🧗 Wisdom from Li Lu: Insights from His Latest Lectures

OIJ (#24) [Full Lectures] Li Lu’s Latest Lessons on Investing, Markets, and Decision-Making

Welcome back dear fellow 🧙♂️ Hermits 👋

ICYMI:

💼 The Hermit Portfolio: February Update

📈 Investment Thesis: Limes Clinics (write-up)

🧙♂️ The Hermit Way: Stock Valuation Tool

If you haven’t yet, subscribe to get access to this post, and every new post

We wanted to offer you a different perspective on investing by translating and interpreting an already excellent lecture and Q&A. Both of these are entirely the work of the Munger Academy.

Before we dive into two of Li Lu's more recent conferences, here’s a bit of context to set the stage.

Li Lu

For all those of you unfamiliar with Li Lu, he’s one of the top investors of all time. Here are a few points on his early life and milestones:

Born in China, Li Lu was a student leader during the 1989 Tiananmen Square protests

He fled China and later moved to the U.S., where he attended Columbia University

He earned three degrees simultaneously:

B.A. in Economics

J.D. from Columbia Law School

M.B.A. from Columbia Business School

Inspired by Warren Buffett’s principles, Li Lu founded Himalaya Capital in 1997

He’s the only manager ever selected by Charlie Munger to manage his family's money

One of his most notable investments is BYD, the Chinese electric vehicle and battery company, which he introduced to Charlie Munger and Warren Buffett. Berkshire Hathaway also invested in BYD in 2008, a move that became one of their most successful bets in China.

Himalaya Capital

We’re not 100% sure of the exact number, but various sources suggest that Himalaya Capital has compounded at 17.5% gross and 14.1% net of fees from 1998 to 2022 (Note that ‘22 is a down year). While we couldn’t pin down the precise figure, it wouldn’t be surprising given how well some its holdings have performed over time.

Even more impressive is that the fund kicked off right before the brutal Asian Financial Crisis, and in its first year, it took a 19% hit, getting battered by Chinese and Korean stocks. Talk about a tough start! 😬

Of course, we all know about Charlie Munger’s legendary investment in 2004, but did you know that Julian Robertson (of Tiger Capital) also seeded Himalaya two years before Munger?

That technically makes it another Tiger Cub, right? Kinda? Maybe? 🐯

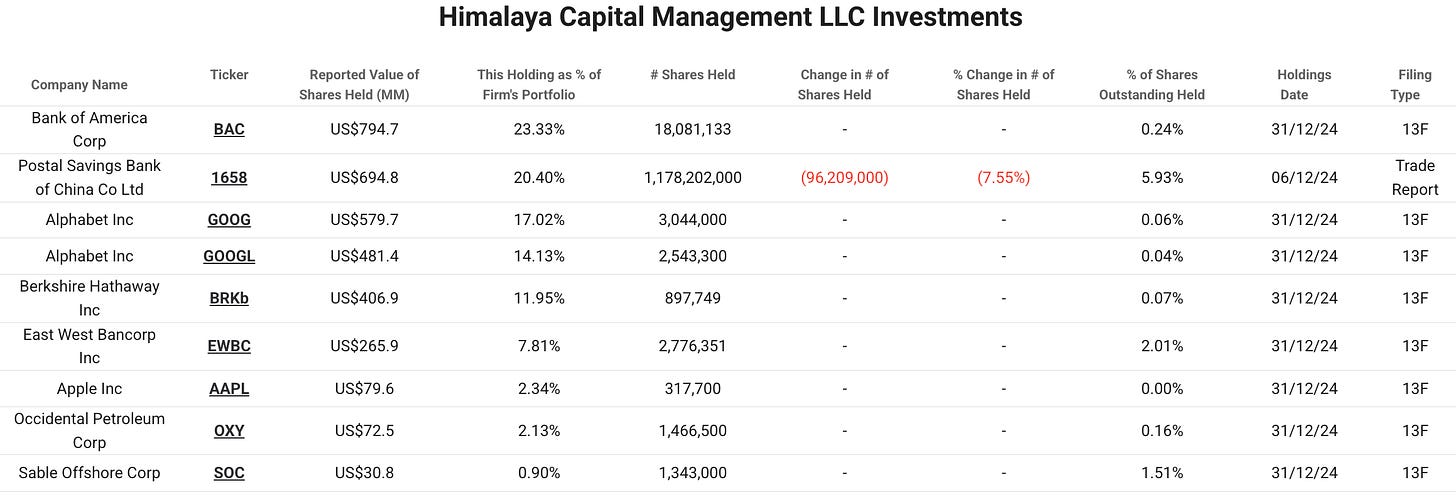

These are Li Lu’s current holdings as of Q4 2024:

Fun fact: Back in 2022, I actually applied to work at Himalaya Capital, which would’ve made me employee #15. Imagine that!

That would’ve been one hell of a story to tell. 😂

Lecture

On December 7, the 10th anniversary salon of the "Value Investment" course of Peking University Guanghua School of Management was held at Columbia University Global Center (Beijing). This innovative course, hosted by Professor Jiang Guohua, is supported by Himalaya Capital, and taught by Mr. Chang Jin, the Executive Director of Himalaya Capital.

Mr. Li Lu, a famous investor and founder of Himalaya Capital, gave a keynote speech entitled "Global Value Investment and the Times" at the salon. This is the third time Mr. Li has given a speech in this course in ten years. This speech will be included in the revised edition of Mr. Li Lu's book "Civilization, Modernization, Value Investment and China".

Li Lu: Thank you to Professor Jiang Guohua, Professor Chang Jin, and all the teachers, colleagues, and students who made this course possible! When Professor Jiang visited the United States this year, we talked about how this course has had a certain impact in academia and industry over the past ten years, and that the number of people who have applied for online classes this year has exceeded 1,000.

Ten years ago, we decided to cooperate with Peking University to support the opening of this course, mainly because of my personal experience. 35 years ago, when I first came to the United States, Columbia University had such a course, which gave me the opportunity to meet the value investment master Mr. Buffett within one or two years of my arrival in the United States. This changed my life for more than 30 years. Therefore, we also hope to pass on such opportunities and ideas to young Chinese students .

