🧗 Argentina’s Comeback Story: Real or Illusion? 🇦🇷📈

OIJ (#25) Breaking down Argentina’s Q4 2024 GDP growth and what it means for the future

Welcome back dear fellow 🧙♂️ Hermits 👋

ICYMI:

🧙♂️ The Hermit Way: Stock Valuation Tool

📝 Company Updates: Cardlytics Q4 2024 Update

🧗 Our Investing Journey: Li Lu Interviews

If you haven’t yet, subscribe to get access to this post, and every new post

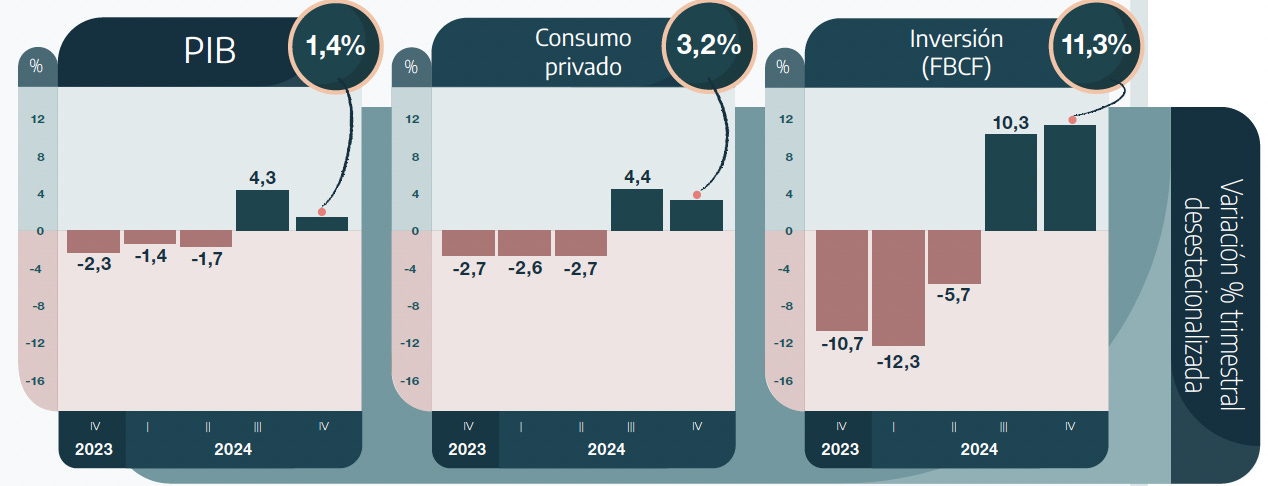

The latest Q4 2024 GDP report from INDEC (Argentina’s National Institute of Statistics and Censuses) has sparked major discussions. With a 2.1% YoY growth and a 1.4% seasonally adjusted QoQ increase, Argentina has officially exited recession and is showing signs of a stronger economic foundation.

But is this growth sustainable? And what does it mean for the country’s future?

Let’s dive into the data 😊

A Major Turnaround for Argentina’s GDP Growth

According to INDEC, Argentina’s economy expanded by 1.4% in Q4 2024 compared to the previous quarter. If this growth rate were sustained for four quarters, it would translate into an annualized growth rate of 5.7% - a remarkable turnaround from the deep recession experienced in previous years.

Even more strikingly, Argentina’s GDP is now 2.1% larger than in Q4 2023, meaning that the economy is already bigger than it was before Javier Milei took office.

Critics have argued that Milei's policies did not yet have time to take full effect in Q4 2024, but an important counterpoint is that GDP in Q4 2024 also surpassed that of Q3 2023 - a quarter in which Milei had no influence and during which the Peronist government applied heavy stimulus (the so-called "Plan Platita") to artificially boost the economy before elections.

Thus, today’s economic expansion is not the result of short-term government stimulus but rather a genuine recovery driven by structural changes and increased investor confidence.

