principle applies to doubling down - you should define an upper limit, at cost, for how much of your portfolio you’re willing to allocate to any single position. This discipline becomes even more critical when managing outside capital.

For instance, Cliff Sosin caps his concentration at 25% of the portfolio at cost and refrains from rebalancing if a position exceeds this percentage due to growth. In practice, this means that if a position’s valuation grows to represent 40% of the portfolio, he doesn’t sell. Selling occurs only when the expected valuation has been fully realized, not simply because the position exceeds an arbitrary size.

Lastly, we shouldn’t hesitate to engage directly with stakeholders, particularly management, when we see significant opportunities for improvement. Cliff Sosin provides two notable examples of activism: his opposition to the sale of At Home and his successful effort to elevate a fellow shareholder to a board position at Cardlytics. These actions demonstrate the power of taking a hands-on approach when the situation calls for it.

This is my personal favorite letter from this manager:

David Bastian, The Astute Hedger

David Bastian is the Chief Investment Officer at Kingdom Capital Advisors (KCA), a Registered Investment Advisor based in Fairfax, Virginia. He earned a Bachelor of Science in Mathematics, with minors in Economics and Statistics, from Pennsylvania State University.

Before founding KCA, Bastian served as an Actuarial Analyst at Mercer and worked as a Merger and Acquisition consultant at PWC and FTI Consulting. In these roles, he primarily assisted with buy-side due diligence for large private equity funds, experiences that honed his ability to evaluate potential investment opportunities from an owner's perspective.

At KCA, Bastian focuses on identifying dislocations between price and intrinsic value, particularly in small and micro-cap stocks. He employs a concentrated investment strategy, often holding fewer than twenty stocks at a time, with up to 25% of the portfolio invested in a single stock.

Bastian has shared his investment insights through various platforms, including pitching The Children's Place at the MicroCap Leadership Summit in September 2023. He has a very strong presence in Seeking Alpha, an amazing resource that can help you learn more about his investment process. He frequently leverages his strengths, which we’d say are rooted in the materials and natural resources sectors.

FYI, KCA has been recognized for its investment research, securing third place in SumZero's "SMID Cap" stock pitch competition.

David employs highly creative exit strategies and hedging techniques that, at first glance, result in a "much more diversified portfolio." However, his involvement with specific companies and the use of options to purchase shares can sometimes create outsized positions. These are often counterbalanced by his strategic hedging plays.

For example, David might invest in a well-managed mining company while simultaneously short-selling the commodity it produces. This approach isolates the company’s operational performance from the broader volatility of its industry, allowing him to focus on the business fundamentals rather than being at the mercy of market fluctuations.

Lessons Learned

The key lessons from observing Mr. Bastian in action can be distilled into three essential points:

Plan your exit before you invest.

Cash flow yield is the ultimate metric.

Unique, high-conviction opportunities ("N of one") can be game-changers.

The first and perhaps most critical lesson revolves around exiting investments. Bastian’s track record features numerous cases of special dividends, substantial buybacks, and even liquidations. His portfolio management style also includes creative use of options to facilitate exits from specific positions.

In the microcap space, illiquidity is often a significant challenge, making well-planned exits especially valuable. More importantly, Bastian's approach emphasizes understanding the mechanics of the exit strategy before committing to a position - a hallmark of his disciplined and forward-thinking investment style.

Secondly, recognizing that Cash Flow Yield is the ultimate metric is crucial. In his letters, David often emphasizes profitability as the cornerstone of his investment philosophy but highlights CF yield as the key metric for comparing opportunities. While this is speculative on our part, it appears that the opportunities he favors tend to offer a Free Cash Flow (FCF) yield of around 15% - a benchmark that closely aligns with how we at The Hermit assess potential investments.

Lastly, special situations or "N of one" opportunities can be absolute game-changers. Identifying and capitalizing on these unique scenarios can yield outsized returns, especially when managed with the right position sizing. Beyond their financial potential, they’re also incredibly engaging and rewarding to analyze.

In his Q2 2022 letter, Bastian highlights a compelling example of this approach with a special situation involving Sysorez ($SYSX):

On a final note, we first came across David when he shared his thoughts on PLCE. Before publishing our thesis on Substack, we walked through every conceivable short thesis with him to identify potential drawbacks of investing in PLCE. Ultimately, we both agreed that none of the theses posed a significant threat.

