📈 Corticeira $COR - The World's ONLY Cork Manufacturer

A comprehensive financial walkthrough of the market leader in cork production, Corticeira Amorim $ELI:COR

Welcome back dear fellow 🧙♂️ Hermits 👋

Discover our Company Coverage 👇👇👇

🏥 Limes Clinics — [Mostly Free] The world’s most exclusive (and expensive) mental health clinics

🎰 Century Casinos — [Premium] A casino operator that’s 10x’d its capacity in just five years with creative financing

💳 Cardlytics — [Premium] The only advertiser that seamlessly connects banking consumer data with top-tier brands

🧸 The Children’s Place — [Premium] A specialty retailer for kids and infants, now controlled by Saudi Arabia’s second-richest family

💧 BluMetric Environmental — [Premium] Profitable water purification and wastewater systems with deep government ties

If you haven’t yet, subscribe to get access to this post, and every new post

Investment Thesis is a series of posts that provide a foundational understanding of listed wunderkind companies. The series aims to achieve a timeless understanding of the company's inner workings. Every month, content on an investment case will be posted as an article, podcast, or both.

This content is intended for informational purposes only and should not be taken as investment advice. The author does not represent any third-party interest, and he may be a shareholder in the companies described in this series.

Please do your own research or consult with a professional advisor before making any financial decision. You will find a full disclaimer at the end of the post.

Context

The Business

Investment Case

👨👩👧👦 Origin Story and the Amorim Family

Corticeira Amorim, a company now recognized as a world leader in cork processing, was founded in 1870. The company’s origins are deeply rooted in the entrepreneurial spirit and vision of the Amorim family, who recognized the vast potential of cork, a 100% natural raw material. From its inception, the family business emphasized the versatility and sustainability of cork, establishing its foundational philosophy of:

not just one market, not just one customer, not just one currency, not just one product

Under the leadership of the Amorim family, the company rapidly expanded its portfolio and entered new markets, developing innovative products that positioned cork as a material of choice in various industries. This expansion was driven by a commitment to sustainability and innovation, which included significant investments in research and development. By the 1960s, the company had diversified its offerings and established itself as a major player in the cork industry.

In the post-World War II era, the third generation of the Amorim family identified new business opportunities amid the global economic recovery. This period marked a significant shift for the company, as it began to focus on adding value to cork by utilizing the 70% of waste generated during cork stopper production. This led to the creation of granulates and cork agglomerates for multiple sectors, thereby reducing waste and increasing the utility of cork. This vertical integration and diversification strategy culminated in the formation of Corticeira Amorim, which later evolved into Amorim Cork Composites.

In the 1980s, Corticeira Amorim significantly increased its production of cork agglomerates, expanding their application to advanced technological sectors. Cork’s properties, such as thermal and acoustic insulation, fire resistance, and compressibility, made it suitable for construction, automotive, and aerospace industries. The growing demand, especially in North America, led to establishing a subsidiary in Canada in 1981, laying the groundwork for further expansion into the US market.

In 2007, Amorim Cork Composites was formally established following the merger of various business units. This restructuring enabled the company to consolidate its market position and enhance operational efficiency. In 2018, the company launched the i.cork factory, an innovative pilot plant dedicated to researching, designing, and developing new cork products and applications. This facility symbolizes the company’s ongoing commitment to innovation and sustainability, continually exploring new processes and technologies to enhance cork's technical performance.

The Amorim family has maintained a strong commitment to sustainability throughout its history. The company’s operations are guided by principles that promote the circular economy, minimize waste, and support good forest management practices. These efforts enhance the quality of cork and contribute to preserving cork oak forests and their ecosystems.

Today, Corticeira Amorim is led by the fourth generation of the Amorim family, who continue to uphold the values of pride, ambition, initiative, and sobriety. The company’s global footprint extends to over 100 countries, and its diverse product portfolio serves industries ranging from aerospace to wine and spirits. The Amorim family's enduring legacy is one of innovation, sustainability, and an unwavering commitment to excellence in the cork industry.

🏭 The Industry

The Natural Cork Council reports that cork is primarily produced in the Mediterranean region, with Portugal leading 34% of the world's forest area and 50% of production. In 2023, ~200 tons of cork were produced globally. Global cork production is highly concentrated in the Iberian Peninsula. By country, the main cork producers in the world include:

The cork industry employs 30,000 people and produces about 13 billion wine stoppers annually. Worldwide, wine stoppers account for 72% of all cork revenue.

In recent years, cork production has decreased in major producing countries, but this has been partially offset by increases in countries with smaller market shares, such as Russia and Latin America.

In the US, natural cork usage is growing steadily, with a 7% annual increase and an estimated 1,200 million natural corks used in 2023. Cork-finished wines command higher prices and exhibit greater sales growth than those with alternative closures.

The wine bottle market in the US, the largest segment serviced by cork, clearly illustrates cork's value. Consumers will pay up to a 66% premium for cork closures over alternatives. This preference is driven by cork's inherent properties and the cultural perception of cork as a mark of quality.

Despite a general decline in wine demand, influenced by a slowdown in China since 2018 and the impact of COVID-19, the market for cork continues to grow. This is driven by consumers migrating towards more expensive wines, which typically use cork stoppers and the growth of other beverages, such as spirits.

