🧗 The Worst Financial Inventions

OIJ (#20) Looking at the biggest legal-ish failings of the financial industry

My dear fellow Hermits 👋

Welcome back to 🧙♂️ The Hermit 🧙♂️

ICYMI:

🧗 Our Investing Journey: Investment Watchlist

💼 The Hermit Portfolio: October Update

📈 Investment Thesis: Corticeira (write-up)

If you haven’t yet, subscribe to get access to this post, and every new post

🏢 Lovely Bureaucratic Nonsense

Last week, I officially passed my accreditation as an EU-compliant financial advisor. The process? A mix of basic financial math, outdated financial theories, and an exhausting dive into regulations covering assets, taxes, and the inner workings of EU regulatory bodies. In short: a marathon of mind-numbing bureaucracy.

We’ve been grinding away at this since late April, so finally wrapping it up feels like a major win. That said, as life gets back to normal, we’ve been reflecting on something that’s been weighing on us: the health of our Substack. Once upon a time, we had a comfortable pipeline - posts scheduled two or three weeks ahead, which gave us flexibility to react to breaking news or key earnings reports.

But with the bureaucratic distractions behind us, it’s time to refocus. We're working hard to get back into our flow, starting with next week’s portfolio update. It’s shaping up to be a big one, so you’ll soon start seeing the results of this renewed energy. Here's to getting back on track and delivering what you signed up for: insightful, actionable investment theses.

💣 Financial Weapons of Mass Destruction

Today, we’re diving into some of the worst financial inventions of (mostly) the past century. The list is ranked from "questionable" to "downright disastrous," and yes, some entries might stir up controversy. It’s worth noting that most of these tools aren’t inherently bad or malicious - in fact, many were created with good intentions.

The problem lies in how they’ve been misused or abused, often leading to devastating consequences for stakeholders. Buckle up, it’s going to be a bumpy ride through financial history.

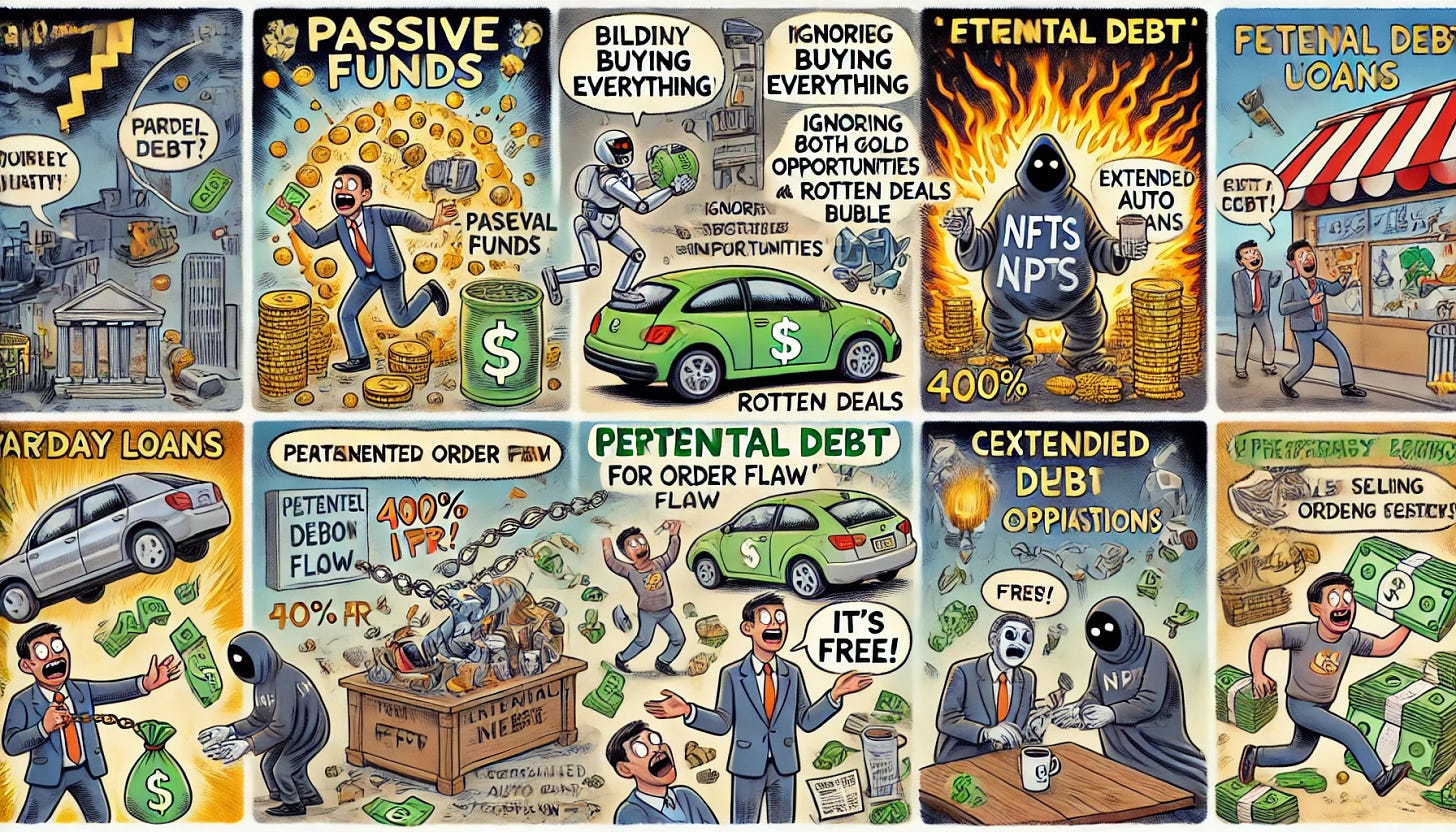

Passive Funds are the "set-it-and-forget-it" darlings of the investment world. These funds faithfully track market indices, delivering steady (if unexciting) returns without the “drama” of active management. They’re low-cost, diversified, and dependable, in theory.