Private Consumption: More Spending, Less Inflation

Private consumption grew 3.2% QoQ in Q4 2024 and is now 2.8% above its Q4 2023 level. In simple terms, Argentinians are spending more today than at the end of the Peronist administration.

Even more impressive is that this consumption rise has been accompanied by a sharp decline in inflation. Inflation, which was over 11% monthly in November 2023, is now well below 3% monthly.

This directly contradicts the narrative that inflation was falling only because consumption collapsed. Many economists claimed that Milei’s policies were crushing demand, so prices stabilized.

However, the data proves the opposite: consumption is rising. Yet, inflation is falling. This suggests that the primary reason for disinflation is not demand contraction but rather the government’s fiscal discipline and central bank reforms.

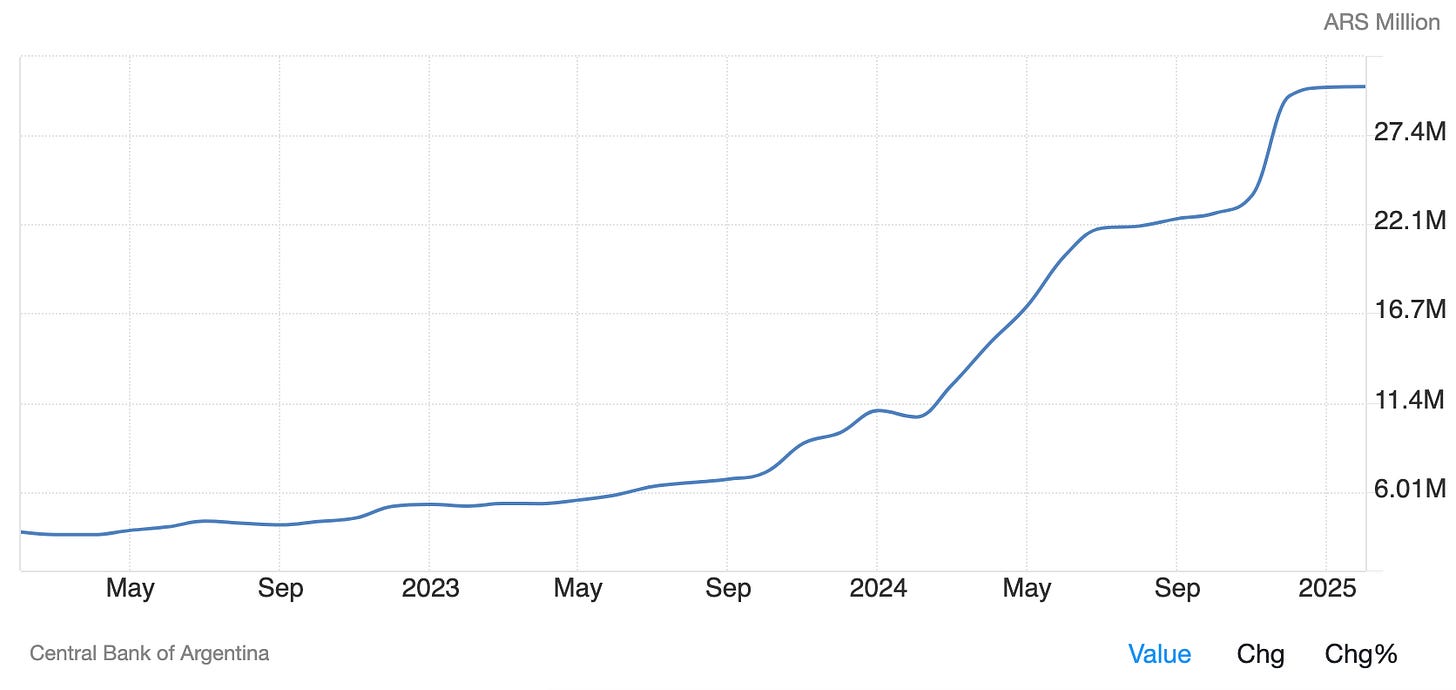

The graph above illustrates Argentina’s money supply trends. It shows a sharp increase from late 2023 into 2024, followed by a stabilization in early 2025.