Cork prices are generally stable but can spike during supply shortages or periods of inflation. These price increases affect Corticeira Amorim's margins, as the cork business does not have the same pricing power as glass and barrels. For instance, Corticeira only offset 50% of the cork cost increase in 2018. Additionally, cork purchased in one year impacts the cost of goods sold (COGS) in the following year when used to produce and sell stoppers. Thus, the price increase in 2018 significantly affected margins in 2019 and beyond rather than in 2018.

From 2000 to 2008, cork lost market share, but this trend began to reverse in 2010, with cork gaining market share annually.

Demand and Supply: e.g. Catalonia 2023

The cork harvest season in Catalonia ended with significant contrasts due to drought and a 30% increase in cork prices. On the positive side, rising demand and market prices have boosted interest in cork extraction. However, adverse weather conditions shortened the season, which started late and ended early due to a lack of rain and high temperatures. The drought has weakened many cork trees, resulting in fewer leaves and lower overall health.

In 2023, 55-65% of the cork harvested was waste, 2-3% was burnt, 5-10% was pilgrim cork, and only 25% was suitable for making corks or discs. The total production was around 1,800 tons, significantly lower than the 4,500 tons in 2018 and far below the potential 11,000 tons per year, highlighting a gap between supply and demand.

🍾 The Product: Cork

The cork harvesting process, known as descortiçamento in Portuguese, occurs from mid-May to late August during the peak of vegetative activity. This highly specialized process ensures that the cork oak trees are not damaged.

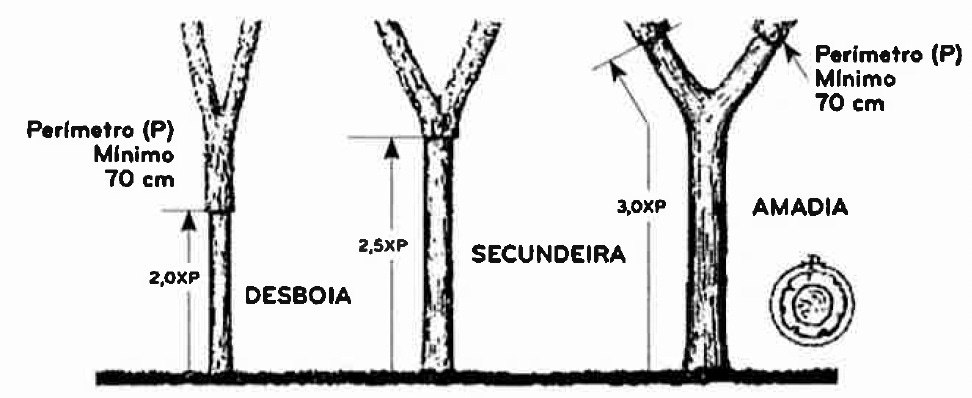

Cork oaks are slow-growing trees that can live up to 200 years, allowing for approximately 16 harvests over their lifespan. The first harvest, known as virgin cork (low quality), occurs when the tree is 25 years old with a trunk perimeter of 70 cm. Nine years later, the secondary cork (good quality) is harvested. Subsequent harvests, called amadia cork (excellent quality), occur every nine years and provide the high-quality cork used for stoppers. It takes 43 years from planting to obtain the first amadia cork.

🏰 Talk about barriers to entry!

Cork Composition

Cork is composed of various materials that impart unique properties. Its chemical composition includes:

Suberina (45%): The fatty acids (feluric, stearic, and felony) are its main components. Suberin gives cork cells hydrophobic properties, protecting them from external pathogens, preventing water evaporation, and healing wounds

Lignin (27%): polymer composed of aromatic alcohols that lend rigidity and impermeability to the cell membrane

Cellulose and polysaccharides (12%): The cellulose forms rigid microfibrils that make it resistant and non-stretchable

Tannin (6%): polyphenolic substances that bind to proteins, making them insoluble and rot-proof

Ceroids (5%): fatty acids responsible for the impermeability of cork

Cork Production and Procurement

Portugal and Spain are the leading global producers of cork, accounting for over 80% of the world's supply. In 2021, Corticeira Amorim purchased cork and cork products worth 292 million euros, with 95% sourced locally from Portugal and Spain. Most of the cork is bought from private family-owned cork oak plantations in Europe, particularly in Spain and Portugal, with around 1,000 active contracts.

Corticeira Amorim also sources cork from North Africa (Algeria and Tunisia), where state-owned forests sell cork through public auctions, a process Amorim describes as transparent.

Market Distinctions

Cork is sourced from two main markets:

Primary Market: Cork is bought directly from cork oak owners who harvest the trees and sell the cork sheets or strips.

Secondary Market: Cork remnants from natural stopper producers are used to manufacture technical stoppers and other products.

Unlike its main competitor, Oeneo, which exclusively buys cork in the secondary market to produce technical stoppers, Corticeira Amorim buys only 40% of its cork from the secondary market. This strategy allows Amorim to secure better prices and higher-quality raw materials, enhancing its product offerings and maintaining a competitive edge.

Pricing Power

Cork is harvested every nine years, with the previous cycle occurring in 2008/09. During 2009, demand for cork from producers like Amorim decreased, leading Portuguese farmers to invest less in harvesting. Consequently, production dropped, and by 2018, the number of trees ready for harvest was low. This scarcity caused cork prices to rise by approximately 30% from 2017 to 2018. Although Amorim lacks significant pricing power, it managed to pass on 50% of the price increase to customers.

