🧗 Capital Structures Explained ft. $PLCE

OIJ (#16) A full guide on how to evaluate the capital structure of a company

My dear fellow Hermits 👋

Welcome back to 🧙♂️ The Hermit 🧙♂️

ICYMI:

🧗 Our Investing Journey: On Moats

💼 The Hermit Portfolio: September Update

📈 Investment Thesis: Lazydays (mini write-up)

If you haven’t yet, subscribe to get access to this post, and every new post

Sometimes reading company docs can get confusing. Knowing what to look for and where to look for it is rather important. This is precisely why we wanted to share with you a fairly advanced and complete guide on the capital structure.

When you’re looking for your next investment, we’re confident this should be…

A Complete - yet Beginner-friendly - Guide to Understanding Debt, Equity, and Working Capital

When it comes to running a business or even just investing, understanding debt and equity is crucial. There are so many different types of debt and financing options that it can get confusing quickly. But don’t worry, we’re going to break it all down in a more casual 😉, easy-to-understand way, with a few real-world examples to help things click 😄

Recourse vs. Collateralized Debt

Recourse Debt is a type of loan where you’re personally on the hook if things go south. Let’s say you take out a loan to start a business and offer up your house as collateral.

If your business fails and you can’t repay the loan, the bank can seize your house 🏠. But it doesn’t stop there - they can also come after your other assets to make up the difference.

Collateralized Debt is a little safer in a way because the lender can only take the collateral you’ve pledged.

With this, the lender can only seize the collateral (like a car 🚗 or a property 🏢) if you default. They can’t go after your personal savings or other assets, which makes it a bit less risky for you.

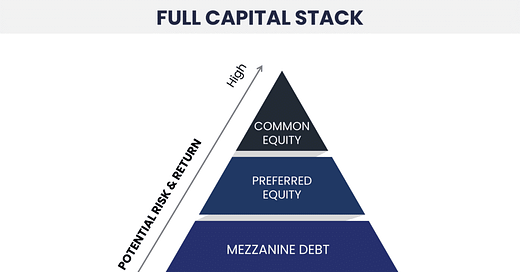

Senior, Junior, and Mezzanine Debt

When companies borrow money, not all debts are treated equally. There’s a kind of debt "pecking order", especially if things go wrong.

Senior Debt: Think of this as the first in line 🥇. If the company goes under, senior debt holders are the first to get paid. Since there’s less risk, these loans often come with lower interest rates.

Junior Debt: These folks are second in line, meaning they only get paid after the senior debt holders are settled. Because of this extra risk, junior debt comes with higher interest rates.

Mezzanine Debt: This is a mix between debt and equity. It’s usually used to fund big projects like expansions or acquisitions. It’s riskier than senior debt but often includes an option to convert into equity, which could lead to a big payoff 💸 if things go well. These are commonly called “equity kickers” and the most common one is convertible debt.

E.g. Imagine a real estate development. The company might take on senior debt from a bank to fund most of the project. They might also bring in mezzanine debt from investors willing to take on more risk, but who might get a chunk of the profits later on if the project is successful.

With unlimited upside, comes additional risk.

Lines of Credit and Term Loans

Lines of Credit: This is like having a credit card for your business 💳. You can borrow money when you need it, up to a certain limit. You usually pay interest on what you use, not the whole amount available.

For example, if you have a $100,000 line of credit and only use $20,000, you’ll just pay interest on that $20,000. With this in mind, most times banks will ask for a small payment on the unused part of the LOC.

Term Loans: These are straightforward - you borrow a lump sum and pay it back over a set period, usually with a fixed interest rate. For example, a company might take out a $500,000 term loan to buy new equipment and repay it over five years.

They usually have a specific purpose and a specific payment schedule which can be spread out over time (amortizing), or all at once at the end of the period (bullet).

Equity

Equity means ownership in a company. If you own shares, you own part of that company. Companies can raise money by selling equity instead of taking on debt, but that means giving up some control and/or future profits.

Primary Equity: When a company issues new shares to raise money, this is primary equity 🆕. For example, if a startup needs cash to grow, they might issue new shares to investors.

Secondary Equity: This is when existing shareholders sell their shares to new investors. The company doesn’t get any money from this, but it gives current shareholders a way to cash out.

Rights and Warrants: Rights give existing shareholders the chance to buy more shares at a discount. Warrants are like options - investors can buy shares at a set price later, which is great if the stock price shoots up 📈.

Preferred Equity: These shareholders get first dibs on dividends and payouts if the company goes under, but they don’t usually have voting rights.