This reflects a significant shift in monetary policy as authorities attempt to curb hyperinflation and restore economic stability. Argentina has suffered from one of the highest inflation rates globally, exceeding 200% year-over-year in 2023.

Excessive monetary expansion under previous administrations was a key driver of this crisis. This led to currency devaluation and a loss of confidence in the financial system.

The sharp increase in money supply in 2024 appears to correlate with debt restructuring and financial sector adjustments. However, since late 2024, the trend suggests a more disciplined approach, likely aimed at reducing inflationary pressures and stabilizing the peso.

If monetary tightening continues, Argentina could see further inflation reduction in 2025.

However, excessive liquidity restrictions could impact private credit availability and economic growth. The balance between fiscal discipline and economic recovery will determine whether Argentina successfully exits its inflationary spiral.

Investment Surge: Confidence in the Future?

The biggest highlight of Q4 2024 was the surge in investment (FBCF), which grew 11.3% quarter over quarter.

Even more notable, investment in Q4 2024 is now 1.9% above Q4 2023 levels - suggesting that business confidence in Argentina remains strong and has even improved from the previous quarter.

This is crucial because investment is the foundation for future economic growth. A sustained increase in capital spending leads to higher productivity, job creation, and long-term economic expansion.

Unlike Q3 2024, which saw strong GDP growth due to a post-recession rebound effect, the investment-led growth in Q4 2024 points to deeper structural improvements in business sentiment and forward-looking expansion plans.

If we look at individual sectors, we will also notice that hotels and restaurants (+18.1%), financial services (+8.4%), and mining and quarrying (+7.9%) were the big winners in Q4 2024.

The hospitality sector benefited from a surge in tourism and domestic spending, while financial services expanded due to increased liquidity and banking activity. The mining sector saw strong growth, likely fueled by higher commodity prices and increased exports.

On the other hand, construction (-12.4%) was the largest loser, as expected, given the substantial reduction in public works spending under the new administration.

Other declining sectors included social services & healthcare (-1.0%), public administration & defense (-2.1%), and other community services (-4.2%), reflecting ongoing fiscal adjustments and spending cuts.

Is This a Sustainable Recovery?

Argentina has officially exited recession, but can this momentum continue?

Macroeconomic Stability: So far, the combination of budget discipline, monetary tightening, and market-friendly policies has restored some investor confidence. If this trend continues, Argentina could be on a path to sustained economic expansion.

Debt & Fiscal Policy: A key challenge remains debt refinancing. While the economy is growing, Argentina still carries a heavy debt burden, and securing favorable refinancing terms will be essential to avoid a financial crisis.

Investment & Productivity: If the current surge in investment continues, Argentina could see long-term improvements in competitiveness, leading to a stronger and more resilient economy.

The Milei Shift

Javier Milei’s first year in office has been a defining moment for Argentina’s economy. The country has moved from deep recession to strong GDP growth, from runaway inflation to price stabilization, and from uncertainty to renewed investment confidence.

While challenges remain - especially regarding debt restructuring and social stability - the economic transformation underway is undeniable. Argentina’s growth is no longer based on short-term stimulus but on real structural changes that could reshape the country’s trajectory for years to come.

Check out the full report released on March 19th 👇

🚀 Is this the beginning of a new era for Argentina? We’d love to hear your thoughts! 💬

🙏 Feel free to ❤️ and comment so that more people can discover and enjoy this Substack 😇

Will Libertad Avanza win the most seats in the 2025 Argentine elections? If they do, would that give President Milei more flexibility on dealing with YPF?

¡VLLC!

We're closely monitoring developments in Vaca Muerta. Once Milei secures control of the House, YPF’s privatization - along with other key asset sales/privatizations - should have a clearer path to approval