As the world's largest cork processing company, Amorim holds substantial influence in the supply chain. However, the company must balance negotiation power with long-term sustainability. Cork cultivation is often a supplementary income for farmers, not their primary activity. If Amorim pushes too hard on price negotiations, it could discourage farmers from investing in cork oaks, ultimately harming the industry's future and Amorim's growth capacity.

🧩 Business Overview

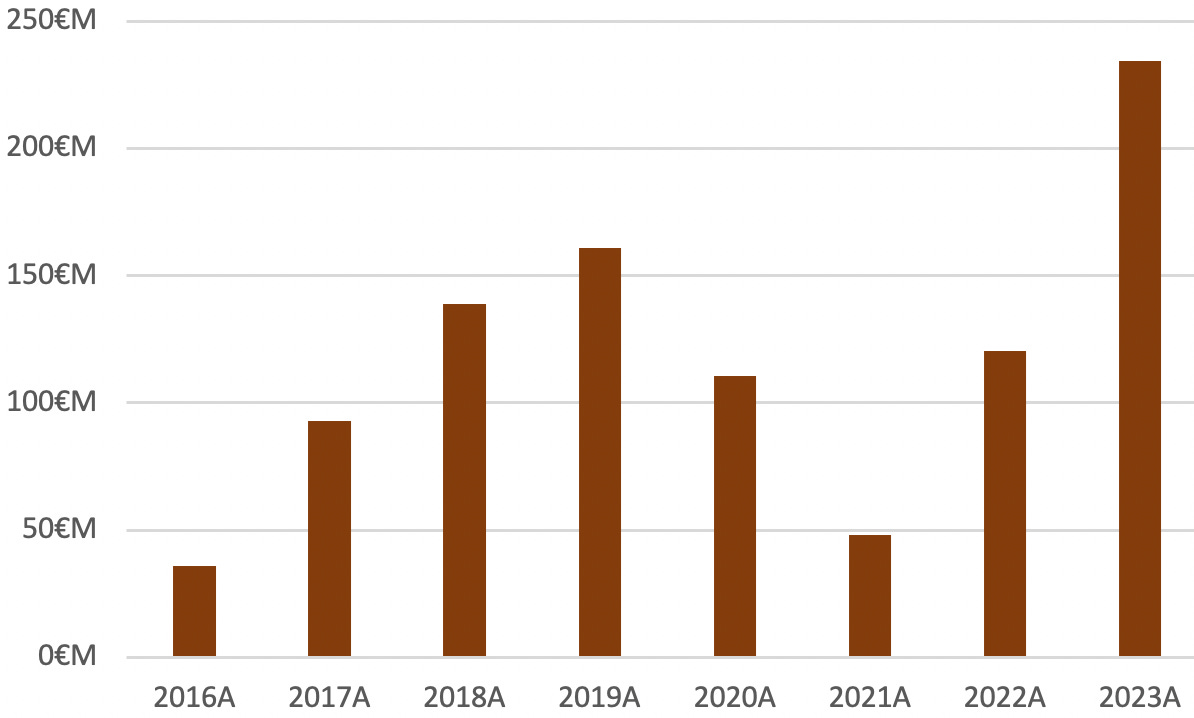

The chart illustrates Corticeira Amorim's financial performance from 2008 to 2023, focusing on three key metrics: sales, EBITDA, and EBITDA margin.

We can observe the following trends from the graph above:

Steady sales growth: Despite economic downturns and the COVID-19 pandemic, the company achieved significant sales increases, particularly in the last decade

Improved EBITDA: Consistent growth in EBITDA demonstrates enhanced profitability and operational efficiency

Stable and increasing EBITDA margins: The margin improvements indicate effective cost control and robust financial health

The following is the latest distribution of sales by geography:

Amorim is a pure cork player, a material destined to win due to the trend towards "premium” and ESG criteria, with interesting organic growth potential.

Cork benefits primarily from the growth of premium wine, bourbon, and gin. More artisanal spirits are increasingly using cork, and this segment has enormous growth potential since cork lost a considerable part of the wine market between 2000 and 2008 due to alternative TCA-free materials (more on this later). However, cork producers have eradicated the quality deficiencies of cork, which now surpasses synthetic and aluminum stoppers.