There are many friends and students here and in Beijing today, thank you very much!

I will not say any more polite words, and will get straight to the point. In the first class in 2015, I talked about "The Prospect of Value Investing in China". Five years later, in 2019, I talked about "The Unity of Knowledge and Action in Value Investing in Practice". Earlier this year, Mr. Jiang came to Seattle to discuss the idea of commemorating the tenth anniversary of the value investing course with me and invited me to give another class. The topic I want to talk about today is "Global Value Investing and the Times" .

In the five years since 2019, a lot of changes have taken place both in China and around the world, which has brought a lot of confusion to investors. Value investing is closely related to the times wherever it is, which is inevitable. Although value investing generally emphasizes bottom-up fundamental analysis, the companies we invest in are in a specific era and will be more or less affected by many macro factors. We cannot avoid the era we live in. I would like to take this opportunity today to share with you some of my personal views.

My sharing today will focus on the following four topics:

First , what are the main puzzles of our time? Second, the thoughts on these puzzles, their causes and nature . Third, about the middle-income trap, the leap of middle-income countries, and some views on today's international relations. Fourth, back to our topic, as a global value investor, how to cope with the challenges of today's era.

These four topics are very broad, so we cannot go into them in depth, but I will try to cover the main points of each topic . If there are any points that I have not touched upon, please raise them during the Q&A session, and I will try to share some of my thoughts with you.

The confusion of the times

Let's talk about the first topic first. What are the puzzles of our time? Let's talk about it from both domestic and international perspectives.

Domestically, everyone has personal experience, especially young students, who are facing great pressure in finding employment. According to the data from the National Bureau of Statistics, the unemployment rate of young people aged 16 to 24 has reached about 20%. The employment problem reflects the confidence of private enterprises. Because today there are about 700 million to 800 million employed people in China, 80-90% of which are provided by non-state-owned enterprises and individuals, mainly private enterprises. State-owned enterprises only provide about 10% of employment. Therefore, the employment problem mainly reflects the problems of the private economy. In recent years, private entrepreneurs have also faced a series of problems in property safety and even personal safety.

Of course, the employment problem also reflects the problem of consumer confidence, behind which is the substantial shrinkage of wealth assets, especially real estate. Real estate once accounted for about 70% of Chinese household wealth, and currently accounts for about 60%, and is still the primary source of household wealth. Therefore, the sharp drop in real estate prices and capital market prices will inevitably affect people's consumer confidence and expectations for the future.

In the past few years, due to some problems in the economy, we have implemented some economic policies that are mainly focused on the supply side. However, the current problems are mainly on the demand side, which has also led to the emergence of deflation. The word "volume" is popular in China, which actually refers to the extreme competition in a deflationary environment. Competition under normal economic growth is not in the form of "volume", but spirals upward. In addition, in the current tightening environment, the bureaucracy lacks an effective positive incentive mechanism, and the phenomenon of "lying flat" has emerged, which has also affected the transmission and implementation of policies. These are some of the confusions we face in China.

After more than 40 years of development, China accounts for more than 30% of the global manufacturing value-added, but its own consumption accounts for only about half of it. This means that half of the goods produced in China need to be sold to other countries, among which the largest customers are developed countries. Although Southeast Asia has become China's largest export trading partner, much of the final consumption is not in Southeast Asian countries. It is re-export trade, and a large part of the final consumption still has to return to developed countries.

Internationally, China also faces a series of challenges, especially in relations with developed countries, such as China-US relations and China-EU relations. In the past five or six years, the biggest variable in the international arena is that the United States has fundamentally questioned its role in the international community. After World War II, the United States has always played the role of an "anchor" in global affairs, maintaining peace, international trade stability, freedom of the seas, and international capital flows, and has built an international system that can be called the "American order", including a series of institutions, laws, and dispute resolution mechanisms. In all aspects, the United States plays a core role. However, in recent years, the United States, from the elites, the middle class to the ordinary people, has begun to have fundamental doubts about whether the United States deserves to play this role. The United States bears about 80% of the world's military spending. At the same time, as the ultimate buyer, currency provider, and final consumer market of the global economy, it has played the role of an "anchor" to stabilize the global order. But now the American people widely believe that the United States has lost more than it has gained in this process. China's rise has taken advantage of the American order, and after its rise, it has posed a fundamental and even hostile challenge to the American order. Whether this view is right or wrong, it has led the United States to re-examine its role and resource investment in the international order. This has not only triggered profound changes in Sino-US relations, but also raised a fundamental question about the international order: How will the future international order evolve? Who will invest in and maintain public goods in international trade (such as peace and freedom of navigation and trade)? In this context, what challenges will China's industry face and what role will it play?

In summary, a series of problems have emerged in the past few years , both domestically and internationally, which can be called the "perplexity of the times." This confusion is not only temporary and local , nor is it just a short-term phenomenon, but it has caused people to worry about the uncertainty of the future prospects.

Thinking about these confusions

Next, I would like to talk about my thoughts on these confusions.

In fact, these puzzles are not unique to China. Looking back at the world history of the past 500 years, all countries will enter a period of intermediate consolidation after experiencing industrial takeoff and entering the middle-income stage. This is a common problem faced by all countries in the process of development.

In "Civilization, Modernization, Value Investment and China", I divided the evolution of civilization into three stages: 1.0 hunting civilization, 2.0 agricultural civilization, and 3.0 modern scientific and technological civilization. The consolidation period in the middle, I call it stage 2.5. China is in stage . All countries that have experienced industrial takeoff, such as Germany, Japan, South America and some Southeast Asian countries, have experienced similar stages and faced the challenges China faces today. Some countries have successfully achieved the leap, while some countries are still struggling in the middle-income trap. The path for each country to cross this stage is different. In addition, from the perspective of international order, in the history of human international relations, there has never been an international relations model of "3.0 scientific and technological civilization era".

