🧗 Crypto Protocols for Dummies

OIJ (#17) From Proof-of-Work to Stake, exploring the terminology behind it all

My dear fellow Hermits 👋

Welcome back to 🧙♂️ The Hermit 🧙♂️

ICYMI:

🧗 Our Investing Journey: A Guide on Capital Structures

💼 The Hermit Portfolio: September Update

📈 Investment Thesis: Lazydays (mini write-up)

If you haven’t yet, subscribe to get access to this post, and every new post

Ah, cryptocurrencies. The great financial revolution that some folks think will change the world and others think is a ticking time bomb that will explode your savings faster than you can say, "dogecoin to the moon!"

Today, we won’t be talking about the latest meme coin making headlines. Instead, let's dive into the meat and potatoes of crypto: the protocols behind the magic ✨ - and why they matter more than what Elon Musk is tweeting about.

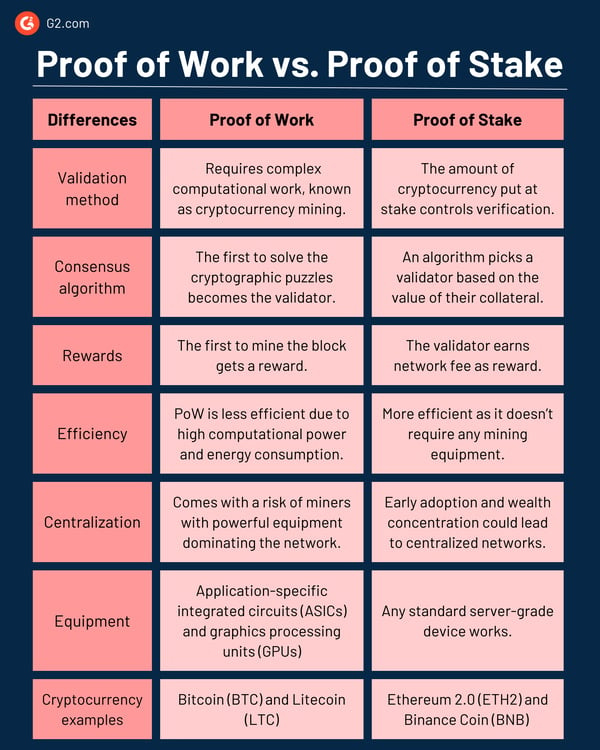

The Original Proof of Work

Let's start with the OG: Bitcoin, which introduced the concept of Proof of Work (PoW). Think of PoW as a bunch of computers playing a math-based version of The Hunger Games.

These computers (called miners) compete to solve complex cryptographic puzzles, and the winner gets to add a new block to the blockchain and take home some sweet, sweet Bitcoin. The process is not too far from running a marathon, except instead of getting fit, miners burn through electricity like it's going out of style. 💡💸

This was a goldmine back when China’s energy subsidies were practically fueling the mining rigs for free. These days, though, the real money flows where power is cheap and constant, so top earners are tapping into budget-friendly nuclear or renewable sources like hydro. I won’t go into the halving, but understanding how that relates to energy prices is important to determine the price of one Bitcoin. Read about it here.

Bitcoin's white paper by the mysterious Satoshi Nakamoto laid out this system back in 2008. And in classic white paper fashion, it was both brilliant and cryptic (pun intended). The basic idea was to ensure that no single entity could dominate the network by making mining difficult - kind of like making sure that no one person at a trivia night knows all the answers, so everyone has a fighting chance.

The catch? PoW is resource-intensive. To mine Bitcoin today, you'd need a warehouse full of computers working 24/7, and your electricity bill will look like Jeff Bezos' shopping cart on Prime Day. Enter the next generation of crypto protocols: Proof of Stake (PoS). 💪

Proof of Stake, the Autocracy

While Bitcoin miners are out there sweating over puzzles, the Proof of Stake system, first made popular by projects like Ethereum 2.0, is more like sitting back in a chair, sipping a latte, and saying, "Yeah, I’ll stake my claim on this block, thank you very much."