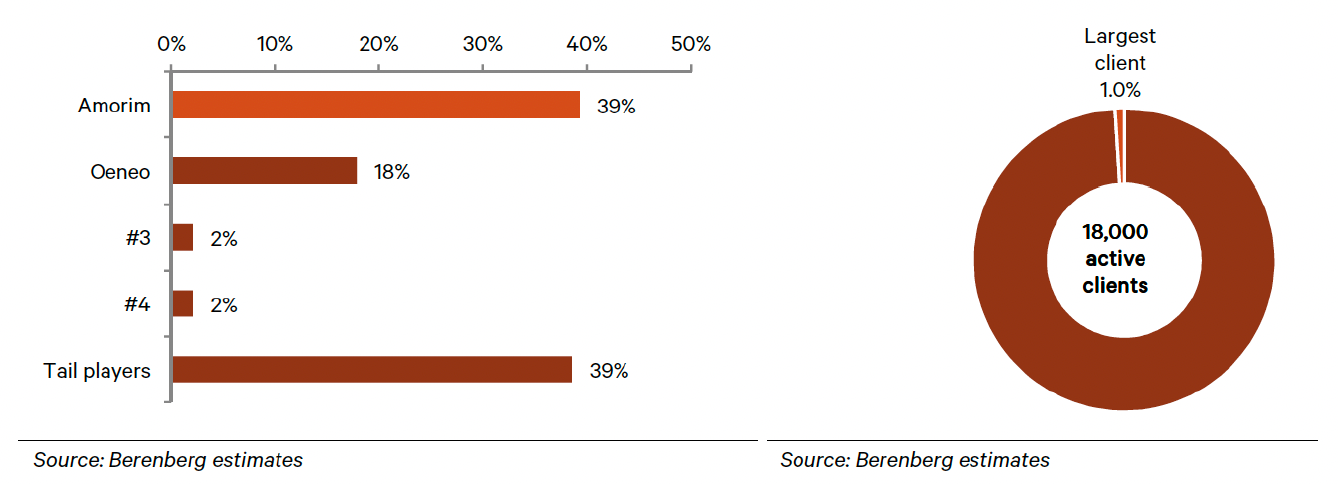

Amorim is the leader in its industry, with a 27% market share. Its clients are highly fragmented, with the largest representing 1% of its sales. In the beverage cork stoppers segment, it holds a 40% share.

Business Units

Corticeira Amorim's income is not solely derived from cork stoppers; 30% comes from other segments. These areas are more cyclical and have lower margins but are crucial for using 100% of the cork.

Forestal (Raw Materials): This unit handles the entire supply chain for raw cork, ensuring the efficient flow and high quality of materials from the forest to production

Cork Stoppers: Corticeira Amorim is the world leader in producing and distributing cork stoppers, used primarily in wine and spirits bottles

Floor and Wall Coverings: The company offers high-quality, eco-friendly cork flooring and wall coverings in over 60 countries

Composite Cork: This division focuses on creating new cork-based materials by reusing and reinventing cork for various applications, including automotive and aerospace industries

Insulation Cork: This company produces natural cork insulation materials known for their excellent thermal, acoustic, and vibration-insulating properties. These properties contribute to energy-efficient and sustainable building solutions

The following is the latest distribution of sales by segment:

The following is the distribution of sales by segment since 2008:

The following is the contribution to EBITDA of each segment since 2008:

The following is the evolution of margins in recent years of each business segment (w/ the recent rebranding of Raw Materials as Forestal):

It is important to note that while Corticeira Amorim produces composite cork, insulation cork, and flooring, these are considered secondary products. The company's primary focus remains on its core products: cork stoppers and raw cork material (rebranded as Forestal).

The company’s business units contribute substantially to its overall success. Amorim Cork, the largest segment, leads the market with sales of €759.4 million, producing 5.6 billion cork stoppers annually. Amorim Florestal, responsible for managing the cork value chain, contributes €234.0 million in sales. Additionally, Amorim Cork Flooring adds €92.2 million in sales, with the capacity to install 10 million square meters of flooring each year.

Corticeira Amorim operates in a segment with strong growth prospects. Since 2010, the company has actively recovered lost market share in the wine sector. Additionally, cork benefits from ESG trends, which support its organic growth due to the increasing demand for sustainable and environmentally friendly products.

Amorim sees significant potential for growth in the spirits segment, where it currently perceives itself as under-penetrated. The company aims for organic growth of over 10% in this segment. While the wine market is mature and growth is limited, consumer preference for more expensive wines favors cork stoppers.

The group is estimated to sell 300 million stoppers annually to the spirits market, capturing 30% of that segment, although this represents only 1% of Amorim's total production. The spirits market is particularly promising for Amorim due to its higher complexity and demand for more sophisticated cork products, resulting in an EBITDA margin of over 20%.

🤝 Strategic Acquisitions

In addition to its organic growth strategy, the company employs a highly selective M&A approach, targeting recent acquisitions at multiples of 5-6x EBITDA, making them accretive to earnings.

Recent strategic acquisitions include a 50% stake in the SACI Group for €48.7 million and a 55% stake in VMD Group SA for €12.1 million. These moves support Amorim's strategy of leveraging growth opportunities while maintaining a focus on sustainability. The following is a list of acquired companies:

During times of sector stress, such as the Global Financial Crisis (2008-2010), companies within the sector enter or approach bankruptcy, representing a good M&A opportunity for Corticeira Amorim. However, this strategy is not entirely attractive for the company; it prefers to buy companies that are doing well. Buying bankrupt companies increases capacity quickly, but it prefers to increase it organically.

Significant Transaction: SACI Deal

Amorim reached an agreement to acquire 50% of SACI for 48.66 million euros. The Getto and Perlich families equally controlled the SACI Group. SACI consists of 17 companies operating in diversified sectors. Its main activity is the production and commercialization of wire wood. The company has about 340 employees and is present in more than 30 countries.

The most important subsidiary of the SACI Group is Industria Canavesana Attrezzature Speciali S.p.A. (ICAS). ICAS was founded in 1956 in Ivrea by Bruno Getto. Getto aimed to meet the specific requests of the leading Italian sparkling wine producers, creating and developing a high-precision automatic machine to industrialize the production of stopper wires, which had previously been done by hand. ICAS is currently the world's leading producer of stopper wires. Continuous investments in R&D, the use of state-of-the-art machinery, and its highly qualified team support a diversified and technologically advanced range of high-quality and exclusive products recognized by its customers, ultimately providing reliable experiences for final consumers when opening the bottle.

SACI is expected to maintain its identity and autonomy to safeguard its brands. In the 2020 fiscal year, SACI had 70 million euros in sales and an EBITDA of 10.5 million euros (15% margin).