The last example is about the role of the government. What should the role of the government be during the economic transformation process?

On the middle-income trap, the leap of middle-income countries and contemporary international relations

The whole process established a complete credit system. Related to the credit system is a complete set of legal systems, dispute resolution , customary practices, and everyone's trust. This system is very difficult to establish and requires constant trial and error. Since the transplantation and establishment of this system, the United Kingdom has never failed in wars with Europe . In the past, the United Kingdom supported the war with the royal power, its own assets, income and territory, and assumed unlimited liability. Now it has been replaced by a new credit system. Through this system, the debt issued by the United Kingdom once exceeded its GDP by several times. It attracted global investment and never had bankruptcy or default . This is the first truly modern capital market system.

Looking back at the beginning of reform and opening up , Deng Xiaoping said that practice is the criterion for testing truth, and whether it works depends on the results. He also said that we should continue to explore and "cross the river by feeling the stones", and there is no fixed rule. At this stage, many top-level designs are often not particularly applicable and need to be constantly adjusted through practice. What is the performance indicator ( KPI ) of practice? It is to achieve real modernization. What is real modernization? It is that China can rely on spontaneous and endogenous forces to generate sustainable economic growth. Spontaneous, native and sustainable economic growth is the KPI.

How should global value investors respond to the challenges of the times?

Why do I spend so much time talking about the above? Because in the past five years since my last speech, the biggest change is that people are obviously more confused and uneasy. And with confusion and anxiety, it is very difficult to hold stocks firmly and really make long-term investments. Finally, let's return to the fourth topic. As global value investors, facing the changes in today's international and domestic situations, how should we respond and how should we invest?

For example, in the era of agricultural civilization, wealth was land and population. So, is land still wealth today? Looking back at the entire world history, especially in Europe, the feudal system lasted for hundreds and thousands of years, and the feudal system in many countries collapsed due to revolutions, with one exception - Britain. In the past few hundred years, there has been no major revolution in Britain, and many nobles who originally owned land still retain a lot of land and magnificent castles. In the past, they were the richest people. However, are these nobles still rich today? The answer is no. Most nobles who only own land and castles are no longer rich, and have even become relatively poor. Only a few nobles are still rich because they have other investments, rather than relying solely on the original land and castles.

As a global investor, you need to invest in the economy you think is the most dynamic, but at the same time, you need to pay attention to your actual needs

I founded Himalaya Fund in 1997. Before that, I bought my first stock in 1993, starting with cheap companies. In the process of investing in cheap companies, I gradually built up my circle of competence and slowly transitioned from looking for cheap companies to looking for high-quality and cheap companies. In 1997, when the fund was first established, I experienced the Asian financial crisis. In the past few years, the Chinese market has experienced a sharp decline in capital and assets, and many people have suffered from the decline in real estate, stock and other securities prices. However, the extent of this round of decline is still incomparable to the Asian financial crisis of that year. During the Asian financial crisis of 1997-1998, the markets of major Asian countries generally fell by more than 70%, and the worst even fell by more than 90%. Our fund also faced huge challenges and experienced relatively large fluctuations, but the sum of the performance of those years was exactly a period of high returns for us. At that time, the market was full of gold.

Later, I discovered that every time Mr. Munger went fishing , he didn't know which island to go to beforehand, but was led by a fishing guide. His name was Leroy. Two generations of his family had been in the bait business, so he went to different lakes to look for bait all year round. By looking for bait, he knew which lake had fish. The species, growth, season, and location of fish in each lake were different. This was his exclusive knowledge. So many people bought bait from him to find out where there were fish. Mr. Munger asked Leroy to take us every time , and we. I initially thought that there were so many fish in each lake , but the failed experience of Xingdao Lake made me realize that each lake is indeed different.

Let me repeat these six basic concepts of value investing:

Q&A section

To give another example, we have held BYD for 22 years. During these 22 years, its stock has fallen by more than 50% at least seven or eight times, and once it even fell by 80%. Every time the stock price falls sharply, it will test the authenticity of the boundaries of your circle of competence. Do you really understand it? Do you really know what its value is? How much value has it created? In a certain year, the value created by BYD may have increased, but the stock fell by 70%. This is the real test of whether you have a circle of competence. Only when you touch the boundary can you confirm whether this circle exists. During the period we held it, BYD's sales increased from 1 billion yuan to nearly 1 trillion yuan, and it has not yet capped. It is still growing and creating value. This is the fun of investing.

The way humans are organized today is still based on governments and nation-states. Although the world has formed a common market economically, in terms of international relations, it is still a loose system based on nation-states, and there is no international political organization. The fundamental reason is that

Interview

November 28th marks the first anniversary of Charlie Munger’s death. With the collaboration of Munger Institute and CITIC Publishing Group, Mr. Li Lu, asset manager of the Munger family and founder of Himalaya Capital, accepted an online interview with Zhenghe Island on the same day.

This is the first interview Mr. Li Lu has accepted with domestic media after four years. In the interview, Li Lu recalled his mentor Munger, summarized his spiritual legacy, and pointed out that Munger made value investing possible in the global practice.

The one you truly love will never leave

Q: Can you tell us about your thoughts and feelings over the past year?

Li Lu: Today is a very special day. It is the first anniversary of Charlie's death and Thanksgiving in the United States. The first time I had a long conversation with Charlie was on Thanksgiving Day in 2003. We talked for four or five hours, and then we officially became partners. It has been 20 years since he passed away.

Charlie died on Thanksgiving weekend, he was with his family, and during dinner he was still chatting and laughing as usual. But when it came time for dessert, he felt a little uncomfortable, and was taken to the hospital early the next morning. About a day later, he passed away. Charlie lived his whole life on his own clock, and he never changed. He insisted on working and spending time with his family until the last moment. We were together for 20 years, and in the year since his death, I often think about the conversations we had with him.