That said, we meticulously discussed each scenario in detail, focusing on those with the highest likelihood of occurring - for instance, the potential impact of dilution. This thorough approach highlights the importance of refining your convictions through thoughtful dialogue and analysis.

This is my personal favorite letter from this manager:

Michael Melby, The Cautious Teambuilder

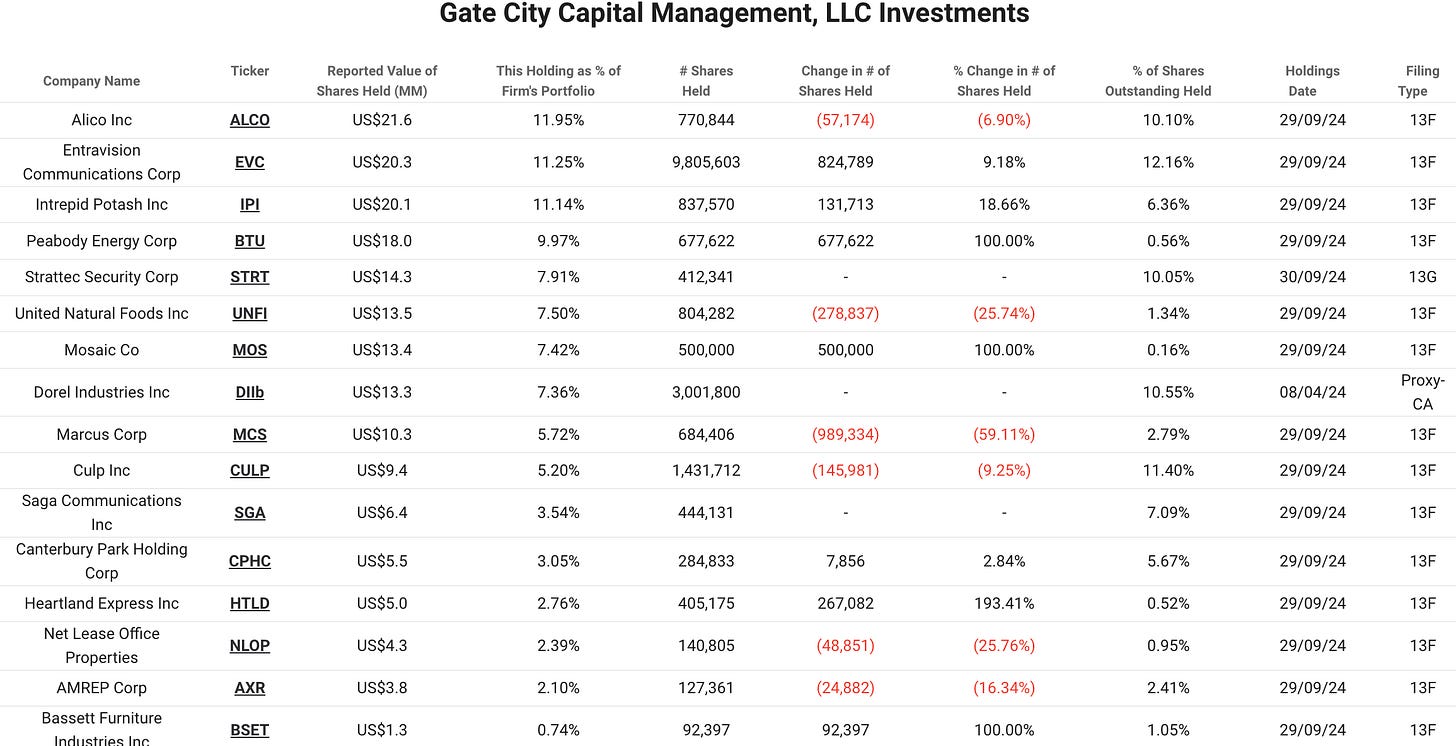

Michael Melby is the founder and portfolio manager of Gate City Capital Management, a Chicago-based investment firm focused on uncovering value in micro-cap equities.

Before founding Gate City Capital Management, Michael built a strong foundation in the financial industry. He served as a North American debt specialist at Deutsche Bank, gained equity analysis experience with the Notre Dame University Endowment, and honed his investment skills as an analyst at Crystal Rock Capital Management.

Michael earned an MBA from the University of Chicago Booth School of Business and holds a degree in finance from the University of Notre Dame.