🧑🔬 Research & Development

Corticeira Amorim strongly emphasizes innovation, investing €11.3 million in research, development, and innovation (R&D+I) in 2023. This investment supports technological advancements such as NDTech, a screening technology for TCA-free corks, and the development of cork composite products used in high-tech sectors like aerospace and automotive industries.

TCA

To comprehend the cork industry and Corticeira Amorim’s market positioning, it's crucial to understand Trichloroanisole (TCA). TCA is a compound found in cork that, at elevated levels, imparts a musty taste to the wine. Customers can demand reimbursement or take legal action if detected in Amorim's corks. However, Amorim has the capability to analyze and guarantee the quality of its cork products.

At the turn of the century, the prevalence of TCA led to a significant loss of market share for cork as winemakers turned to plastic and aluminum stoppers. These alternatives gained popularity because they eliminated the risk of cork taint. In the early 2000s, approximately 5% of cork stoppers were affected by TCA, causing cork’s market share to plummet from 90% in 2000 to 50% in 2008. In response, Amorim invested between 15 and 20 million euros in R&D to tackle the TCA issue.

Amorim has countered the threat of alternative stoppers by developing new cork-based products and improving their reliability. Thanks to innovations like technical cork, the prevalence of TCA in cork stoppers has been reduced to around 0.5%. Technical cork, made from treated cork granules, has driven the resurgence of the cork stopper market.

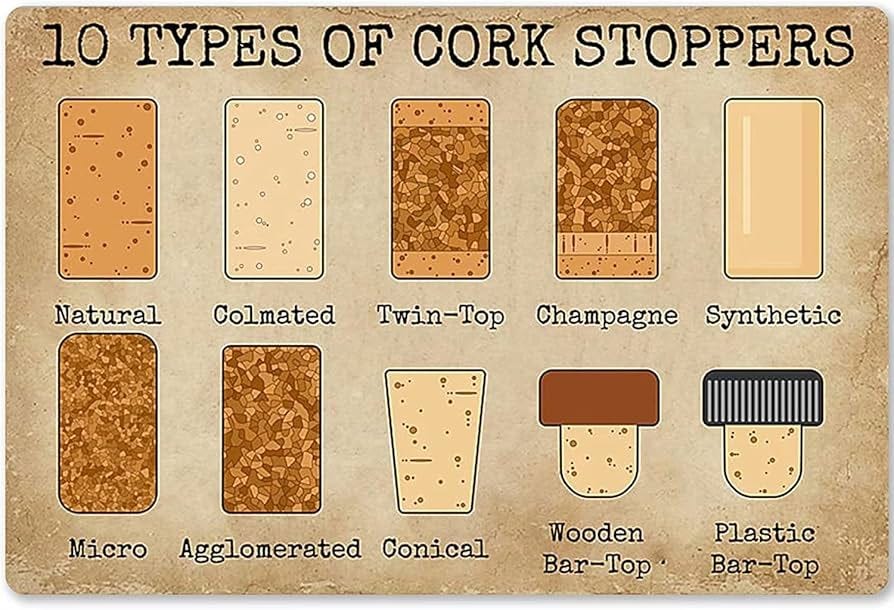

Amorim offers two main types of cork products:

Technical Cork: Made from treated cork granules with natural cork discs added, creating a robust stopper for the mid-market. Amorim’s technical stoppers contain 80% pure cork

Natural Cork: These stoppers are derived directly from cork bark and provide an authentic look and optimal characteristics for wine aging

Currently, about 80% of Amorim’s stoppers are technical, priced between $0.08 and $10 per unit. This blend of natural aesthetics and reliability has been a major driver of cork’s market share increase.

In 2016, after a five-year investment of 10 million euros, Amorim launched NDTech, the world’s first high-speed TCA screening technology. This technology rejects corks with more than 0.5 nanograms of TCA per liter and guarantees TCA-free stoppers, allowing Amorim to offer a premium product.

Due to its cost, only a select number of stoppers undergo NDTech testing, which is reserved for the most expensive wines. Currently, 80 million out of the 5.8 billion stoppers produced annually are NDTech tested.

NDTech has driven 6-8% annual growth in the natural cork stopper line, which typically sells at a 10% premium. The average natural cork stopper sells for $0.20. In the wine industry, Amorim is seen as the safest bet for cork stoppers, offering a practically guaranteed problem-free product, unlike competitors who can face significant issues.

♻️ Sustainability and Circular Economy

Sustainability is a core focus for Corticeira Amorim. The company manages 8,181 hectares of cork oak forests and planted over 387,675 cork oak trees in 2023 to promote biodiversity and sustainable forest management. Additionally, it utilizes 76.7% renewable energy and has avoided 72,578 tCO2eq emissions through various initiatives. Significant investments in photovoltaic projects aim to meet 20% of the company’s electricity needs by 2024.

The product extracted from Quercus suber, or Cork Oaks, is naturally carbon-negative, offering a compelling reason to continue and expand the use of the material with -112.01g of CO2 per 1,000 stoppers.

Corticeira Amorim's commitment to a circular economy is evident. Ninety-two percent of the materials used are sustainable, and 88.7 percent are renewable.

This dedication extends to community engagement. The company employs 4,958 workers globally, 70% of whom are based in Portugal. It invests in community development through educational initiatives and employment programs, enhancing social and economic resilience in the regions it operates in.