My oldest daughter died a few months after Charlie. It was an unexpected tragedy. So in the space of two or three months, I lost Charlie, who was like a father to me, and my oldest daughter. I felt the pain of loss in life. This also gave me a further understanding of life. One of the points is that the people you truly love will never leave. I can still feel that both Charlie and Julia are with us at all times. This is what we Chinese say: the spirit is eternal. On this special day today, a day to celebrate gratitude as a festival, I miss them even more.

Charlie never disappoints.

Q: What is the greatest life wisdom you learned from Munger?

Li Lu: We used to have breakfast together at 7 o'clock, and Charlie would always arrive half an hour or an hour early. After his wife passed away, we changed to having dinner together every Tuesday. There is a book called Tuesdays with Morrie, which is about a young man and an old man who agreed to meet every Tuesday, so we chose Tuesday. This lasted for more than ten years, and we talked about everything. It left many warm memories, and I also learned a lot.

The most important thing about Charlie to me is that he is a real role model. Each of us needs role models in life, and I have found many from ancient and modern times, both at home and abroad since I was a child. But it is very difficult to use a real person as a role model in life, because real people always have all kinds of problems. We talk about final judgment, and after the conclusion, we can keep the good parts of the past, but in reality we must endure the complexity of reality. Charlie and I have lived together for more than 20 years. We either have breakfast together or dinner every Tuesday. We talk almost every few days, but I have never found that anything he did disappointed me. On the contrary, his thinking and behavior continue to inspire me. This is a unique experience in my life. Charlie is a person who is always consistent in his appearance and in his heart, consistent in his words and deeds, and in unity of knowledge and action.

Charlie is both worldly and detached from the world. Like Confucius as we Chinese understand him, he deeply loves his family, relatives, and friends with whom he has deep friendships. He pursues knowledge, wisdom, and spiritual satisfaction throughout his life. He is committed to improving the world in real life through inner cultivation. In other words, he uses learning to gain wisdom, uses wisdom to gain worldly success, and then uses success to help society, leaving a spiritual legacy to the world and future generations with his example.

Countless fans and followers of Charlie all over the world, as well as those who aspire to inherit him, actually hold a common view: Charlie is a real role model who can be learned and imitated. The universal wisdom he studies originates from the contemporary era and is also applicable to the contemporary era; Charlie has spent his life pursuing universal wisdom and has achieved great success through it - Berkshire's success is like a monument. He also uses the same wisdom to do good in society, and by promoting a special way of behavior, especially a win-win business behavior, he has become a role model for countless people; by spreading a spiritual concept, he has left us an amazing spiritual legacy. Charlie said: "My sword will be left to those who can wield it." In my opinion, this is the sword he left behind.

This is also the realm I pursue personally. As I get older, I am involved in more and more social welfare, especially in the past few years. In 2021, we established the Asian American Foundation, which has become the most important umbrella organization for tens of millions of Asian Americans in the United States. We plan to raise $1.1 billion in aid over five years. After three years, our audited aid has reached $2.8 billion. I believe that after five years, this number will far exceed the original estimate. Of course, this is only part of it. We will continue to do it and serve the society.

Charlie is the designer and Warren is the general contractor.

Q: Please help us sort out Munger’s investment philosophy from your perspective?

Li Lu: First, Charlie accepted Mr. Graham's original explanation of value investing, namely: first, stocks are part of the company's ownership, not just a piece of paper; second, the existence of the market is to help these real value investors, not to guide you what to do, which is the so-called "Mr. Market" concept; third, investment must have a sufficient safety margin.

Charlie highly respected these three basic principles. However, because he lived in a different era, he developed his own unique contributions based on Graham's principles. This is reflected in two aspects:

1. Buy great companies at reasonable prices within your circle of competence.

Graham lived in the Great Depression and the two world wars. The entire economy suffered various traumas during this period, so maintaining his purchasing power was the most important thing for him.

In the era of Charlie and Warren, the entire US economy and the world economy were developing rapidly, and value was constantly being created. Therefore, Charlie keenly felt that truly effective investment is to buy a few truly excellent and great companies at reasonable prices within the scope of your circle of competence, hold them for a long time, and increase your wealth as the company's intrinsic value grows. Berkshire was established according to this principle. This is Charlie's truly remarkable and monumental achievement.

2. Go fishing where there are fish.

Another unique contribution of Charlie is that he expanded the scope of application of value investing. He has a famous saying that investment is like fishing. There are two important principles for fishing: the first is that you should go fishing where there are fish, and the second is that you should never forget the first principle. The same is true for investment. Where can you find your circle of competence? How to build a circle of competence? Our time is very limited. He said that you should go to places where there are really fish, where it is easier to build a circle of competence, and where there are more choices after it is established. Following this concept, Charlie expanded value investing from the earliest focus on severely undervalued companies in the United States to great companies with high growth in the United States, and further expanded to places outside the United States where there are still many great companies and are in a growth period. This makes it possible to practice value investing globally.

What we have done in the past 30 years is to practice and promote the value investment concept on a global scale, which is at least very consistent with Charlie's second concept. This is why the Munger family entrusted Himalaya to help manage part of its assets. It is also for this reason that we have formed a close relationship for more than 20 years, not only as partners, but also as friends, students, and in a sense, even as father and son. Our relationship has many levels.

When Warren talked about his relationship with Charlie, he also talked about many levels. He compared Charlie to a designer, and he was the general contractor. He regarded Charlie as a partner and a best friend. Charlie was six years older than him, so in a sense, it was a bit like a father-son relationship. Charlie had such abilities and tendencies. His youngest son and I were also similar in age. This was a very unique relationship.

Munger was still investing at the age of 99

Q: BYD is a particularly representative investment case. Are there any other specific examples that can help us better understand Munger’s investment philosophy?

Li Lu: We have held BYD for about 22 years, and it is not the company we have held the longest. During this process, its stock price fell by more than 50% at least six or seven times, and even fell by 80% once, but we did not feel very stressed because we knew that it was creating new value every year. It is extremely important to understand value. At any time, we must be able to estimate the value of the company itself. When the price and value deviate, we can also selectively increase our holdings. We have invested in quite a lot in the past 30 years, whether in the United States, China or other parts of Asia.