The issue with passive is they miss a critical part of investing - price discovery. Without price discovery, you do not know what the real (intrinsic) value of what you’re buying is. By purchasing everything, you are not distinguishing good from bad, and if everyone does this, well, by definition, you’ll get a bubble.

Perpetual Debt is the financial equivalent of "till death do us part." These bonds don’t have a maturity date, meaning issuers pay interest forever - or until they decide to buy them back.

Investors love their steady income and higher yields, but perpetual bonds are like a bad tattoo: hard to get rid of and prone to losing their luster (thanks, inflation). In practice, money printing will lead to a great deal for lenders and a very poor one for investors. And that’s without taking a look at instruments like banks’ CoCos.

Extended Auto Loans are a car buyer's dream - or nightmare, depending on how you look at it. With repayment terms stretching to 72 or even 96 months, they make that shiny new ride look affordable, with lower monthly payments.

By the time you finish paying it off, your car might be worth less than your daily cup of coffee. Negative equity and sky-high interest over time turn this arrangement into more of a financial pothole than a smooth ride. Generally speaking, taking out loans - especially long-term ones - on depreciating assets is one of the worst financial moves you can make.

Non-Fungible Tokens (NFTs) were all the hype a few years ago. These are unique, trendy, and occasionally wildly overpriced? or underpriced? They let artists and creators cash in on their work while offering buyers bragging rights and a blockchain-backed proof of ownership.

How these are priced remains a mystery to me. While there are a few exceptions where NFTs serve a functional purpose or have tangible utility, the majority seem speculative at best. Personally, I’d steer clear of this type of "investment."

Payment for Order Flow (PFOF) is Wall Street’s version of "you scratch my back, I scratch yours." Brokers send client trade orders (data) to market makers in exchange for cash, keeping trading commissions at zero for retail investors.

What could go wrong…

The amount of behind-the-scenes shenanigans this setup can enable is downright absurd. So, the next time your broker proudly proclaims, “It’s free,” it’s worth asking yourself - at what cost Mr. Robinhood?

PayDay Loans are the financial equivalent of selling your soul for rent money. In theory, you take out a loan to close out a money-making deal in a very short period (think hours).

In practice, they’ll give you cash fast, but the sky-high interest rates (think 400% APR and beyond) can drag you into a debt spiral you won’t escape without a miracle - or a lottery win. They’re the kind of lifeline that feels more like a noose.

Collateralized Debt Obligations (CDOs) are like a financial casserole: a mix of loans and mortgages baked together and served in tranches to investors. If you’re lucky, you get the crème brûlée of returns. If not, well... we all remember 2008. Lack of transparency and a talent for amplifying systemic risks made CDOs the bad boys of the financial crisis, and their reputation aged like fine milk.

These instruments are a black box, and let’s be honest: 99.9% of investors should sprint in the opposite direction at the mere mention of the term. Why? Because we both know you’re not going to dig deep enough to figure out what’s actually inside - and that’s exactly the problem.

Leveraged ETFs are the financial equivalent of high-octane fuel: great for a quick boost but risky for the long haul. These funds promise 2x or 3x the daily performance of an index, making them appealing for thrill-seekers chasing short-term gains.

But hold them too long, and the compounding effects - especially with inverse ETFs - can turn a promising idea into a financial disaster. It’s like taking a good concept, cranking the WallStreetBets chaos dial to the max, and ending up with synthetic derivatives that can swiftly vaporize your savings. Handle with extreme caution, or better yet, just don’t.

Value at Risk (VaR) is like that friend who tells you how bad things might get - only to realize it’s coming from your forgetful great-grandpa who can’t even remember where he left his cane. This one’s my favorite out of them all. In theory, VaR provides you with a percentage maximum drawdown over a 1–5 day period out of every 300 days (with a 95% to 99% confidence level).

Sounds useful, right? Well, not so fast. While it may hold up under normal market conditions, it completely falls apart when you actually need it. VaR glosses over extreme disasters, ignores the scale of losses beyond its threshold, and relies heavily on historical data that may not reflect future realities.

In short, it’s one of the most misleading metrics ever created, offering a false sense of security when you should be peak concerned. If someone’s waving VaR at you like it’s a crystal ball, do yourself a favor: Run. Fast.

Conclusion

Wall Street games the system, and instruments like these are a prime example. Don’t waste your time listening to the noise or getting tangled up in complex instruments you can’t control.

Instead, focus on real organizations - the businesses behind the stocks - and the people driving them forward. Paraphrasing the author William Green, you’ll end up richer, wiser, and happier. And honestly, isn’t that the goal?

🙏 Feel free to ❤️ and comment so that more people can discover and enjoy this Substack 😇

Loved the section on Passive Funds - everyone piling in without price discovery just builds a bubble waiting to pop. Markets need active checks to stay rational or we’re just on autopilot towards trouble. Appreciate the insight, looking forward to more of that renewed energy in the updates. Cheers.

Fun list! I'd add SPACs to the list: With blind trust handing a sack of money to financial managers who can buy whatever they want, at whatever prices and get a royal payday whether it's a good buy or not.