In 2023, the company planted over 387,675 cork oaks (+233,065 more than in 2022) and plans to plant an additional 250,000 in 2024. These efforts support biodiversity, combat climate change, and ensure a sustainable supply of raw materials. Additionally, Corticeira Amorim has invested in the Herdade de Rio Frio estate to develop a new silviculture model for cork oaks, enhancing forest management practices and sustainability.

A significant aspect of Corticeira Amorim’s sustainability strategy is its shift towards renewable energy. The company has invested heavily in photovoltaic projects and aims to cover 20% of its electricity needs by 2024. This transition to solar energy reduces the company’s carbon footprint and promotes the use of sustainable energy sources.

The company is committed to reducing waste through zero-waste initiatives. Corticeira Amorim ensures the full utilization of cork material, minimizing waste by using by-products from cork stopper production in applications such as flooring, insulation, and composites. Additionally, the company runs recycling programs to repurpose used cork stoppers and other cork products, further reducing waste.

Corticeira Amorim also emphasizes social responsibility through various community engagement and employment initiatives. It is committed to improving youth employment by 2026, fostering economic development, and providing opportunities for young people in local communities. Furthermore, the Embrace Equity campaign promotes gender equality within the company, ensuring a diverse and inclusive workforce.

Corticeira Amorim's partnerships and commitments demonstrate its dedication to environmental stewardship. For example, it has joined 24 organizations in the Floresta 2030 Commitment to protect Portuguese forests, showcasing its long-term commitment to environmental conservation. Additionally, launching an ESG credit line in partnership with Caixa Geral de Depósitos promotes sustainable practices among cork suppliers.

Innovation is at the heart of Corticeira Amorim’s approach to sustainability. The company continuously develops eco-friendly products, including cork-based insulation materials with excellent thermal, acoustic, and vibration insulation properties. These advancements reflect Corticeira Amorim’s commitment to research and development, driving the creation of sustainable and environmentally friendly products.

💎 Hidden Value: Land and Carbon Credits

Land

Corticeira Amorim, the world’s leading cork producer, owns and manages an extensive expanse of cork oak forests, demonstrating a deep commitment to sustainable forestry practices.

Corticeira Amorim's land holdings, acquired over numerous generations, are recorded in their books at the original purchase cost. Many of these properties occupy prime locations near the Portuguese coastline, areas today considered highly desirable and valuable. Given their strategic locations, these lands hold significant potential for appreciation in value.

If Corticeira Amorim ever chooses to divest from its traditional business operations, selling this land to developers interested in constructing hotels or luxury residences could potentially yield returns three to five times the current assets' book value. This potential for high-value real estate development underscores the strategic advantage of the company's long-held real estate assets in today's market.

Carbon Credits

Corticeira is dedicated to sustainable practices and actively participates in carbon credit initiatives. These efforts align with the company's environmental goals and highlight its role as a responsible industry leader.

Corticeira Amorim's cork oak forests play a vital role in carbon sequestration, absorbing significant amounts of CO2 from the atmosphere. The company helps combat climate change and supports global carbon reduction efforts by maintaining and expanding these forests.

Cork oak trees are particularly beneficial for carbon offsetting because their bark can be harvested without felling the trees. The bark regenerates, allowing for repeated harvesting, which sustains the trees' lives and enhances their carbon absorption capacity. This cyclical harvesting process significantly contributes to carbon sequestration.

Each new tree helps absorb CO2, generating carbon credits that can be sold or traded in carbon markets.

🤼 Competitors

Taking the cork stopper market as a key indicator of the company's market share, Amorim holds a dominant position, producing 40% of the world's cork stoppers. This equates to 5.5 billion stoppers out of a global total of ~14 billion annually. Amorim's significant lead over its competitors makes it more than twice the size of the second-largest operator, Oeneo, highlighting Amorim's market leadership.

Beyond Amorim and Oeneo's leading players, the cork-stopper market becomes increasingly fragmented, presenting ample opportunities for acquisitions and consolidation. This fragmentation allows Amorim to explore strategic acquisitions to further strengthen its market position and diversify its product offerings. The company's ability to leverage its extensive production capabilities and global distribution network positions it well to capitalize on these opportunities, enhancing its competitive edge and driving growth

Similarly, Amorim benefits from a fragmented customer base, serving around 18,000 clients. The largest customer accounts for just €8 million, or 1% of total sales, reducing dependency on any single client. Despite a 15% annual customer turnover, Amorim aims to lower this to below 10% in the coming years by strengthening relationships and enhancing service quality.

Oeneo, Amorim's main competitor with an 18% market share, focuses primarily on agglomerate (technical) stoppers made from cork leftovers. Amorim, however, has a comprehensive presence across all segments, including both technical and natural stoppers. Oeneo benefits from higher margins due to its strong position in the higher-priced French market.

Amorim's advantage lies in its superior diversification across geographic markets and stopper types. Additionally, Amorim is less exposed to the secondary market, where prices are generally lower. The secondary market deals with cork waste from companies, while the primary market involves purchasing new cork directly from cork oak owners. This diversification and market positioning contribute to Amorim's more robust and resilient market presence.

🚀 Drivers of the Competitive Advantage

Corticeira Amorim identifies several competitive advantages that distinguish it from its competitors in the cork industry. These advantages are integral to its business model, scale, and distribution network.

1. Vertical Integration

Corticeira Amorim’s vertically integrated business model is a significant competitive advantage. This model allows the company to source all its cork directly from forest producers, primarily through the primary market. By buying cork in the primary market, Amorim can secure better prices and higher-quality raw materials, unlike competitors like Oeneo, which primarily purchase from the secondary market and tend to pay higher prices for raw materials without segmenting cork prices.