Here’s how it works: instead of solving puzzles, validators (the PoS version of miners) are chosen to create new blocks based on how many coins they "stake" (or lock up) as collateral. So, in theory, the more skin you have in the game, the more likely you'll be chosen to validate transactions and earn rewards. It’s like a lottery, but instead of buying more tickets, you're tossing in your own crypto for a shot at winning.

PoS gained popularity because it’s much more energy-efficient, and it avoids turning the Earth into a crispy potato chip due to excessive energy consumption. 🌍 And as we move toward a more environmentally-conscious world, that’s supposed to be important (or something).

But of course, it’s not all roses.

Some critics argue PoS can lead to centralization - meaning the rich get richer as the people with the most coins control the network. Think of it as the "crypto 1%" ruling over the blockchain while the rest of us hope for (patent pending) trickle-down Bitcoinomics. 😂

A Tale of Two White Papers

Now, let’s take a quick peek at two of the most famous white papers in crypto: Bitcoin and Ethereum. These are the foundational texts, like the Magna Carta of decentralized finance (except much nerdier and with more code).

Bitcoin’s White Paper (2008): Written by the legendary (and anonymous) Satoshi Nakamoto, this paper was all about creating a "peer-to-peer electronic cash system." It had a revolutionary goal: to create a currency free from banks, governments, and that annoying guy who charges $3 at the ATM for no reason. The elegance of Bitcoin's white paper is its simplicity. It laid the groundwork for decentralized finance by introducing blockchain and the concept of a distributed ledger - like a public notebook that everyone can see but no one can erase. The paper includes a cap for the supply of Bitcoin at 21 million units.

Ethereum’s White Paper (2013): Vitalik Buterin, Ethereum’s boy genius co-founder, wasn’t satisfied with just cryptocurrency. He wanted a decentralized world computer. Ethereum’s white paper is essentially a manifesto for turning the blockchain into a platform for everything. Smart contracts, decentralized applications (dApps), NFTs, and decentralized finance (DeFi) all sprouted from Ethereum’s ambitious vision. If Bitcoin is digital gold, Ethereum is more like an app store where your angry bird can actually own the slingshot.

Forks - Why Ethereum is no longer Ethereum

This is EXTREMELY important.

A fork in blockchain technology is essentially a split in the blockchain’s codebase, creating two distinct versions of the blockchain. Forks can be either "soft" (minor changes allowing compatibility) or "hard" (major changes creating two incompatible blockchains).

Hard forks often result from community disagreements on the blockchain's direction or security concerns, which lead to different groups creating their own version of the protocol.

In the case of Ethereum, a significant “hack” in 2016 led to a controversial hard fork. The Ethereum 1.0 blockchain was exploited through a vulnerability in a project called The DAO (Decentralized Autonomous Organization), a smart contract holding millions in Ether (ETH). Hackers drained around 3.6 million ETH from The DAO, sparking a heated debate on how to respond.

To recover the stolen funds, the Ethereum community decided on a hard fork, creating two chains: the updated Ethereum we know today (Ethereum 2.0) and Ethereum Classic, which maintained the original, unaltered ledger aka they went back to the ledger before the “hack”.

They like to call it a “hack,” but let’s be honest - it’s really just a group of folks who gathered enough clout (and crypto) to rewrite the rulebook. Think of it less as a heist and more like a boardroom power play, where the “major stakeholders” flex their collective muscle to steer the blockchain’s course. It’s all good until the whales don’t have your interest at heart.

This division should have emphasized blockchain immutability versus intervention and set a precedent for managing security flaws in decentralized finance (DeFi) spaces. Instead, IMO, it highlighted how proof of stake is a dictatorship, the people with the most ETH dictate the rules and play god at will. Not my cup of tea.