But I think what I learned the most from Charlie is that he continued to learn throughout his life. This is the most amazing thing about him. Charlie rarely made a move, but he would continue to read. For example, he read Barron's every week for 50 years and only made one investment. He was like this with many things. There was a stock that everyone disliked, and it might not be particularly politically correct. Charlie studied this company for a long time and invested in it when he was 99 years old. The week before he died, this stock had doubled from the time he started investing to that time. So he still had a passion for investment until he was 99 years old, and he could still go against the market consensus and live to see this stock double. Today, this stock is still in the Munger family portfolio and is still performing very well, and the company is also performing very well. This is a very interesting example. Charlie was learning all his life and was still with his family until the day before he died. His life has hardly changed, which is part of the rational principle he has always adhered to.

Value investing is prepared for the most difficult times

Q: Is the concept of value investing applicable in the new normal where competition is more intense?

Li Lu: When value investing was first proposed, advocated, and practiced, the United States and the world were in an abnormal period. The background for Graham to propose and practice value investing was the long-term Great Depression in the United States. After the US stock market peaked in 1929, it was not until 1954, about 25 years later, that it returned to this place. In the middle, there was the World War and the Great Depression. The unemployment rate in the United States was as high as 25%. At that time, the whole world was in a state of war, not just a state of confrontation. So compared with that era, the era we are in today is relatively good.

On the contrary, the era of Berkshire's rapid development is a relatively special period in the past 200 years of history. So when Charlie and Warren talk about Berkshire's success, they always emphasize the importance of luck and always emphasize that in all their imaginations, they could not have expected Berkshire to achieve such results. They know that the method they adopted is almost impossible to fail and will definitely have a certain degree of success, but such a great success is unexpected in the eyes of everyone.

Value investing was born in the most difficult times and is prepared for the most difficult times. When the situation gets better, it will perform better. I certainly believe that value investing can be practiced more and should be practiced more in the current context, because other investment styles will encounter more risks. The risks we are talking about are not short-term fluctuations, but permanent losses of capital.

Value investing is closely related to human character

Q: What are the key factors in determining investment success? What does it take to be a true value investor?

Li Lu: Value investing is a widely accepted method in China. In a sense, it is because of Berkshire's extraordinary success, Buffett and Munger's spread of the concept of value investing, and perhaps also because of official promotion. However, there is a big difference between value investing in words and value investing in practice. Something that is advocated is usually put on the lips, which is natural. To judge whether it is true value investing, you have to look at the final result. But when looking at the results, people often return to their original habitual views, still believing that stocks are mainly a piece of paper that can be bought and sold, and whether the investment is successful mainly depends on the results after buying and selling, which goes back to time, performance, short-term, medium-term and long-term. So in fact, apart from using the term value investment, other aspects of thinking have not changed, just talking about a set of terms. This is not necessarily a lack of unity between knowledge and action, it may just be ignorance.

In 30 years of practice, I have met many investors from all over the world. I feel that value investors will always be a small minority. More and more people like to use this term, but fewer people practice it. Warren himself said that value investing is like vaccination. It works for some people and not for others. You will know after the vaccination. Either he really accepts it all at once and agrees with his philosophy; or he will never practice it in his life, no matter if he says it or not. This is extremely related to a person's basic character and is highly related to what a person actually does, but has little to do with short-term performance.

Value investing does not mean that you will never sell after you buy. You can grow with some good companies for a long time; sometimes you will make mistakes and correct them immediately; sometimes you will find better companies and sell them. Sometimes, as an asset manager, you have no choice but to sell when investors want to redeem. This problem exists both at home and abroad. In our early days, in the first year, 1998, we had a book loss of 19% because some people wanted to withdraw. I had no choice but to sell part of it. But the remaining ones rose by more than 50% or more than 100% in 1999 and 2000. So whether it is three years or five years, it is ultimately necessary to use a relatively long-term performance to illustrate the situation. Short-term performance is difficult to be of reference significance. But if the time is long enough, for example, a person has been practicing the same value investment method for more than ten years, his long-term performance can generally illustrate the problem.

Therefore, to judge whether a person is a true value investor, we should mainly look at what he does in the long term and the long-term results. In the short term, everyone can be Buffett, everyone can be Munger, and even far surpass Buffett and Munger. But there is no one who can be on par with them or even surpass them in the long term. Of course, they have been doing it for a long time, for 60 years. In fact, there are very few people who can persist for a long time, which in a sense shows that this is indeed difficult. But if you insist on value investing, at least you will have a long-term record, because most other methods are difficult to have long-term performance. Without long-term performance, it often stops at a certain point.

Charlie advocates four levels of rationality

Q: How do you understand what Charlie Munger means by rationality and how do you draw its boundaries?

Li Lu: The rationality that Charlie talks about is different from what most of us understand as whether a person is calm and rational. It contains at least four levels:

One is the universal wisdom that comes from the real world.

Charlie has spent his entire life studying universal wisdom and various successes and failures. These universal wisdoms are summed up from real life and real history, including the decisions made by entrepreneurs at critical moments, etc. It is not just mathematical logic.

The universal wisdom proposed by Charlie and the first principles are actually the same thing. If I were to talk about it, I would say it is a scientific way of thinking, that is, a physics way of thinking. It was developed on the basis of physics, and later gradually evolved into a universal way of thinking and modern thinking in the West. Physics, starting from Aristotle, always has to discover the first driving force for everything, so it is called the first principle, which is to derive logical conclusions from facts and axioms. So whether your conclusion is correct actually depends on the basic facts, basic assumptions and reasoning process. This is the basic thinking of physics, mathematics and all modern sciences. However, most people do not apply this way of thinking to other aspects outside of science. Only truly pure and rational people will extend this way of thinking to all aspects of life, and then use it to test many things we do, including decision-making.