Primary Market Procurement: Ensures higher quality and lower costs for raw materials

Control Over Supply Chain: Enhances quality control and operational efficiency

Sustainability Practices: Promotes responsible forest management and sustainability

2. Scale

Amorim is the largest producer in the cork industry, benefiting from economies of scale that smaller competitors cannot match. This scale provides operational leverage and allows for significant investments in research and development (R&D).

Economies of Scale: Lower production costs per unit due to large-scale operations

R&D Investment: With more financial resources, Amorim can invest heavily in R&D, leading to innovations such as TCA-free corks. This commitment to R&D ensures that Amorim remains at the forefront of technological advancements in the cork industry

Quality Assurance: Larger scale allows for comprehensive quality assurance processes that small manufacturers cannot provide, ensuring better product reliability and customer satisfaction

3. Distribution Network

Corticeira Amorim has a robust distribution network, with 80% of sales conducted through its own teams. The company is present in key markets, including Spain, France, Italy, the USA, South Africa, Australia, and New Zealand. This extensive network allows Amorim to stay close to its customers and swiftly detect and respond to market trends.

Global Presence: Ensures proximity to key markets and customers, enhancing customer service and satisfaction

Trend Detection: The ability to quickly detect and adapt to changing market trends gives Amorim a strategic advantage in maintaining market relevance

Reduced Dependency on Intermediaries: Direct sales reduce dependency on intermediaries, allowing for better control over sales processes and customer relationships

⚖️ Valuation

Corticeira Amorim, an industrial company, experiences margin impacts primarily from two sources:

Raw Material Prices (Price Takers): Fluctuations in cork prices directly affect the gross margin

Operational Leverage (Price Makers): Efficiency in managing fixed costs impacts operational leverage

Cork Prices

The increase in cork prices from 2018 to 2019 directly impacted the gross margin. Additionally, the effects of COVID-19 since 2020 have further influenced the EBIT margin. Here's a graphic showing the price changes of 15kg of raw cork in euros.

Operational Efficiencies

Corticeira has improved productivity, reducing personnel and external service costs as a percentage of sales. Between 2013 and 2018, these efforts saved 100 basis points. Innovations like automatic drilling technology for natural cork stoppers have helped increase efficiency. The number of cork stoppers produced per employee rose from 1.096 million in 2013 to 1.215 million in 2021, an 11% improvement.

High fixed costs mean that during low-demand periods, these costs represent a larger proportion of sales. As demand recovers, Amorim's margins improve.

Corticeira maintains excellent working capital management, averaging around 3.5% investment in working capital over sales due to prepayment for cork for the entire year. In 2017, working capital investment rose to 8% of sales due to increased inventories in anticipation of a price increase, positively reducing the impact on gross margin.

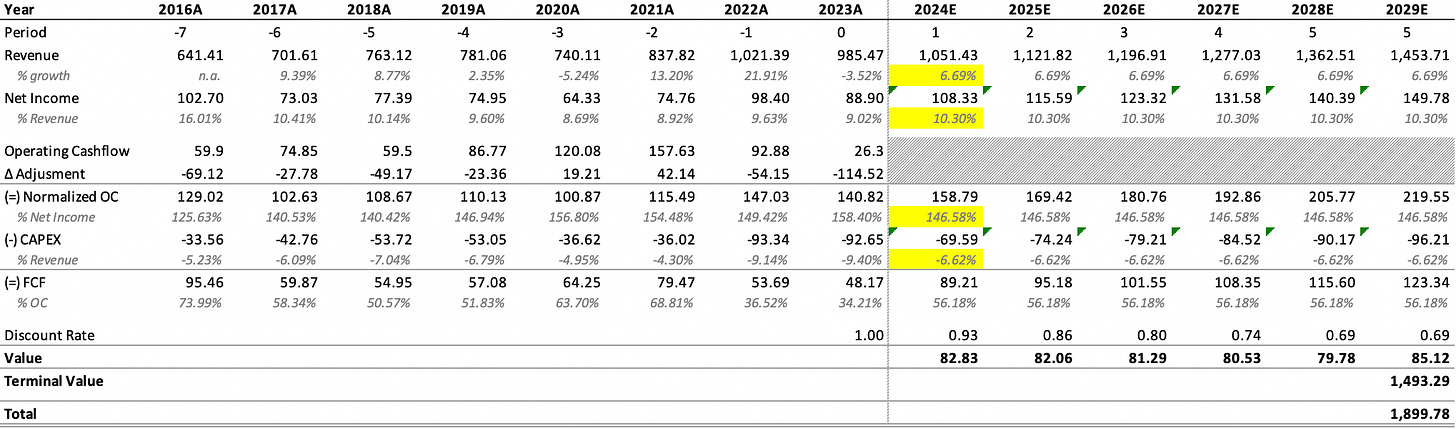

DCF Valuation

Using a Free Cash Flow (FCF) analysis, we arrive at a €1.90 billion valuation for Corticeira Amorim, representing a potential 50% upside from its current market cap of €1.26 billion.

Alternatively, applying a standard FCF multiple of 8-12x, which varies based on the company's growth prospects, a 10x multiple yields a valuation of approximately €1.23 billion. This indicates that the company is currently fairly valued.

Please note that Corticeira currently offers a dividend yield exceeding 2%, providing a reliable income stream for investors. Additionally, the Amorim family holds 70% of the float meaning investors may need to price in (very mild) illiquidity.