ICOs, Crowdfunding on Steroids

Now that we’ve touched on Ethereum, we can't leave out one of the most exciting (and sometimes scandalous) developments in crypto history: Initial Coin Offerings (ICOs). Think of ICOs like Kickstarter campaigns for blockchain projects. But instead of getting a t-shirt or early access to a product, you get... coins. A company creates a new cryptocurrency, writes a white paper explaining why it's the next big thing, and asks investors to throw some money at it in exchange for their shiny new tokens.

ICOs were huge during the 2017 crypto boom, with projects raising millions in a matter of days or even hours. It was the wild west of fundraising, with some projects turning out to be massive successes, and others... well, let’s just say you can still hear the crickets chirping in the background. 😅

Moral of the story: Do your homework before you speculate in the next "game-changing" ICO! Or, better yet, don’t throw your money at it.

The Digital Fingerprints of the Blockchain

Now, let’s talk about one of the most fundamental concepts in blockchain: the hash. A hash is basically a digital fingerprint. It’s a cryptographic algorithm that takes an input (like transaction data) and transforms it into a fixed-length string of characters. No matter what the input is, it will always produce a unique hash.

For example, in Bitcoin, hashes are used to link blocks together in the blockchain. Each block contains a hash of the previous block, creating a secure chain that ensures no one can go back and tamper with old transactions. It’s like sealing each page of a diary with a super-strong wax seal that breaks if someone tries to open it.

If you try to change even the tiniest detail in a block - like flipping a single "0" to a "1" - the entire hash changes, setting off alarm bells across the network. In other words, you can’t sneak in some "creative" edits without everyone noticing. 🕵️♂️