Musk's success has made people more receptive to the concept of first principles. For example, Musk said that the biggest cost of a rocket is more than 90% of the rocket manufacturing itself, but after each rocket is launched, it basically explodes. After it is launched, it automatically disappears into the universe, and the remaining carrier continues to move forward, perhaps becoming a satellite or putting people on the space station, so this more than 90% can only be used once. But in fact, if we can launch it, we can also recover it. And because of gravity, it is actually easier to recover it. This is a very simple scientific way of thinking, but before him, this way of thinking was not applied in practice, largely because those who made rockets were not entrepreneurs and had no concept of cost. So Musk said that I want to treat it as a business and consider the cost. The first time he talked about the relevant design concept was at TED, and I remember it very clearly. I was sitting in the first row. At that time, he asserted: If I succeed, I will reduce the entire launch cost by 99%, and in the future it may cost less than 500,000 US dollars, and everyone can go to the moon for a tour. Many people in the audience raised their hands to express their willingness to participate. This was many years ago. Charlie’s way of thinking is exactly the same. This is the first level of rational thinking.

The second is to use diversified thinking to solve practical problems.

The second level that Charlie talked about is to study universal wisdom, to summarize and learn from all human disciplines, which is the so-called fence-like thinking. He studied the most important research results in various fields of mankind, and then mixed them together and applied them to the problems he faced. The real world is actually very complex and contains fundamental problems from all aspects. When we do research, we must learn the knowledge of each discipline separately, but when it comes to application, you must string this knowledge together, just like weaving a fence-like net. Don't have a narrow view of disciplinary separation, or set such obstacles for yourself.

Third, we must avoid systematic irrationality.

The third important part of rationality is to figure out what is irrational when we think about problems. For this reason, Charlie spent a long time summarizing the systematic irrational tendencies of human beings one by one. How should we think rationally and make the right decisions? First of all, we need to think about when people are irrational and make wrong decisions? What are the reasons for this wrong decision? Which reasons are systematic? Can we make a list of them? After thinking clearly, we can deliberately avoid them. Finally, Charlie summarized a set of human misjudgment psychology and listed 25 systematic error tendencies that humans continue to make.

This is behavioral economics, which later won the Nobel Prize in Economics. It was actually an idea first proposed by Munger and put forward in practice. He studied a series of mistakes that humans make when rationalizing their behavior under irrational circumstances, so his rationality means avoiding all systematic traps in human thinking. We all fall into this trap because we evolved from animals, and our brains often reflect our survival needs. The need for survival is often in the first-level thinking, such as the knee jerk reflex that will naturally bounce up when you tap your knee. A lot of our thinking is conditioned reflex and irrational, which is very suitable for animal survival. But it is not suitable for humans to make correct decisions in modern life after evolving into Homo sapiens. These reflexes are deeply rooted in human DNA after millions of years of evolution. So if you want to think rationally, you need to systematically detect these thinking patterns that have been imprinted in your genes, and then check them in a checklist way, so that you can be truly rational when making decisions. I strongly recommend that you read the 11th chapter of The Poor Charlie's Almanack, "The Psychology of Human Misjudgment," which lists 25 seemingly rational but irrational tendencies that humans try to rationalize reality. They are all summarized from practice. When you read it, you will feel that everyone has these misjudgments. They exist in our DNA and are innate.

Entrepreneurs need to be passionate and ambitious. But if they keep making systematic mistakes, they are unlikely to become successful entrepreneurs, or even impossible to become entrepreneurs. So there are many people who start businesses, and even more people who want to start businesses, but not many succeed. Some things that seem crazy are actually very reasonable, and some things that seem reasonable are actually extremely wrong. Charlie's summary of the psychology of human misjudgment is his original contribution to the world.

Fourth, it is based on common sense and respects common sense.

Charlie's rationality is based on common sense, and he respects common sense. In Charlie's opinion, common sense is actually the most scarce cognition, which is summarized from practice. When you violate common sense, you will pay a price, and these prices will disprove these common sense. So his most important view on rationality is "copy what works, avoid what doesn't", to repeat those methods that have been proven correct by time, and to avoid those methods that have been proven wrong by time. This is very, very important.

In practice, Charlie admires Lee Kuan Yew in a broader sense, and to some extent Deng Xiaoping. Both of them are able to copy what works and avoid what doesn't, and the common sense they use is actually considered dangerous by the mainstream at the time. For example, when Lee Kuan Yew founded the country, 70% of the country was Chinese, so what should the national language be? In theory, it should be Mandarin, but he chose English, and then used Mandarin as an auxiliary language, which later proved to be an extremely important decision. But this is indeed not so intuitive and not so direct. Deng Xiaoping pursued planned economy all his life, but when these were proven to be wrong, he decisively chose to try those things in the market economy that could really be applied under the Chinese system, so he took a set of methods of "crossing the river by feeling the stones" and "testing the truth with practice", allowing China to take a completely new path, which is very difficult to do. So the common sense and rationality that Charlie talks about are indeed not as simple as ordinary people understand, and it does not just mean logic. Many people use logic to discuss problems, which sounds rational, but many times he is actually rationalizing. Rationalization refers to a kind of self-defense (justify), which is not called rationality. He is just using rational language to maintain his predetermined position. So rationality and rationalization are completely different.

Charlie's rationality actually contains a lot of content, it is profound and is a great legacy. I think it includes at least the above four different aspects, his theory of universal wisdom, his cross-application of the most important research results of multiple disciplines, his psychology of human misjudgment to avoid systematic irrationality, his common sense, and his advocacy of copying what works but avoiding what doesn't. These all sound simple, but there are many cases in life where people violate common sense, both in ancient and modern times, both in China and abroad, and indeed every time it happens, people will pay a heavy price.

Both value investing and venture capital are probabilistic thinking

Q: Are Munger and Musk’s ways of thinking essentially the same?

Li Lu: Charlie, Musk, I and another person once had a very long lunch, and Musk persuaded Charlie to invest in him. They discussed batteries and various scientific issues together. The two of us were on the same wavelength on many things, but we had different views on risks in business judgment. Musk has a high tolerance for risk. He believes that even if there is only a 5% chance of success, you should do it because their return rate is very high. This is the same as the idea of VC. With a 5% chance of success, you can start 100 companies, and some of them can succeed. For Charlie, he may need more than 80% chance of success before he will do it, so he only needs to invest in 5 companies. Whether to invest in the way of VC or Charlie's way is everyone's choice, and it is actually a question of probability.