E.g. Let’s say you invest in a tech startup. If you hold common equity, you’re taking a risk - if the company goes under, you might get nothing. But if you have preferred equity, you might at least get your money back before anyone else.

Working Capital and Vendor Financing

Working Capital is the money a company has available to pay its day-to-day expenses 💵.

It’s calculated by subtracting current liabilities from current assets. A positive working capital means a company can cover its short-term debts and still have some breathing room.

Vendor Financing: This is when a supplier lets you pay for goods or services at a later date. It’s essentially a short-term loan from the vendor to help you manage your cash flow 📦.

Confirming lines can also come in handy, they’re money borrowed to pay the suppliers that prevent cash outflows directly from the mothership.

Accounts Receivable (A/R) Financing: If your company is waiting on customers to pay invoices 🧾, A/R financing lets you borrow against those receivables.

Factoring is similar, but instead of borrowing, you sell the invoices to a third party at a discount for immediate cash.

E.g. Let’s say you run a small business and you’re waiting on $100,000 worth of payments from customers. With A/R financing, you could borrow a percentage of that amount now to cover expenses while you wait for the money to roll in.

Other Types of - for the most part - Debt

Debt can take many forms, and not all of it looks like a traditional loan.

Buy-Lease Back: This is when a company sells an asset (like real estate) to raise cash and then leases it back. The company gets immediate funds but still gets to use the asset.

Deferred Debt and Payments: Sometimes companies negotiate to delay payments on debt, like pushing back interest or principal payments to a later date 📅. Deferred revenue can be considered a short-term form of debt.

Wages and Deferred Compensation: If a company delays paying wages or bonuses, these can accumulate and even incur interest, making them a form of debt. This also applies to pension liabilities 💼.

Capital Leases: This is a lease where the company has the option to buy the asset at the end 🔑. It’s recorded as both an asset and a liability on the balance sheet, and commonly considered debt, especially in CAPEX-intensive industries.

How the **** do I tell if something is DEBT?

The general rule of thumb is: if a company has to pay interest on it, it’s debt 🏦.

For example, rent is a recurring expense but not debt since it doesn’t involve interest payments. However, mortgage payments count as debt because a portion of each payment goes toward interest. Both are payments on a property, but in accounting terms, they are completely different.

Chaos in the Land of “El Hogar de los Niños”?

Children's Place ($PLCE) currently holds a significant amount of debt which at the end of May 2024 had a 9.9% total interest rate. Here's a quick breakdown of the main types of debt it possesses:

Short-Term Debt: As of 2024, Children's Place has substantial short-term borrowings. Their short-term debt stands at approximately $316.7 million (including $226.1m in a revolving facility). This includes revolving credit facilities (likely similar to lines of credit) that help manage their immediate liquidity needs and working capital for ongoing operations, such as managing inventory or financing day-to-day business costs.

Long-Term Debt: The company also carries long-term debt of $165.4 million, which represents borrowings that will be paid back over a period extending beyond one year. This type of debt might include term loans used for major capital expenditures, such as store expansions or technological upgrades.

Leasing Obligations: In addition to these loans, Children's Place has lease commitments as part of its operations, especially given its retail presence. The company has both short-term and long-term lease obligations, with around $110.6 million in long-term lease liabilities, reflecting the cost of maintaining their stores and other facilities.

Asset-Based Lending (ABL) Facility: The company also uses an ABL credit facility to manage cash flow and maintain liquidity, leveraging its inventory and receivables. The facility includes up to $433.0 million in revolving credit and $286.0 million in term loan financing, with portions of both currently in use, as previously noted. Understanding these limits is crucial. This type of asset-backed financing is common in retail, allowing companies to borrow against assets like inventory, providing flexibility in managing cash flow.

Ending Note

Debt, equity, and working capital are all crucial parts of a business’s financial health. Each type of financing comes with its own risks and rewards, and understanding how they work can make a big difference in how a company grows, or slowly crawls into a grave of its own making.

Whether you're managing a business or just trying to deepen your understanding of investments, these concepts are invaluable. As you embark on your next venture, keep these insights in mind and use them as a roadmap to navigate the financial landscape with confidence.

🙏 Feel free to ❤️ and comment so that more people can discover and enjoy this Substack 😇

This hits close to home - I've seen countless promising companies in my analysis derailed by debt issues that weren't obvious at first glance. Your PLCE case study perfectly illustrates why I always tell investors to look beyond surface metrics to understand true financial health. I'm restacking this guide with my readers as a masterclass in how proper capital structure analysis can reveal hidden risks and opportunities.