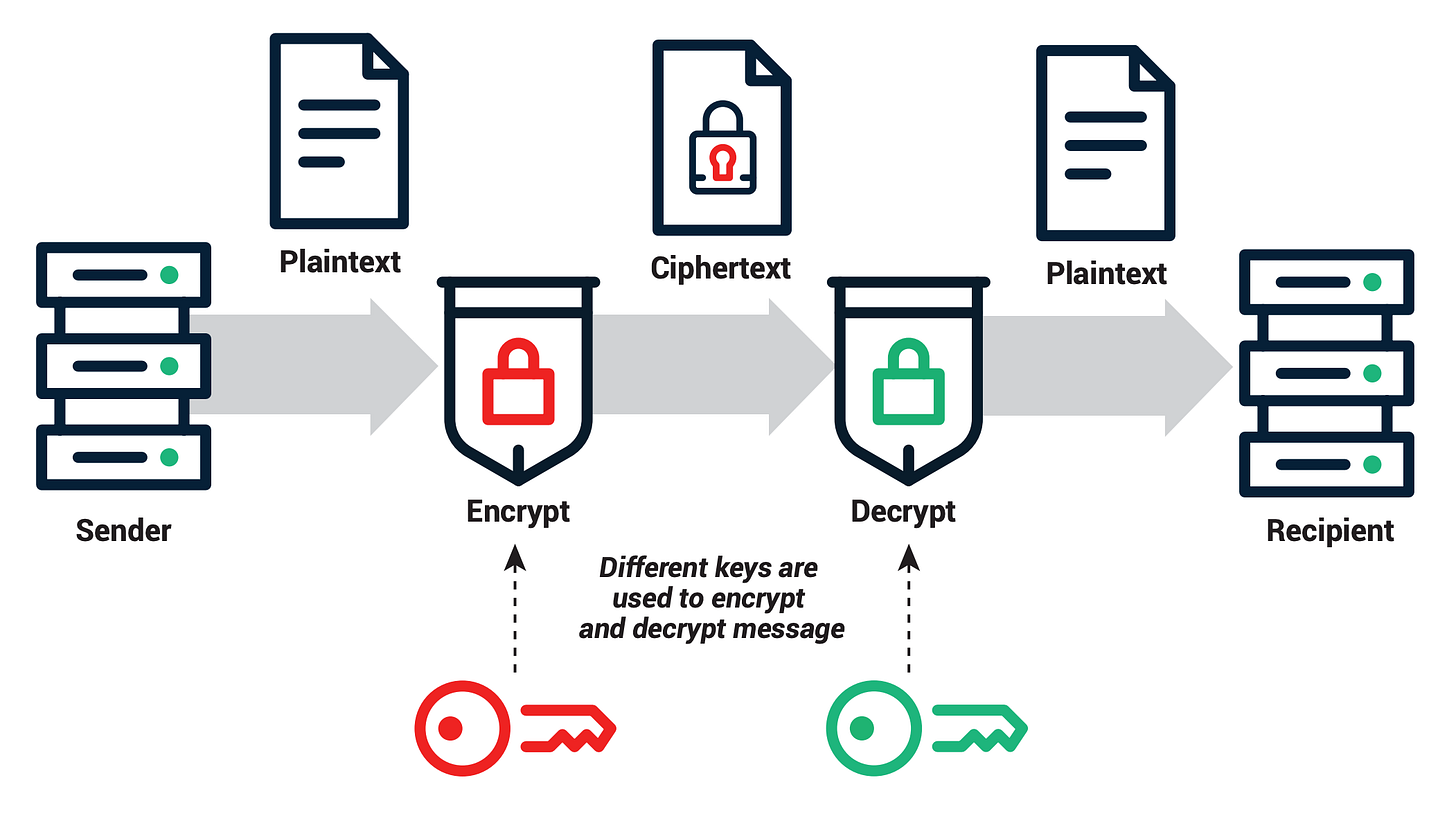

Public vs. Private Keys

Lastly, we can’t finish without addressing the heart of crypto security: public and private keys. If hashes are the digital fingerprints, then public and private keys are like your username and password on the blockchain - except way more secure.

Public Key: This is your public-facing address on the blockchain, kind of like your bank account number. You can share it with anyone who wants to send you cryptocurrency, and they can use it to verify transactions that you've signed.

Private Key: This is where the magic happens. Your private key is your secret code, known only to you, that allows you to sign transactions and prove ownership of your cryptocurrency. Think of it like your ATM PIN, but if anyone gets their hands on it, they can drain your crypto faster than you can say, "oops."

Together, public and private keys ensure that transactions on the blockchain are secure, verified, and can't be tampered with - unless you accidentally lose your private key. In that case, you're locked out of your own digital vault. 😬

Final Thoughts - The Future of Protocols

Whether you're a Proof-of-Work purist or a Proof-of-Stake staker sipping that latte, the future of crypto is evolving fast. Each protocol comes with its own set of trade-offs, but they all aim to answer the same question: How can we build a decentralized, secure, and scalable system without letting a few big players take over the game?

With newer ideas like Proof of Space-Time (yes, that’s a thing!) and Proof of Authority gaining traction, it's clear the crypto space will keep inventing clever (and sometimes baffling) solutions to these problems.

Right now, the frontrunner in terms of security and utility (affordability) is likely Solana’s Proof of History. It’s complex and there’s a lot to unpack there, so we’ll dive deeper into it in an upcoming post.

Just remember, while crypto protocols might sound confusing, at their core, they're all about one thing: trust without middlemen.

Whether you like your trust built on sweat (PoW) or on collateral (PoS), just be sure to hold on tight - because this ride isn't over yet! 🚀

🙏 Feel free to ❤️ and comment so that more people can discover and enjoy this Substack 😇

I have a cold wallet at home to store my Bitcoin. Storing it on Kraken would be too risky given the constant threat of hacker attacks.

Reminds me why I stick to analyzing companies with actual earnings and cash flows in the Nasdaq-100! While the tech behind blockchain is fascinating, I'd give most crypto investments a solid 🟥 rating until we see more regulatory clarity and proven business models. Keep these deep dives coming!