We used the WACC provided by Reuters. The cells highlighted in yellow are averages of the previous 6-7 years.

⚠️ Risks

The following is a non-exhaustive list of risks:

Cork Prices: The price of cork significantly influences the company's margins. Fluctuations in cork prices, driven by supply and demand dynamics, can impact profitability. For example, a poor harvest due to weather conditions can drive up cork prices, squeezing margins

Supply Chain Disruptions: Any disruption in the supply of raw cork, whether due to environmental factors, political instability, or other issues, can adversely affect operations and financial performance

Economic Downturns: As a global business, Corticeira Amorim is exposed to economic cycles. Recessions or economic slowdowns in key markets can reduce demand for cork products, particularly in discretionary segments like wine and spirits

Market Competition: Increased competition from alternative closure products, such as synthetic stoppers or screw caps, can erode market share and pressure pricing

Production Challenges: Issues such as machinery breakdowns, labor strikes, or other operational disruptions can lead to production delays and increased costs

Quality Control: Maintaining high-quality standards is crucial, particularly for cork stoppers used in premium wines. Any lapses in quality control can damage the company’s reputation and lead to costly recalls or loss of business

Regulatory Changes: Changes in environmental regulations, labor laws, or trade policies in the regions where Corticeira Amorim operates can increase operational costs or restrict business practices

Environmental Impact: As a company heavily reliant on natural resources, environmental sustainability is critical. Any failure to adhere to environmental standards or manage resources sustainably can result in legal penalties and reputational damage

Currency Risk: As an international company, Corticeira Amorim is exposed to fluctuations in exchange rates. Adverse movements in currency values can impact revenues and profitability, particularly when earnings are repatriated to the company's home currency

Leverage and Debt: High debt levels can be risky, particularly if the company experiences a downturn. Increases in interest rates can also raise the cost of servicing debt

🔍 Conclusions

Corticeira Amorim embodies the key traits of a value investing company. As a family-owned business, it aligns its interests strongly and has a high level of management involvement.

The management has proven effective, particularly during the challenging 2000-2008 period due to TCA problems. They successfully resolved issues and ensured a reliable, problem-free product for customers.

Corticeira also has a near-monopoly in a sector benefiting from ESG trends. However, the company currently faces margin pressures due to increased cork prices and energy inflation.

Once these factors stabilize, Corticeira is expected to return to its intrinsic value, which is estimated to be between 0% and 50% higher than its current price as of July 2024.

📊 Bonus: 2023 Annual Report Summary

Chairman’s Message

In 2023, the global economy grew by approximately 3.1%, which, although lower than the previous year, was stronger than anticipated. The year was marked by challenges such as geopolitical instability, inflation, and restrictive monetary policies. Corticeira Amorim reported consolidated sales of €985.5 million, a slight decrease from 2022, primarily due to reduced activity in the flooring sector and unfavorable exchange rates. However, there was a significant improvement in EBITDA, with the margin increasing to 18%. The company planted over 200,000 cork oaks in 2023 and plans to plant an additional 250,000 in 2024. Investments in photovoltaic projects are ongoing, aiming to cover 20% of electricity needs by 2024. The company continues to innovate in cork applications, contributing to various sectors. The outlook for 2024 is uncertain but optimistic, focusing on innovation, new market expansion, and profitability.

Corticeira Amorim operates globally with multiple units dedicated to different aspects of cork production and distribution. These include forestry, industrial, and distribution units spread across countries such as Portugal, Spain, the USA, China, and others.

Key Events

In 2023, Corticeira Amorim joined 24 organizations in the Floresta 2030 Commitment to protect Portuguese forests. The company celebrated the 60th anniversary of Amorim Cork Composites, a leader in cork composite materials development. It also committed to improving youth employment by 2026 and launched the Embrace Equity gender equality campaign. Additionally, Corticeira Amorim collaborated with Parsons School of Design to promote cork in design and won the C-IDEA Golden Award 2022 for the SuberDesign Award. The company was recognized by Randstad as one of the most attractive companies to work for in Portugal and undertook various sustainable projects, including a solar park and innovative architectural projects using cork.

Financial Performance

Corticeira Amorim achieved consolidated sales of €985.5 million and net earnings of €88.9 million in 2023. The EBITDA margin improved to 18%. Major investments included planting cork oaks, developing photovoltaic projects, and conducting research and development programs.

Amorim Florestal: Achieved an EBITDA of €23.2 million in 2023, a 7% increase from the previous year, with sales growth primarily in preparation and granulates.

Amorim Cork: Recorded sales of €759.4 million and an EBITDA of €147.7 million, reflecting an increase in sales and operational efficiency.

Strategic Initiatives, Sustainability and Outlook

The company continued to invest in forest management, particularly in the Herdade de Rio Frio estate, to develop a new silviculture model for cork oaks. It also launched an ESG credit line for cork suppliers in partnership with Caixa Geral de Depósitos, promoting sustainability practices.

Corticeira Amorim plans to continue investing in new technologies and applications to maintain its market leadership and expand into new markets. The company is committed to enhancing its environmental practices and supporting biodiversity through various initiatives.

🙏 Feel free to ❤️ and comment so that more people can discover and enjoy this Substack 😇

I cannot stand the related party transactions of the family. My feeling is they use the company like their private ATM.

Such an excellent piece and analysis. Thank you for your perspective.