Should we start a company with an 80% chance of success, or should we start a company with a 5% chance of success? This is a question that entrepreneurs should consider. If there is an 80% chance of success, then everyone will start a business, and this possibility will disappear. Therefore, entrepreneurs often face a high probability of failure and a low probability of success. For example, before Musk and Wang Chuanfu started to make electric cars, there had been no successful cases of large automobile companies in the United States and the world for nearly 100 years. The last success was the rise of Korean cars. The rise of Korean cars was after World War II, but in fact, these Korean car manufacturers later went bankrupt. After the bankruptcy, Hyundai acquired Kia and other failed companies, and eventually formed today's Hyundai. This is the last example, and it was produced under the circumstances of bankruptcy reorganization. Other successes have been gone for almost 70 or 80 years. So at this time, Tesla in the United States and BYD in China decided to challenge again, of course, their chances of success were not high. The methods they adopted were also different. Wang Chuanfu's method was to use the cash flow of his already successful company to support this company with a low chance of success but a very high return after success. Musk used the support of the mature financial market in the United States, through VC, public markets, and of course the government's special support for electric vehicles, to overcome several crises of possible failure. The support of the Chinese government and China's support for the Shanghai factory were also important reasons for his success despite several failures. They embody entrepreneurial spirit, and they can use all resources to increase the probability of success under their control when there is a small probability of success.

So the basic way of thinking is the same, all of which is based on probability. Musk himself will also tell you very clearly that the probability of success when he does this thing is extremely low, but this thing is worth doing, and the return after success is very high. This is also the basic logic of VC investment.

We have opened the era of global value investment

Q: How do you understand the inheritance between each generation of value investment masters, including your personal contribution?

Li Lu: Graham started investing in a difficult era of social unrest. He started in the era of rapid growth in the 1920s, and soon experienced the Great Depression, World War II, and then post-war reconstruction. He faced the most turbulent decades in the world and the United States, and his value investment philosophy was born in such a state. So he emphasized three concepts: stocks are actually ownership, not just a piece of paper that can be bought and sold; the market exists to serve you, not to command you; third, investment must have enough safety margin, must understand its value, and must invest when the price is far below the value. This is his most important basic concept.

Buffett and Munger have been investing since the post-war period until today, which is about 60 to 70 years, and is also the golden growth period of the United States. Of course, they have also experienced various challenges and changes such as the Cold War and nuclear threats, as well as the long-term stagflation in the 1970s that is hard to imagine today. The inflation rate has been as high as 10%, and the risk-free interest rate has been as high as 20%. In addition, there have been several oil crises, etc. They have experienced all of these. But in general, they are in the growth trend of the United States, so the biggest development of Munger and Buffett for value investing is to buy great and growing companies within the scope of their circle of competence at a reasonable price and hold them for a long time. Truly great and long-term competitive companies begin to enter long-term sustainable growth and can create extraordinary value for the company and shareholders. That is the power of compound interest. This is the greatest exemplary expansion of value investing by Munger, Buffett, and Berkshire. In addition, Munger is more unique in that he pointed out that building a circle of competence may vary from person to person. For different people, it is best to build a circle of competence within the scope of what they can understand, and go fishing where there are fish. So, finding great companies and fishing where the fish are is Munger's very unique contribution.

If our generation wants to make a contribution, I think it is to put value investing into practice on a global scale over the past 30 years, that is, the so-called global value investing. We are practicing it not only in China, but also in Southeast Asia, South America, and North America. We have gone through different stages. For example, China has experienced a period of rapid growth, a period of relatively slow growth, and now a period of doubt and growth. In terms of the international environment, we have experienced the honeymoon period between China and the United States, the entire global integration, and now we are facing some contradictions and integration processes. In addition, South America, Southeast Asia and other places have also experienced different stages of the modernization process. So in the past 100 years, value investing has been successfully applied in different environments, different countries, and different situations. There are also some lessons worth summarizing, which constitutes the most important source of our confidence in the continued application of this concept.

So if we have any contribution, it is to make some efforts to promote the application of value investing on a global scale, because after all, 80 to 90 percent of people live outside developed countries and are still in the process of modernization. The entire modernization is not just a powerful movement that has lasted for two or three hundred years. In my opinion, it is actually a shift in the civilization paradigm, which is unstoppable and cannot be reversed. This path will continue until 700 to 800 million people in the world enter modern life. Just like the transition from agricultural civilization, humans went from hunting and gathering to agricultural civilization, which lasted for about thousands of years, and the entire direction could not be changed. The lifestyle of agriculture and animal husbandry is a shift in the civilization paradigm, and so is today's modernization process. The foundation of the market economy is basic elements such as private enterprises, joint-stock management, and financial markets. As long as such elements exist and the shift of the basic civilization paradigm continues, there will be a huge space for value investing to be applicable, and such places are where there are fish.

AI may be the biggest existential risk we all face

Q: How do you understand AI? How do you understand new investments in the AI era?

Li Lu: AI is the most important technology we have today, but its specific impact is still unknown.

Compared to the past, is it as important as the iPhone, or as important as the Internet? Or as important as the invention of the steam engine, the invention of agriculture? Or as important as the discovery of fire before that? It seems that fire is more important than agriculture, and agriculture is more important than the steam engine, because it created an entire agricultural civilization. The invention of the Internet or electricity is more important than the iPhone. History develops step by step, and the importance of each invention and its lasting impact on the world are different.

In human history, there have been several milestone discoveries: fire, wheels, agriculture, steam engines, electricity, and the Internet. All of these technologies have ultimately changed human civilization in all aspects. Today, AI is at least an all-round technology that will affect all aspects of human life and business, but how will it affect us? To what extent? No one can really say it today. We have many predictions about the future, and we can do a lot of things based on these predictions, but in fact no one can know exactly what impact this new technology will ultimately have on human society and civilization. It is still in the process of progress.