At Gate City Capital Management, Michael leads the firm with a disciplined, research-intensive approach. The team builds a concentrated portfolio by conducting thorough fundamental analysis, carefully balancing potential risks and returns to identify high-conviction investment opportunities.

Michael's investment style shares similarities with the previous two managers but differs notably in terms of portfolio rotation and concentration. While he aims to maintain a portfolio of 15 companies, he typically ends up with a higher number, which can distort his turnover metrics. On average, his holdings have a duration of 2 to 2.5 years, but his larger positions often remain in the portfolio for significantly longer - an outcome driven by his focus on concentration.

In Michael's case, concentration refers to the percentage of a company’s outstanding shares that he owns. A glance at his current portfolio reveals his high conviction in select names, with ownership stakes exceeding 10% of outstanding shares being a common occurrence. This level of commitment underscores his belief in the long-term potential of his core investments.

Lessons Learned

The key takeaways from watching Mr. Melby in action boil down to three powerful principles:

Lead with the bad news.

Let DCFs guide you, but always have a safety net.

Invest in your team and value face-to-face interactions.

First and foremost, hold yourself accountable and maintain the highest standards - this starts with regularly reflecting on your mistakes. Mr. Melby exemplifies this practice by consistently beginning his commentary with an analysis of the portfolio's largest detractor.

While concepts like turnover, concentration, maintaining more cash than debt on the balance sheet, or celebrating special dividends are undoubtedly valuable, they pale in comparison to the discipline of accountability. Breaking down businesses and identifying optionality are great tools, but they can’t match the consistency and clarity that come from owning up to and learning from your missteps.

Secondly, Mr. Melby employs a dual valuation system to evaluate opportunities. Rather than basing allocations on potential future outcomes or probabilities, he compares the best-case and worst-case scenarios, allocating a percentage of his portfolio according to this ratio.

His approach combines two distinct models: a discounted cash flow (DCF) analysis and a floor value assessment, which closely resembles a liquidation scenario. The DCF model estimates the cash flow the company can generate over time, while the floor value model evaluates the intrinsic value of the company’s assets. This includes considerations such as potential fire-sale outcomes and the recurring costs associated with liquidating the business over a defined time frame. This dual framework allows him to balance optimism with practicality, ensuring a comprehensive view of each opportunity.

Lastly, Mr. Melby attributes one of the largest drivers of performance to face-to-face interactions, applying this principle in a dual capacity: with his team and with the management of his portfolio companies.

Starting with the latter, before committing to any investment, Mr. Melby insists on in-person meetings with company management. These sessions go beyond traditional interviews; they often include factory tours where he and his team assess qualitative factors such as employee satisfaction, productivity, organizational efficiency, and middle-management competency (among others). This hands-on approach provides invaluable insights that can't be gleaned from financial statements alone.

Similarly, this commitment to face time extends to his own team. Michael has built a four-person operation, including an internal CFO dedicated to operations and three research analysts. Notably, the analysts began as interns, with their work leading to some intriguing opportunities for Gate City.

A particularly compelling practice he has implemented is the weekly portfolio review: on a rotating basis, each team member is tasked with presenting their ideal portfolio and defending how it compares to Gate City’s current holdings. This exercise fosters accountability, critical thinking, and fresh perspectives within the team.

This is my personal favorite letter from this manager:

Bonus Clip

A few days ago Bob Robotti held his annual gathering. We’d strongly recommend you take a look at his work and philosophy:

Conclusion

This series highlights the unique investment approaches and philosophies of three exceptional managers, each bringing distinct strategies to the table. From Cliff Sosin’s relentless pursuit of conviction and his willingness to engage in activism, to David Bastian’s creative exit strategies and focus on high cash flow yielding opportunities, to Michael Melby’s disciplined dual valuation models and emphasis on accountability - there is a wealth of insights to be gained. These managers demonstrate how different methods can achieve consistent success, emphasizing the importance of adapting strategies to one’s strengths while maintaining a commitment to rigorous analysis and accountability.

As we conclude this exploration, the lessons learned from these professionals remind us that investing is as much about understanding and refining your process as it is about finding great opportunities. Their willingness to challenge conventional wisdom, learn from mistakes, and prioritize both qualitative and quantitative analysis offers a roadmap for aspiring investors. Whether through in-depth fundamental research, creative hedging techniques, or team-driven collaboration, their experiences underscore the value of discipline, curiosity, and a relentless drive for improvement.

🙏 Feel free to ❤️ and comment so that more people can discover and enjoy this Substack 😇