AI brings great promise but also great risks, both at the same time.

Previous technologies have been used to enhance the capabilities of various organs in our body, the most important of which is muscle strength. Starting with the steam engine, a kind of power was invented, which can be used in all aspects. Since the digital revolution, the functions of the human brain have been expanded, including the advancement of a series of communication technologies brought about by computers and semiconductor technology. However, AI is universal and is an all-round expansion of intelligence. We talked about the four different levels of Munger's rationality. Human rationality does not only refer to logical thinking, but is actually the advantage that the human species has over other species. Today's AI is at least to expand the advantage of the human species in the brain. This expansion brings huge opportunities and huge challenges. The opportunity lies in the fact that the various limitations that humans are currently subject to due to knowledge and intelligence may be broken through, from curing cancer, extending life to knowing everything. This is an amazing and great hope.

But on the other hand, it may threaten the existence of humans as the most intelligent species on Earth, which is the foundation of human civilization. Humans are probably the last major species. We have only existed for more than 200,000 years, so we are the culmination of the entire 1.5 billion years of evolutionary history. Our brains have the highest intelligence that exceeds that of all species. But if the development of AI causes people to lose control of it one day, the intelligence of AI may exceed that of humans, so that humans will no longer be the smartest species on Earth. This is a survival danger for humans, because our status as the most decisive species on Earth will disappear. Is this possibility big or small? When will it happen? We don't know, but we know that the possibility exists. As long as AI's self-learning and self-determination capabilities are formed, it may evolve by itself without human supervision. When it evolves to a certain extent, it will surpass humans, and far surpass humans. The development direction of the AI wave today is actually to allow it to gradually enhance its self-learning capabilities within the scope of digital and actual space, and gradually acquire the knowledge and capabilities that humans already have. So this risk is real, and once this risk becomes a reality, the fate of mankind will be completely changed.

This survival crisis does not mean that once AI surpasses humans in all aspects, it will immediately destroy humans. But it is entirely possible that AI will treat humans as its own tools. We humans treat almost all other species on the earth as tools, or food, landscape, objects of reproduction, and sources of energy. The highest level is probably pets. This is not because we have an innate hatred for other species, but because our intelligence far exceeds theirs, the difference is too great, so we do not have empathy. If AI far exceeds all aspects of humans in the future, then it will be difficult for it to have empathy for humans.

So my third point is that AI technology must develop in a controllable direction. It requires all-round cooperation between the government and the private sector so that a reasonable, feasible and effective governance framework can be formed in a timely manner, and this framework can unite all governments and private sectors of the world. Because the problem of AI is a problem for all of humanity, just like aliens, the epidemic that just happened, and the nuclear threat of the 20th century.

Q: Can humans create something more complex and intelligent than themselves?

Li Lu: Humans themselves evolved naturally. When humans evolved from gorillas, there were only about 2-3% genetic changes, which is the difference between us and gorillas, and a lot of evolution is accidental. In addition, if we use scientific thinking to understand the world, in fact, most of the entire universe is unrelated and completely random. There is a part of high correlation, which we call physical laws and mathematical laws, but these laws will also change under certain conditions, so it actually involves a higher correlation. The reason why AI is so useful is that its main approach is to establish correlations among all factors.

So far, humans have no way to understand most general correlations because their functions are too large. With the continuous improvement of computing power, which has increased by 1 million times in the past 11 years, and may increase by millions of times in the future, we can calculate all the data and everything produced by humans, and finally establish the science of correlation. This science did not exist before, so the intelligence that AI will eventually produce may not be the same as human intelligence, but it can include human intelligence. Just like the 2%-3% difference in the transformation from gorillas to Homo sapiens, we have all the intelligence of gorillas, but more than their intelligence.

With endless possibilities, we can establish scientific correlations among trillions of factors today. For example, our conversation today can be conducted in hundreds of millions of different ways according to the permutations and combinations, but in the end, the conversation over the past two hours took place. What factors led to this situation? Why are we able to do such questions and answers now? There are correlations in all of this. You and I are difficult to predict, but AI can judge the most likely one of the hundreds of millions of possibilities to enter our question session today by highly correlating the questions you, me, and several other people online have recently thought about. This kind of science did not exist before because we did not have the computing power and no way to obtain so much information, but AI's existing technology can do this, so large-scale companies can do advanced push.

The newly emerged intelligence will not be exactly the same as human intelligence. It can be different from human intelligence, and it contains all kinds of possibilities. It may not have a human soul, but it can be smarter than humans; it can be different from human considerations. Just like gorillas' considerations and moral judgments on issues are different from humans. But we don't care about the moral standards of gorillas, because our intelligence far exceeds theirs, so we can use our standards to completely overwhelm theirs. This is what we don't want to see. When there is an intelligence that is superior in all aspects and can never be caught up, when we are no longer the most intelligent species on earth, we face the risk of losing control, which is the biggest and real survival risk faced by all humans. As for what species it develops into, it is actually not important, and we don't quite understand it, just like today's gorillas don't quite understand why we are discussing these issues. What's more, our understanding of the world is very narrow. 95% of this world is dark matter and dark energy, and we know nothing about it, so we call it dark matter, dark energy. We don't know whether this world is parallel or not.

So despite the competition between China and the United States, despite the Middle East issues, and the conflict between Ukraine and Russia, humanity is actually facing more common challenges. At this time, we need the common spirit of humanity that Munger talked about even more. Mr. Munger has always admired and respected Chinese culture and traditions, and he hopes that China and the United States can cooperate for a long time. This is the last point I want to talk about, and it is also a great legacy that Mr. Munger has left us. In fact, there are people in China and the United States who respect him and believe in his ideas. He always holds the view that China and the United States should cooperate permanently, and I hope that one day it will happen.

🙏 Feel free to ❤️ and comment so that more people can discover and enjoy this Substack 😇

Charlie Munger's favorite investor!

When he warns AI might view humans as we view gorillas—not with hatred but indifference—our market obsessions suddenly seem quaint.